Key Points

- Big tech’s large cash reserves give them the advantage over big pharma

- Leading tech companies are quietly aggregating healthcare IP and seeking new patents

- Apple, Microsoft, Google and Amazon are investing heavily in healthcare startups and enterprises

Seismic Shifts in Healthcare

By the year 2030, the global healthcare budget is estimated to rise to $15 trillion.1 Much of this massive market is comprised of new and never-before-imagined healthcare adjacencies. These innovations are being driven by the demands of a younger generation of tech-savvy, health-conscious, prevention-minded consumers. This influential group is poised to spend their healthcare dollars in very distinct ways while maintaining some of the traditions of past generations when it comes to insurance coverage and treatments for disease.

There’s a huge, and growing, opportunity to digitally disrupt the healthcare space. Despite having no experience in drug discovery or development, tech giants like Amazon, Microsoft, Apple, Alphabet and others are making major investments in health and wellness. They are vying with pharma titans like Pfizer, Merck, GSK and others who, by comparison, only have modest experience in managing, analyzing and extracting utility from zettabytes of digital information. In the future, these two industries will compete for access to patient data and the ability to benefit from it. Whoever is best able to utilize every individual’s digital health record, fed by his or her “data-ome,” will capture significant new profit pools and disrupt existing ones.

“There’s a huge, and growing, opportunity to digitally disrupt the healthcare space.”

- Sasson Darwish

Tech’s Unmatched Firepower

Tech giants are searching for ways to establish a leadership position in the quickly evolving healthcare sector. They are using their extraordinarily large cash balances to bolster their internal healthcare R&D budgets as well as investing heavily and aggressively in AI companies, data analytics startups and biotech enterprises.

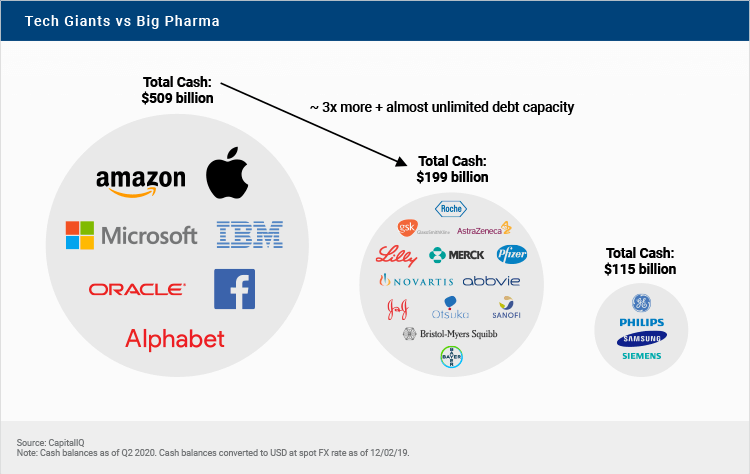

Perhaps Stuart Varney, Fox Business Network anchor, put it best: “The tech giants are extending their tentacles because they have the money to do so.” And with $509 billion of cash, and another equivalent amount of debt capacity, they outpace the $199 billion of cash the pharma titans have on hand.

Similar to this

Innovations in the Pipeline

The tech world is quietly aggregating healthcare intellectual property. The major players filed over 1,500 healthcare related patents from 2015 to 2017 alone.2 Haptic medical devices, personal health wearables, imaging technology, smart homes, and data-related patents are just a few of the innovations in the pipeline.

For Apple, it’s been a foray into devices like the massively popular Apple Watch whose Series 4 and Series 5 watches can accommodate ECG capabilities cleared by the FDA. Apple partnered with Stanford University to execute the Apple Heart Study in 400,000 Apple Watch wearers to detect atrial fibrillation. The company’s watches now include features for diabetes management and it sells the One Drop Chrome blood glucose monitor and accessories in some of its physical stores. Apple CEO, Tim Cook, recently stated, “If you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ It will be about health.”

Microsoft has made a move into biopharmtech by investing in experimental wetlabs. In collaboration with DNAnexus, Microsoft has launched a set of cloud-based processing tools for clinicians and scientists pursuing genomics research. Stating that cancer and other biological processes are information processing systems, Microsoft launched an extraordinarily ambitious program to “solve” cancer within a decade.

Just last year, Google acquired Fitbit for $2.1 billion positioning itself for monetizing the “last inch.” It has invested in more than 30 biotech ventures in diverse therapeutic areas, including Spybiotech, a vaccine company, and TScan Therapeutics, a developer of T-cell therapies. Lending particular credence to Google’s efforts, its DeepMind subsidiary, in collaboration with academic medical doctors in the U.S. and EU, published an article in the prestigious journal Nature Medicine describing an AI diagnostic system capable of outperforming expert radiologists in reading mammograms to identify breast cancers at early stages.3

As for Amazon, it has disrupted the pharmaceutical supply chain by purchasing PillPack in 2018 for approximately $750 million, and has invested in Haven, a joint venture with Berkshire Hathaway and J.P. Morgan formed to tackle rising healthcare costs among U.S. employees. It is piloting Amazon Care, a virtual health clinic with in-home follow-ups for employees in Seattle. Amazon’s Alexa has a platform for HIPAA-compliant apps to handle sensitive health information.

1. Source: Where healthcare’s big data actually comes from. https://www.techemergence.com/where-healthcares-big-data-actually-comes-from. Clin Chem Lab Med 57: 328-335 (2018). PwC "Driving the Future of Health" (2019). www.strategyand.pwc.com/report/future-of-health.

2. Source: U.S. Patent and Trademark Office (2016-2018); Stanford Medicine 2018 Health Trends Report: “The Democratization of Health Care”. Note: Results of Search in AppFT Database for: AND/(Google OR Amazon OR Apple OR Microsoft) AND (ACLM/health OR medical OR patient OR disease OR wellness OR (physical AND activity)) OR ABST/health OR medical OR patient OR disease OR wellness OR (physical AND activity)) AND PD/1/1/2015->1/1/2018. Pie chart pertains to patent applications filed from 2015-2017.

3. Source: Nature Medicine 25: 44-56 (2019); Wall Street Research

Start Watching

Start Watching