Supporting healthy ambitions

A lasting partnership

RBC Capital Markets’ relationship with UnitedHealth Group

began in 2015. The bank serves on the group’s $21 billion

commercial paper program and is consistently ranked as

one of UHG’s top dealers.

Delivering

value creation

Minnesota-based UnitedHealth Group (UHG) deploys its distinctive competencies in information, technology and clinical excellence towards its declared mission: to help people live healthier lives and make the health system work better for everyone.

UHG is consistently active in M&A, having completed a host of recent acquisitions spanning the healthcare and health technology sectors. Its growth strategy and need to refinance maturing bonds necessitate regular capital raising exercises.

In July 2024, RBC Capital Markets acted as joint active bookrunner on UHG’s successful launch of a $12 billion, eight-part senior unsecured notes offering. The capital would be used to refinance short-term debt or to redeem, repurchase or repay outstanding securities.

This was the largest offering ever by UHG, standing as the third biggest healthcare transaction of the year and the fourth largest investment-grade deal across all sectors.

Structuring

for success

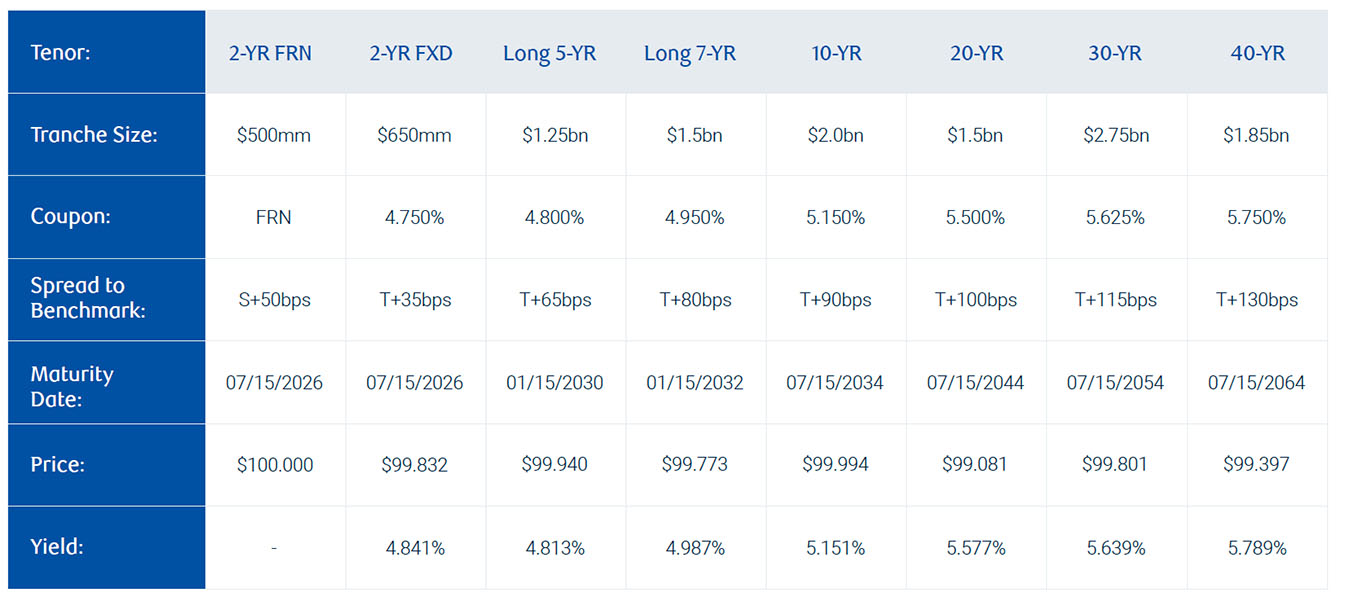

The structure and timing of the transaction were both critical to its success. The issuance was structured in eight parts, including two-year fixed and floating rate notes, long five- and seven-year notes, and 10-, 20-, 30- and 40-year notes.

The spread was designed to appeal to unique investor bases. For example, the 40-year bonds at 5.75% offered highly attractive yield for insurance companies and pension funds. The short-term notes, issued in smaller tranches, targeted a broader investor universe.

The emphasis on the longer end of the curve was designed to meet

UHG’s objective of limiting maturing debt to $5 billion annually. To this end, the RBC team suggested the addition of the 20-year tranche, lifting the transaction beyond the more typical seven-part structure.

RBC’s experts selected the time of the offering to build on the momentum of UHG’s positive second quarter results a week earlier. UHG beat estimates and raised their 2024 outlook, leading to a rally in the share price that the team could build on.

Another key factor in selecting the go-to-market timing was the potential for market volatility raised by predicted Federal Reserve moves on interest rates, as well as the U.S. general election in November. The July launch date was selected to avoid complexities related to both events.

"In the current environment, every basis point matters. Our rationale for the eight-tranche transaction was to spread the offering across the curve, with appeal to a whole spectrum of unique investor types."

Paul Nagle

Managing Director, Debt Capital Markets

RBC Capital Markets

Expectations exceeded

UnitedHealth was able to leverage strong demand for this offering to go out with guidance levels 20 basis points inside initial price thoughts. The two-year fixed and floating rate notes were both able to tighten 25 basis points from the initial price thoughts (IPTs).

Delivering

results

The offering drew strong interest. At its peak, the total order book amounted to nearly USD$40 billion.

Final demand for the floating rate notes was over $2 billion - among the top three largest floating rate order books ever in the corporate space. However, demand was strongest at the long end of the curve, with the prospect of 40-year bonds at 5.789% proving attractive to investors with a lower interest rate environment on the horizon.

RBC’s role in the transaction was founded on a concerted coverage effort across multiple functions, including debt capital markets, corporate banking, risk solutions, healthcare coverage, and commercial paper. Seamless collaboration across the business provided UHG with a clearer path to evaluate deal synergies and ensure financing strategy alignment.

The team also drew on its deep knowledge of the group’s strategy and ambitions: it has worked as a bookrunner on UnitedHealth's three bonds offerings over the past 16 months, which have raised nearly $25 billion in total.