Published October 19, 2022 | 4 min read

Key Points

- Boardroom confidence has dipped due to macro uncertainty, but corporates are still poised for M&A action.

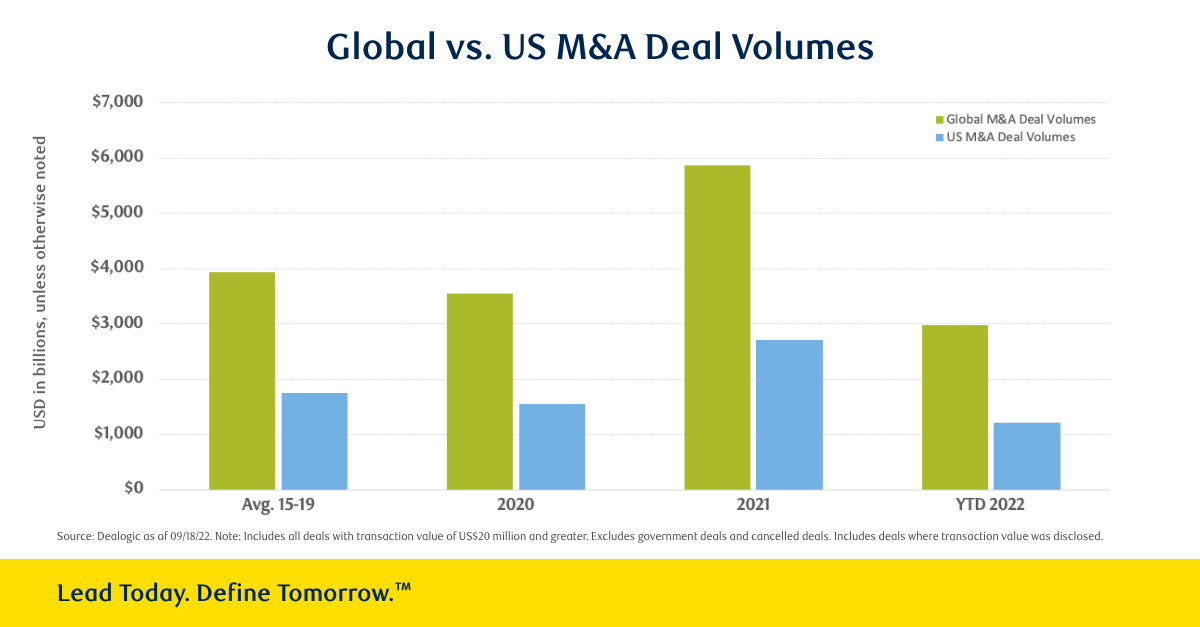

- 2022 activity has dropped below the highs of 2021, but remains strong compared to pre-pandemic levels.

- Slower economic growth, geopolitics and company actions to diversify supply chains are key factors feeding a trend toward more domestic M&A activity.

- Higher interest rates require a financing reset, but many corporates are armed with strong balance sheets.

Current levels of confidence and planning

Larry Grafstein: Confidence drives the M&A market. It’s been a time of tremendous uncertainty. One very expected event – the fact that interest rates were eventually going to have to go up – was followed by the unexpected event, the Ukraine crisis. These two developments followed the pandemic, which has forced a structural adjustment on companies and investors.

Vito Sperduto: The Conference Board’s CEO confidence index was below 50% at the start of the pandemic. Then we saw an incredible jump in the latter part of 2020/21 to an all-time high of over 80%. Now it’s dipped below 50% again due to uncertainty. Our corporate clients have certainly identified assets they want to divest and areas they want to augment. There’s a ton of activity out there, and it’s across sectors.

M&A activity in 2022 compared to previous years

Grafstein: In the first half of this year, M&A activity dropped by 20 to 25% from a very strong 2021. If you ignore SPAC activity – which had a strong moment in early 2021, due to the ultra-low interest rate environment and excessive liquidity in the system – M&A activity was more or less flat for the first part of the year. But in the second part of 2022, there is more conservatism. Most of that is driven by macroeconomics.

Sperduto: The US market this year has lost over 40% in terms of announced deal volume. Globally, volumes are off by 30%, while the European market is off roughly 20%. But the European market was already more depressed in 2021. I would say that the US market continues to be the most sought after.

The trend toward deglobalization and domestic deals

Sperduto: If you look back at the high point of China’s investment into the US, back in 2016, it was in the order of $27 billion. In the first half of 2022, that number dropped to just under $2 billion. What we’re seeing is more transactions that are inwardly focused – within the same country, or among friendly or ally countries. For example, in the same time period, investment by the US into Europe more than doubled, from around $60 billion to $150 billion.

Grafstein: We talk about near-shoring and friend-shoring. Before COVID, the world was really trying to optimize efficiency, and perhaps sacrificed a little resilience. So a version of deglobalization is clearly happening at the macro level. Time will tell how much impact that will have on the economy in general and M&A in particular.

Sperduto: Our clients are multinational. They’re certainly trying to make sure their supply chains are augmented and diversified, to make sure they’re not beholden to any one region. As a result, we’ll see more diversified companies – and a lot of that is going to occur through an M&A lens.

Grafstein: We could see a bit of decoupling of Europe from the US. There’s more of a structural shock in Europe. Also, the Chinese economy is in a slower growth mode than it’s been in quite some time. All of these factors do move us more toward deals that are domestic in focus – whether it’s within the US, or within a unit like the USMCA trade zone, or between very friendly countries.

Financing transactions in a higher-rate environment

Grafstein: As interest rates normalize, higher cost debt could be somewhat dilutive on the margin. The good news, for a subset of companies that are not highly levered, is that they enter this tougher economic period with very strong – in many cases, bulletproof – balance sheets.

Sperduto: Interest rates are still ok – it’s not as if we are back to the 1980s. But companies need to reset their models. You need some stability for a period, and then you’re going to see a tremendous amount of deal flow. From our perspective, we’re making sure clients are ready to pull the trigger as soon as there are windows of opportunity in the market.

Grafstein: The structural issue is around the unpredictability of energy price inputs, and that feedback effect on inflation. From an M&A perspective you need to reset financing markets in that type of environment. There’s also a rebalancing of risk-reward from a buy-side investor perspective. Then you also have the question of how economic activity might feed into your own numbers for your company. It’s very hard to do a deal while your own company is unsettled.

The bottom line: outlook for M&A

Sperduto: We always talk about M&A activity relative to the prior year. However, 2021 saw a level of activity that is not sustainable long-term. Looking at 2022, we’re still well above activity relative to the average of the pre-pandemic years, 2015 to 2019. Once we have that near-term uncertainty lifted, I think we’ll see a rebound and accelerated volume of M&A transactions.