Published April 14, 2022 | 3 min watch

Key Points

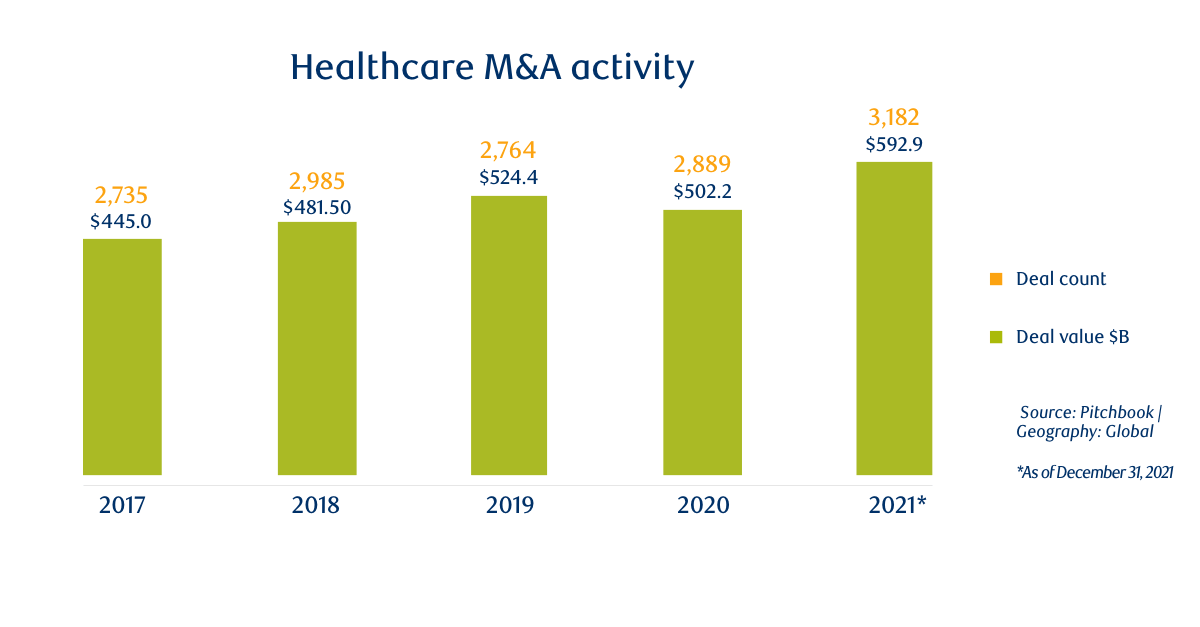

- 2021 saw a record $600B in healthcare M&A activity.

- Building sustainable growth remains a strong focus for many in the healthcare sector.

- Looming patent cliffs in pharma and biotech are expected to drive M&A activity.

- In the first half of 2022, a slowdown in activity is anticipated within healthcare, but M&A prospects remain strong in the medium to long-term.

Vito Sperduto:

As we look back at 2021, it was a record year no matter how you measured it, and all sectors participated. Healthcare is one of the top two or three sectors year in, year out. What did you see in healthcare?

Andrew Callaway:

There was $600 billion worth of M&A activity in healthcare last year. We saw a strong deal environment across all the sub-verticals. About 50% of the volume came from biopharma, but medtech and services also played important roles.

Vito Sperduto:

In many sectors, we see a high correlation between the sustainable growth record of companies and the implied multiple at which they trade. That’s true in the public markets and from the perspective of M&A transactions. Do you see this in healthcare?

Andrew Callaway:

Growth is a critical driver. Everybody is intensely focused on durable top-line growth. Just take, for example, a transaction that we completed recently with a company called LSNE, which was a portfolio company of Permira. We helped sell LSNE to PCI Pharma Services for $1.5 billion. There is no doubt that LSNE will have a very positive impact on PCI’s top line. A couple of other important drivers in healthcare M&A are increased scale and geographic expansion.

Vito Sperduto:

A number of our clients, beyond healthcare, have slowed down the rate at which they complete cross-border deals. This slowdown is a consequence of the recent limitations on extensive due diligence. Have you seen a similar pattern in the healthcare sector?

Andrew Callaway:

In 2021, despite the issues associated with the pandemic and the inability to do complete due diligence in the normal manner, we saw robust cross-border activity. Do I see a slowdown as we head into 2022? Yes, I would say that there will be a considerable reduction in activity, especially given the current geopolitical situation. We do continue to see significant consolidation once the uncertainty abates. Looking at biopharma, we expect buyers to focus on oncology, immunology, neurology and rare diseases. In medtech and diagnostics, our team thinks that cardiovascular, diabetes and neurmodulation are ripe for consolidation; we also expect orthopedic companies to continue to diversity.

“If you think about what is happening in AI and machine-learning drug discovery: those are exciting places to be.”

Andrew Callaway, Global Head, Healthcare

Vito Sperduto:

The last couple of years have produced some extraordinary innovations in the healthcare field, especially with the development of the COVID vaccine and the associated use of mRNA technology. What types of innovation do you currently anticipate?

Andrew Callaway:

Everybody is always seeking disruptive technologies. If you think about what is happening in AI and machine-learning drug discovery: those are exciting places to be. Wearables and digital therapeutics are emerging as important areas from a licensing perspective today, but they could be focal points from an M&A perspective tomorrow.

Vito Sperduto:

In broad terms, we are very bullish on the prospects for M&A and deal volume. Is there anything specific to healthcare that you think should cause us to have a different view?

Andrew Callaway:

As we look back over the last five years, valuations have been creeping higher and higher and peaked about six months ago. Should valuations get back to those peaks, I believe it will be difficult to complete transactions. In addition to that, extended volatility can play a major role in making it challenging to find a meeting point between buyers and sellers.

“I think we will see a big wave of M&A as we move to the back half of 2022.”

Andrew Callaway, Global Head, Healthcare Investment Banking

Vito Sperduto:

There is a large wave of healthcare patents that are coming due in two to five years’ time. As you talk to clients in that wave, what are they looking to do to replace the revenue they will lose?

Andrew Callaway:

Clients will respond by entering the M&A market. We will see significant activity as people look to bolster not only pipelines but commercial portfolios.

Vito Sperduto:

Can you summarize how you are thinking about 2022?

Andrew Callaway:

With relatively quiet capital markets, we are spending significant time with management teams and boards looking at strategic transactions. So I think we will see a big wave of M&A as we move to the second half of 2022.