- Sustainable infrastructure is a key enabler of the transition to a low-carbon economy and an important driver of resilient, inclusive growth

- Multilateral engagement, private capital, and public-private partnerships are essential to bridge the infrastructure financing gap and unlock the capital needed to finance the energy transition

- RBC Capital Markets has extensive knowledge and experience across the Infrastructure sector and partners with our clients to provide the market insights and financing solutions, including sustainable debt opportunities, needed to thrive in the transition to a low-carbon economy

Introduction

The role of infrastructure as a catalyst for sustainable growth and as an enabler of the transition to a low-carbon economy has become increasingly clear in the wake of the COVID-19 pandemic. Stimulus packages issued by G20 governments over the last 18 months, including the Bipartisan Infrastructure Deal in the United States, the National Infrastructure Strategy in the UK, and the EU’s NextGen program, have placed green and social infrastructure investment at the forefront of post-pandemic economic recovery plans.

At the same time, the global infrastructure financing gap – the difference between infrastructure needs and investment – is anticipated to reach US$15 trillion by 2040.1 This gap cannot be reconciled by public funding alone; mobilizing private capital and public-private partnerships (PPPs) will also be essential. A number of multilateral initiatives, including the G20’s “Roadmap to Infrastructure as an Asset Class” and the FAST-Infra Sustainable Infrastructure (SI) labelling system, are underway to help advance these objectives.

This edition of Sustainability Matters explores the role of infrastructure in the transition to a low-carbon economy and as a key driver of resilient, inclusive growth and positive socioeconomic outcomes.

Sustainable Infrastructure and the Transition to an Inclusive, Net-Zero Economy

From transportation systems to energy generation and healthcare facilities, infrastructure delivers essential services and plays an important role in advancing sustainable, inclusive development and enhancing societal resilience. Sustainable infrastructure, which the UN Environment Programme (UNEP) defines as infrastructure that is planned, designed, constructed, operated, and decommissioned in a manner that ensures economic and financial, social, environmental, and institutional sustainability over the entire lifecycle, is garnering increased attention in the wake of the COVID-19 pandemic as economies around the world strive to “build back better”.2

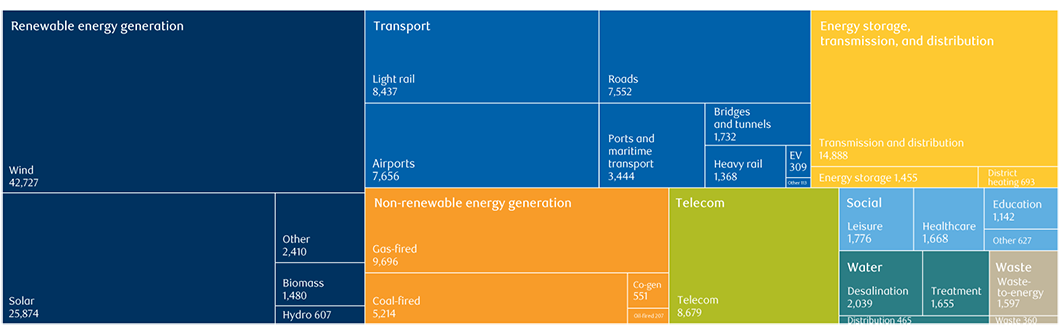

While renewable energy generation, largely driven by wind and solar projects, currently accounts for the majority of private investment in infrastructure projects, infrastructure projects encompass a broad range of subsectors, including transport, telecom, and social infrastructure.3

Private investment in infrastructure projects by subsector, 2020

(USD m)

Please click on the chart below to view.

Source: Global Infrastructure Hub based on IJGlobal data.

Note: Other renewables includes biofuels, hydrogen, geothermal, marine, and others. Other social includes prisons, leisure facilities, municipal street lighting, and others. Other transport includes parking facilities and others.

Given the diversity of subsectors covered, public sources of capital play a critical role in catalyzing investment in energy infrastructure, reducing risk, and advancing investment in areas where access to capital may be constrained.4 However, public funding alone cannot close the infrastructure financing gap: mobilizing private capital and leveraging public-private partnerships will also be essential. As institutional investors increasingly seek to deepen their exposure to green assets and projects, we anticipate that interest in sustainable infrastructure debt – for example, labeled green bonds with proceeds allocated to building climate-resilient infrastructure – will continue to grow.

Founded in 2017, the Canada Infrastructure Bank (CIB) is a public institution designed to mobilize C$35 Bn in capital over 11 years to invest in Canadian infrastructure projects across five priority sectors: green infrastructure, clean power, public transit, trade and transportation, and broadband.5 To fill the gap in financing that can prevent new infrastructure projects from moving forward, the CIB partners with public sponsors and private and institutional investors. A significant proportion of the projects funded by the CIB are focused on transformative greenfield infrastructure; with a construction element and no proven history of revenues, these projects tend to be higher risk and without the CIB’s involvement may have otherwise attracted limited private capital.

