Published April 14, 2022 | 3 min watch

Key Points

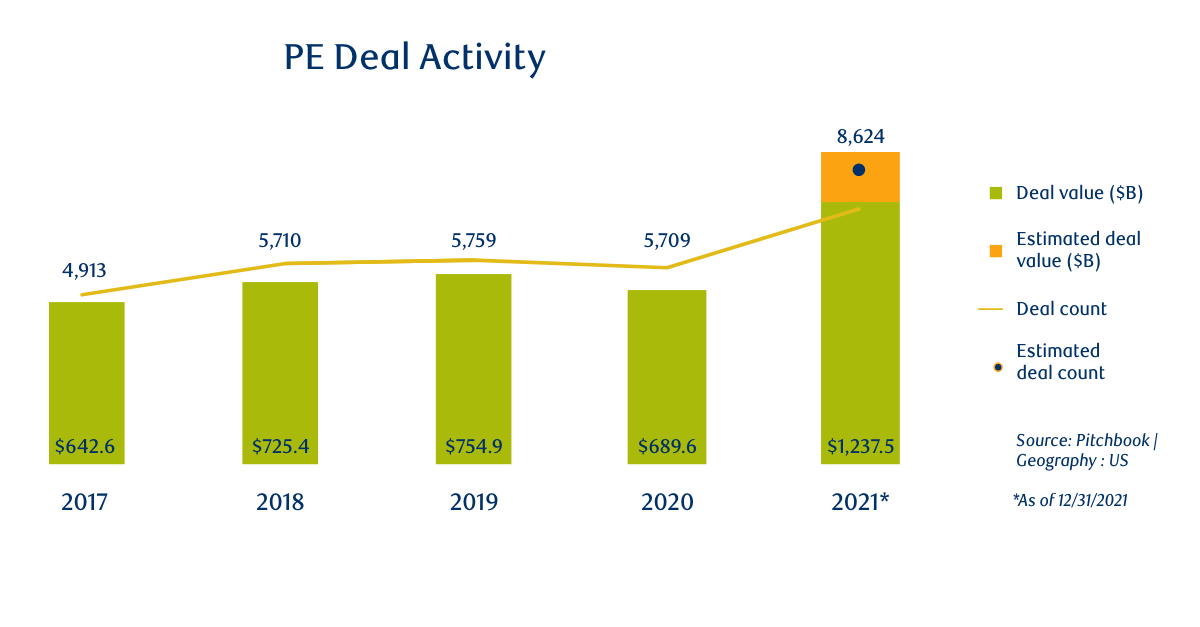

- In 2021, private equity M&A activity was 50% higher than the previous record.

- Funds are experiencing significant growth, with $35B funds now a reality.

- Sponsors are becoming more competitive and can offer advantages over corporates in some deals.

- The outlook for private equity M&A dealmaking remains strong in 2022.

What was the strength of private equity M&A activity in 2021?

Harold Varah:

It was hard to catch a breath in 2021. Private equity firms executed 8,500 transactions worth over $1.2 trillion last year. That’s over 50% higher than the previous record and was almost matched by the exit activity we saw.

Larry Grafstein:

There were a significant number of entries and exits, with ongoing strength in industries such as healthcare and technology, but what was remarkable about last year was the breadth of strong dealmaking across the entire industrial spectrum.

Harold Varah:

