Towering over the competition

Best path forward

"R1 stands apart as the premier revenue management platform, leveraging advanced automation to set new standards in healthcare revenue performance. TowerBrook and CD&R’s investment will propel our innovation as we expand our intelligent automation capabilities and drive customer value. I’m enthusiastic about our strengths and opportunities to serve the broader market and maintain our steadfast commitment to customers success."1

Joe Flanagan

CEO

R1 RCM

Structuring

for success

Nearly 70% of hospitals still manage billing in-house, despite mounting complexity, regulatory change, and cost pressures—an increasingly unsustainable model. As healthcare providers seek more efficient, tech-enabled solutions, R1 RCM stands out as the largest independent end-to-end revenue cycle management (RCM) provider in the U.S. The company serves more than 500 healthcare organizations, including 93 of the top 100 health systems, and manages over $1 trillion in provider net patient revenue (NPR). R1’s automation-first approach helps providers streamline operations, improve cash flow, and refocus on patient care—positioning it at the forefront of a growing, underpenetrated market.

Despite its strong fundamentals, R1 had been trading at a discount relative to its long-term potential. TowerBrook Capital Partners—already a 36% shareholder—identified an opportunity to take the company private, partnering with Clayton, Dubilier & Rice (CD&R) to back R1’s next phase of growth and innovation.

To fund the transaction, RBC Capital Markets arranged and priced the financing in October 2024, serving as lead-left bookrunner on a senior secured notes offering and joint lead arranger on a secured credit facility.

The acquisition closed in November 2024 as an all-cash take-private, with shareholders receiving $14.30 per share—a 29% premium to R1’s unaffected closing price on February 23, 2024.

The deal underscores confidence in R1’s strategic direction and value creation potential. CD&R brings deep operational and investment expertise, with over $53 billion invested across more than 120 portfolio companies, while TowerBrook applies its Responsible Ownership™ framework to support long-term, sustainable growth.

RBC Capital Markets served as joint financial advisor and committed debt financing provider in addition to leading the capital markets execution.

Delivering

value creation

The transaction’s success hinged on a thoughtfully engineered capital structure—built to support execution certainty, investor appeal, and long-term strategic flexibility.

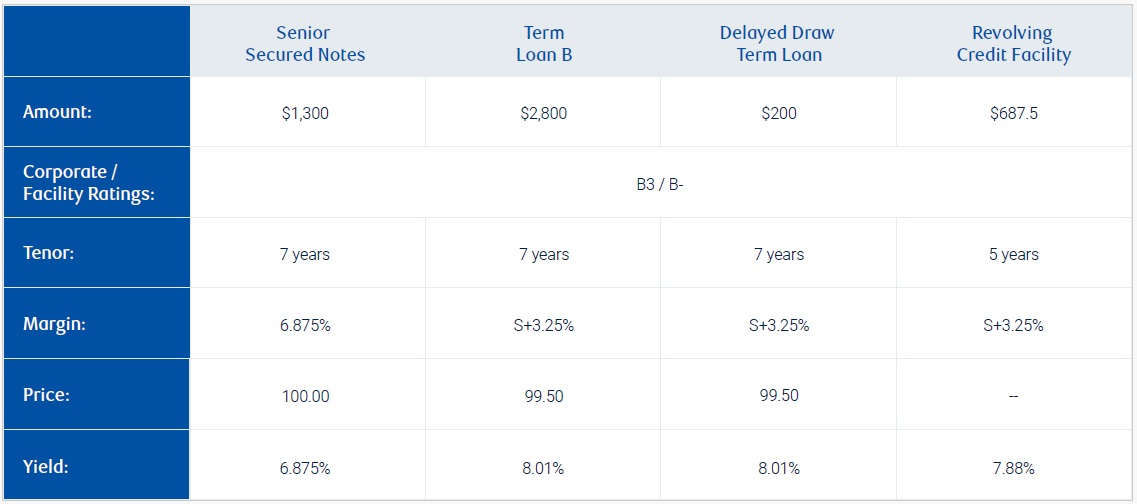

RBC Capital Markets played a central role in shaping and executing the financing. As lead-left bookrunner on R1’s $1.3 billion seven-year senior secured notes (SSNs) offering and joint lead arranger on the $3.0 billion term loan B (TLB), RBC also structured a $200 million delayed draw term loan facility (DDTL) and a $687.5 million revolving credit facility (RCF), leveraging the strength of its balance sheet to support the client with a meaningful commitment.

The financing was structured as a mix of debt instruments, combining secured bonds and credit facilities to balance risk, drive competitive pricing, and optimize execution. RBC underwrote 50% of the final financing package and led the significantly oversubscribed notes offering—enabling an upsized loan and more favorable pricing amid strong investor demand.

RBC’s ability to move quickly under tight timelines—leveraging deep sector expertise and seamless coordination across execution, sponsor coverage, and industry teams—was instrumental in delivering a well-structured, cost-effective solution that aligned with the buyers’ strategic objectives.

“As a long-term, responsible investor in R1, TowerBrook has supported the development of R1 as a leader in healthcare provider revenue management since 2016. Together with CD&R, we look forward to continuing to invest in the Company’s core operations to drive customer performance and value while also continuing to build R1 as a leader in intelligent automation and in the use of GAI in revenue management.”1

Ian Sacks

Managing Director

TowerBrook CEO

Setting the standard

“We see tremendous opportunity to build on R1’s differentiated platform to continue delivering solutions to help healthcare providers operate more efficiently and reduce costs in the system. We are excited to work alongside TowerBrook and the talented team at R1 to continue setting the standard for healthcare performance.”1

Ravi Sachdev

Partner

CD&R

Delivering

results

Now backed by TowerBrook and CD&R, R1 is expanding its intelligent automation capabilities to enhance efficiency and financial performance. As a category leader in a high-growth sector, the company is well-positioned to accelerate investments on behalf of providers and create a new revenue cycle that delivers a faster, frictionless, and more transparent financial experience for both providers and patients.

Private ownership provides the flexibility to accelerate innovation and execution without public market constraints. With a strong market presence, advanced technology, and a growing customer base, R1 is set to lead the industry and drive long-term shareholder value.

RBC’s deep sector expertise and longstanding sponsor relationships were instrumental in delivering this outcome. The firm has completed a number of revenue cycle management and healthcare technology transactions across M&A, capital markets, and debt advisory, and is a leading advisor across revenue cycle management, tech-enabled healthcare services, and healthcare IT. With over 10 transactions completed with CD&R in the past year and a long-standing partnership with TowerBrook, RBC provided the strategic insight and execution precision needed to support a successful transition to private ownership.