Embedding ESG Considerations throughout the Infrastructure Lifecycle

In addition to domestic infrastructure investment programs, multilateral efforts are underway to scale up global infrastructure investment. Recognizing the role of infrastructure as a driver for sustainable economic growth and the need to crowd-in private capital to bridge the infrastructure financing gap, in 2018 the G20 published a “Roadmap to Infrastructure as an Asset Class” in an effort to improve the investment environment for infrastructure, promote greater contractual and financial standardization, and enhance the availability of clear and timely data.6

One year later, the G20 endorsed “The Principles for Quality Infrastructure Investment”, a set of six voluntary principles integrating numerous environmental, social, and governance considerations.7 ESG factors present stakeholders with both risks and opportunities throughout the infrastructure lifecycle. While materiality will vary across asset type, geographic location, and stage of the project, some common ESG considerations include the environmental impacts on ecosystems and biodiversity, community engagement and inclusive decision-making, and climate change mitigation and adaptation.8

Sufficient access to data is an important factor to enable infrastructure investment decision-making, support project management, and mitigate the risk of perceived greenwashing. Initiatives such as the FAST-Infra Sustainable Infrastructure (SI) Label are an important step in this direction. Endorsed by the Glasgow Financial Alliance for Net Zero (GFANZ) and launched at COP26 in November 2021, the SI Label is a consistent, globally applicable labelling system designed to identify and evaluate sustainable infrastructure assets.9

A key objective of the SI Label initiative is to close the sustainable infrastructure investment gap by transforming sustainable infrastructure into a mainstream, liquid asset class. The Label will also facilitate due diligence processes and structuring of investments for sustainable infrastructure assets, and information on all labeled assets will be available to market participants through a data repository. The FAST-Infra Sustainable Infrastructure Framework (SI Framework) leverages over 20 taxonomies, standards, and frameworks and sets out the five requirements below for market participants seeking to apply the SI Label to infrastructure assets.

Source: The Climate Policy Initiative

Project Case Study: Wataynikaneyap Power

In its most recent Annual Report, the CIB highlights clean power as a meaningful channel to address the infrastructure gap in Indigenous and northern communities.10 The Wataynikaneyap Transmission Project is an example of an Indigenous-led energy infrastructure project that will generate environmental and socioeconomic benefits across multiple communities and provide cleaner and more reliable power to the population.

Wataynikaneyap Power LP (Watay) is a licensed transmission company that is majority-owned by 24 First Nations communities (51%), in partnership with Fortis Inc. and other private investors (49%). To connect First Nations communities currently powered by diesel generation to the provincial transmission grid for the first time, Wataynikaneyap – “the line that brings light” in Anishinaabemowin – will develop, construct, own, and operate approximately 1,800 kilometers of transmission lines and 22 substations in northwestern Ontario. After 25 years of operation, the 24 First Nations communities will increase their ownership and control of the Transmission Line to 100%.11 One segment of the Transmission Line is expected to come into service in April 2022 with the others coming into service between 2022 and 2024.12

Once completed, the Transmission Line will connect 17 remote First Nations communities to the main electricity grid in Ontario, supply cleaner, reliable energy to thousands of residents across the region, and eliminate reliance on diesel generation. Continued use of diesel generation to power First Nations communities is financially and environmentally unsustainable and inadequate to meet community needs. By replacing approximately 25 million liters per year of diesel usage, the Project is expected to result in over 6.6 million tons of avoided GHG emissions over 40 years.13

In addition to positive environmental benefits, the Project is expected to generate significant socioeconomic impacts. Historically, and currently, reliance on diesel generation with fuel transported in by air has curtailed population growth and economic activity within remote First Nations communities; establishing a connection to the main electricity grid is anticipated to help lift these constraints and improve residents’ quality of life. The Transmission Project is estimated to create 769 jobs during construction and deliver close to $900 MM in socio-economic value.

Financing of the $1.9 Bn Wataynikaneyap Transmission Project consisted of a ~$680 MM construction bank loan combined with a ~$1.34 Bn loan provided by the Province of Ontario. RBC acted as Senior Bank Administrative Agent, Collateral Agent, Co-Lead Arranger and Joint Bookrunner on the bank facility, leading a syndicate of five Canadian Schedule I banks. Watay was awarded Transmission Deal of the Year 2020 by Power Finance & Risk, North American Transmission Deal of the Year at the IJGlobal Americas Awards, and voted the Clean50 Top Project by peers at the 2021 Clean50 Summit.