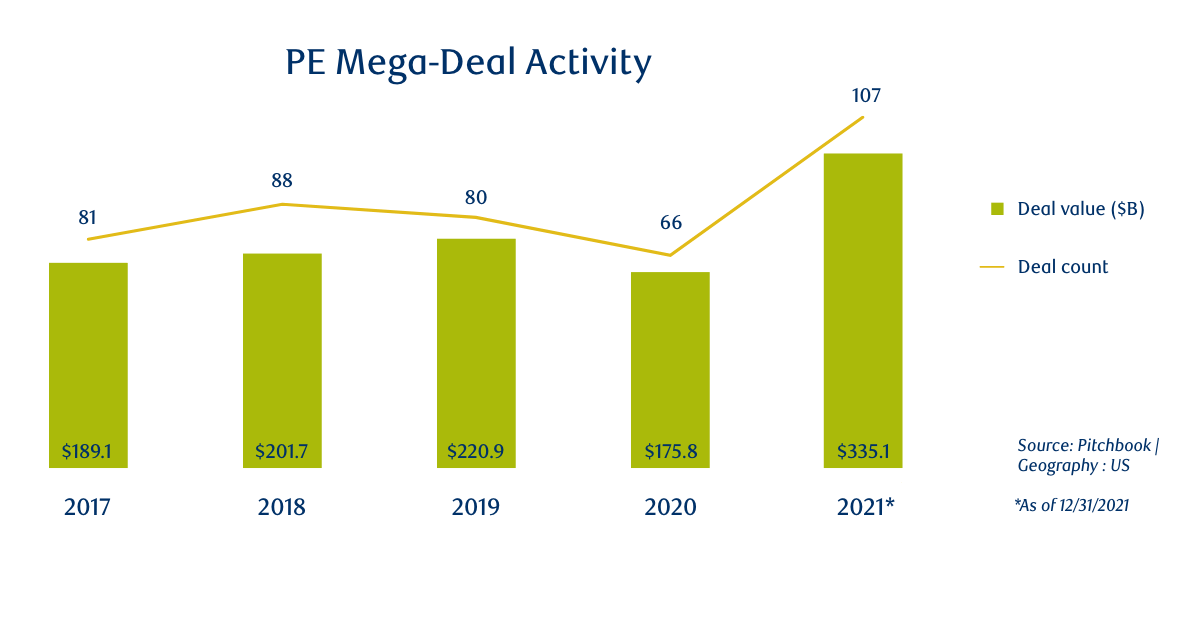

Mega-funds are becoming more mega, and big funds are becoming bigger. Funds of $35 billion are no longer aspirational, they’re a reality. When it comes to the transformative franchise transactions that large private equity firms are looking at, they want to be playing on both ends of the spectrum. They have pools of capital that they want to deploy. While there are only so many firms that can do mega-deals. I believe we are going to see a material increase in deals worth more than $10 billion going forward.

What is currently influencing private equity dealmaking?

Larry Grafstein:

It takes a new administration about a year to put its people in place. It’s now clear that the current administration will challenge many corporate transactions. One of the consequences is that private equity sponsors, who generally have lower market share than corporate competitors when trying to affect a given acquisition, will gain a competitive advantage over corporates in some deals. This new-found edge is enhanced by sponsors’ added capacity to consider deals of significant scale.

Vito Sperduto:

With some larger deals, we are seeing that the sponsors are just as competitive as the corporates involved. I think part of this is sponsors’ ability to offer greater certainty when it comes to closing deals.

What are your thoughts on the current IPO backlog?

Harold Varah:

The IPO backlog has grown, many companies contemplating going public are now sitting in that queue. No sponsor wants to go into a volatile market where they cannot predict the price of an IPO and, more importantly, where it’s going to trade.

“The E in ESG: we’ve seen a significant upsurge in environmental investment.”

Larry Grafstein, Deputy Chairman, Global Investment Banking

What influence is ESG having on private equity dealmaking?

Harold Varah:

Over 80% of limited partners right now state that they are, or will soon be, evaluating ESG as one of the major points of differentiation when deciding where to invest their capital. Interestingly, there’s no standard definition of ESG across the private equity landscape. So, we’re going to see private equity firms continue to evolve how they are thinking about ESG and how it matters to them. Perhaps we’ll see dedicated pools of capital targeted at different ESG themes.

Larry Grafstein:

The E in ESG: we’ve seen a significant upsurge in environmental investment. We see it in renewables, in infrastructure, and in many areas that affect the environment. The environment is a strong focus for us as we help with the transition to cleaner forms of energy. Russia’s invasion of Ukraine has had an impact on all of us. First and foremost, we think of the human impact. Then we think about the economic dislocation that comes with such an event. We’ve seen commodity and energy markets trading with tremendous volatility. These factors play directly into confidence, which influences M&A and investment activity.

What’s the impact of the current regulatory environment on deals?

Vito Sperduto:

We often talk about the regulatory regime in the US. We also need to consider that there are many individual regulatory regimes around the globe. For example, if you look at the EU, 24 of the 27 member states now have their own individual regulatory requirements. With deals where there is exposure to such geographies this presents additional hurdles. I don’t think such hurdles prevent deals; they just elongate the timetable.

How do you see the broad outlook for private equity dealmaking in 2022?

Harold Varah:

I’m incredibly optimistic about this year, it really comes down to the overall health of this asset class.

“Sponsors are not paid to sit on cash. They will find ways, especially in volatile periods, to make the right investments.”

Harold Varah, Co-Head, Financial Sponsors

Vito Sperduto:

Even if there’s a 20% drop-off in volume this year, it will still be the second-best year on record.

Harold Varah:

Sponsors are not paid to sit on cash. They will find ways, especially in volatile periods, to make the right investments that are on theme, consistent with their strategies, and where their returns will outperform almost any metric.