Project Case Study: Réseau express métropolitain

The C$6.3 Bn Réseau express métropolitain (REM) Project is a new automated light rail network in the greater Montréal area and the largest public transit project undertaken in Québec in the last fifty years. The REM will generate 34,000 jobs during construction and, when put into service in 2022-2023, will be fully electric and universally accessible.14 The REM is anticipated to help decrease GHG emissions by 680,000 tonnes over 25 years and reduce vehicle congestion in the Montréal area. With 67 kilometers of dedicated rail lines, the REM will be the fourth largest automated transit network in the world with 26 stations, 13 bus terminals, and 13 parking facilities.

RBC acted as Sole Financial Advisor for the REM project. As part of its role, RBC constructed a complex financial model to budget the project’s capital requirements and establish return thresholds, advised CDPQ Infra on potential financing structures, and provided support in their interactions with internal and external stakeholders, including investment committees and governments.

The Government of Québec has committed C$1.28 billion of investment to the Project and the CIB has provided a C$1.28 billion 15-year senior secured loan. The Autorité Régionale de Transport Métropolitain (“ARTM”), the umbrella organization that manages and integrates road and public transport in the greater Montreal area, will collect fares from commuters and pay a ridership fee to REM based on passenger kilometers travelled.

Project Case Study: Calgary Airport-Banff Rail (CABR) Project

In Western Canada, Liricon Capital and Plenary Americas, a portfolio company of Caisse de dépôt et placement du Québec (CDPQ), are proposing to build a low-carbon rail link that will connect the Calgary International Airport and Banff train station. The proposed rail link will have five stops between Calgary Airport and Banff, including downtown Calgary and Morley (Stoney Nakoda). In December 2021, Liricon submitted a proposal to the Government of Alberta and the CIB to advance the Calgary Airport-Banff Rail (CABR) project from Phase 3 (Development) to Phase 4 (Design).15 The proposal for the CABR project, which is currently under review by the Government of Alberta, is structured as a public-private partnership, contemplating financing from private and institutional capital as well as the CIB, to deliver a rail system by 2025 that has the potential to be hydrogen-powered.16

CABR is anticipated to bring about a number of economic and environmental benefits to the region, increasing labour mobility, expanding and diversifying Alberta’s economy, and reducing carbon emissions. The CABR system also directly supports the Banff National Park Net Zero 2035 initiative, which aims to make Banff the first community in North America to be net zero.17 In addition to attracting business and tourism to Calgary, CABR will provide inclusive access to the mountains for Albertans, including RBC employees.

RBC Capital Markets is supportive of the CABR project and its long-term economic, social, and environmental benefits and we look forward to the future financing opportunities associated with the project.

Closing Thoughts

The role of infrastructure as a catalyst for sustainable growth and as an enabler of the transition to a low-carbon economy has become evident in the wake of the COVID-19 pandemic. Mobilizing private capital and leveraging public-private partnerships will be essential to scale up investment, realize the full potential of infrastructure, and close the global infrastructure financing gap. As institutional investors increasingly seek to deepen their exposure to green assets and projects, as well as invest in projects which advance socio-economic inclusion, we anticipate that interest in sustainable infrastructure debt will continue to grow. RBC Capital Markets has extensive knowledge and experience across the Infrastructure sector and partners with our clients to provide them with the market insights and sustainable debt solutions needed to succeed and thrive in the transition to a low-carbon economy.

1. Infrastructure Monitor 2021 (gihub.org)

2. GPSI.pdf (unep.org)

3. Infrastructure Monitor – ESG in Infrastructure

4. Executive summary – World Energy Outlook 2021 – Analysis - IEA

5. Canada Infrastructure Bank - About Us

6. roadmap-to-infrastructure-as-an-asset-class-50.pdf (gihub.org)

7. annex6_1.pdf (mof.go.jp)

8. download (unpri.org)

9. New Label Designed to Identify Sustainable Infrastructure Assets Launches at COP26 - CPI (climatepolicyinitiative.org)

10. The Canada Infrastructure Bank (CIB) invests in infrastructure projects within the clean power sector. | Canada Infrastructure Bank - an impact investor accelerating new infrastructure by engaging private and institutional investors and project developers. (cib-bic.ca)

11. https://www.wataypower.ca/ownership/partnership

12. Backgrounder - EB-2021-0134 – Application for 2022 Electricity Transmission Rates and Other Charges (oeb.ca)

13. Wataynikaneyap Power Project: Connecting 24 First Nations: Wataynikaneyap Power & FortisOntario | Clean50

14. Presentation of the Réseau express métropolitain (rem.info)

15. Calgary-Airport-Banff-Rail-Design-Phase-Press-Release-12-08-2021.pdf (banffecotransithub.ca)

16. Calgary-Airport-Banff-Rail-Design-Phase-Press-Release-12-08-2021.pdf (banffecotransithub.ca)

17. Calgary Airport - Banff Passenger Rail Project Enters (globenewswire.com)