Key Points

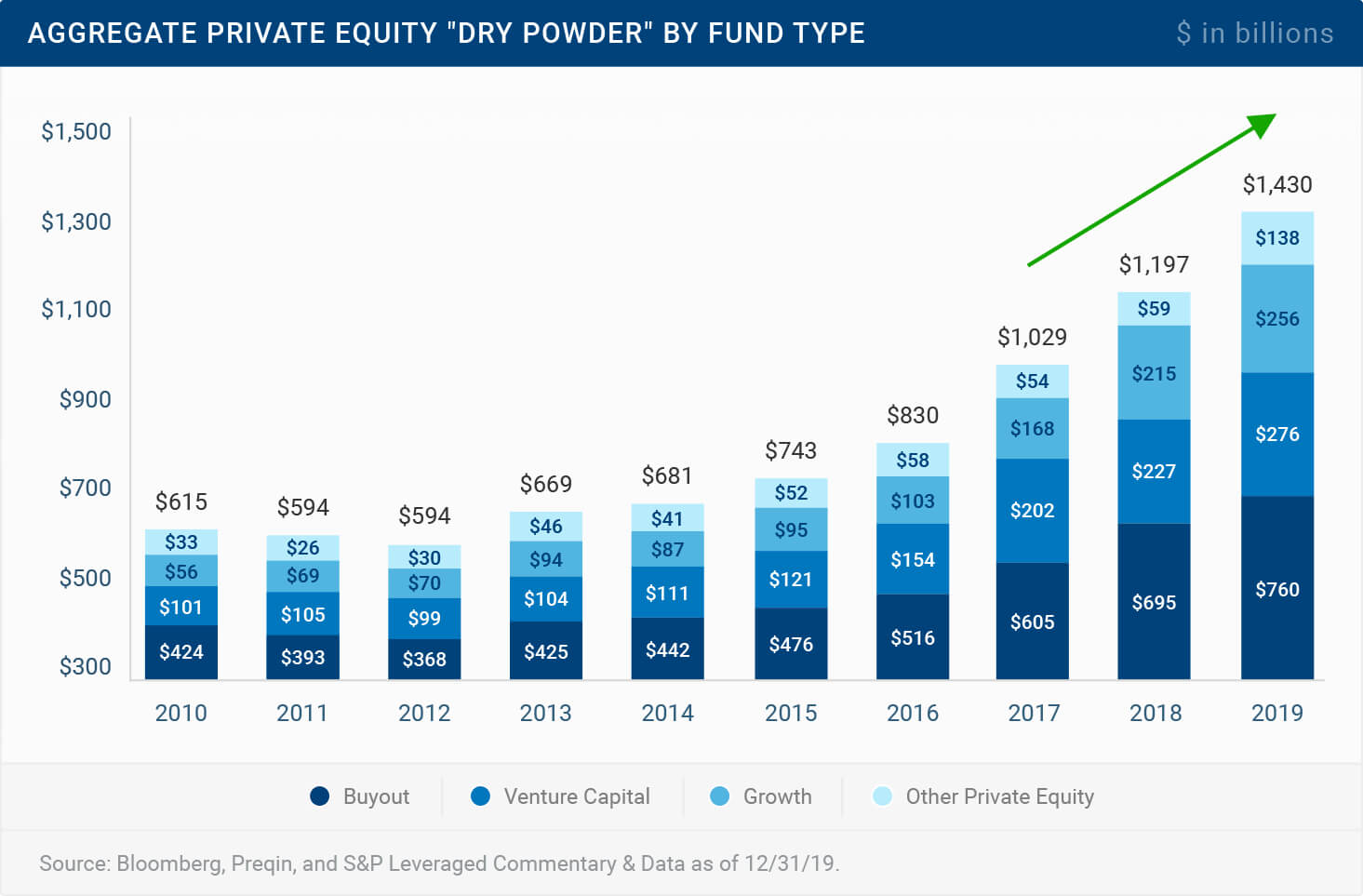

- 1.4tn of dry powder creates pent-up demand and need for exits

- PE likely to play stronger role post-outbreak than it did after the 2008 downturn

- While market downturn makes targets cheaper, firms may be hesitant to do deals

- Add-on transactions have made portfolio companies more resilient

- Infrastructure funds are well positioned for more opportunities

The outlook for private equity

There is still a lot of pent-up demand in the private equity (PE) industry. Firms are sitting on $1.4tn of dry powder, the largest pool of private capital raised in history.

The difficulty is how firms put dollars to work. Despite the fact that 95% of the funds raised last year were bigger than their predecessors, deals of $1bn or greater in value actually dropped 28%.

Firms have also been holding companies longer than they would have traditionally, and some of the tech unicorns did not hit the market as favorably as originally expected. While the hold periods are likely to extend given market volatility driven by the coronavirus outbreak, these companies can’t stay private forever. PE firms will still want to unlock liquidity from some of their portfolio companies.

“While it can remain hard to get the attention of a corporate counterparty, we believe PE is going to be a bigger player in the next couple of years than it was post the 2008-09 crisis.”

- Larry Grafstein

What factors are driving decision making?

Private equity firms, of course, own substantial portfolios and will prioritize their existing investments. These span the full range of sectors and are often characterized by leveraged capital structures.

Many industries have confronted a sudden, sharp change in circumstances—travel, leisure, real estate, energy to name a few—and PE firms will devote attention and capital to protecting their best companies.

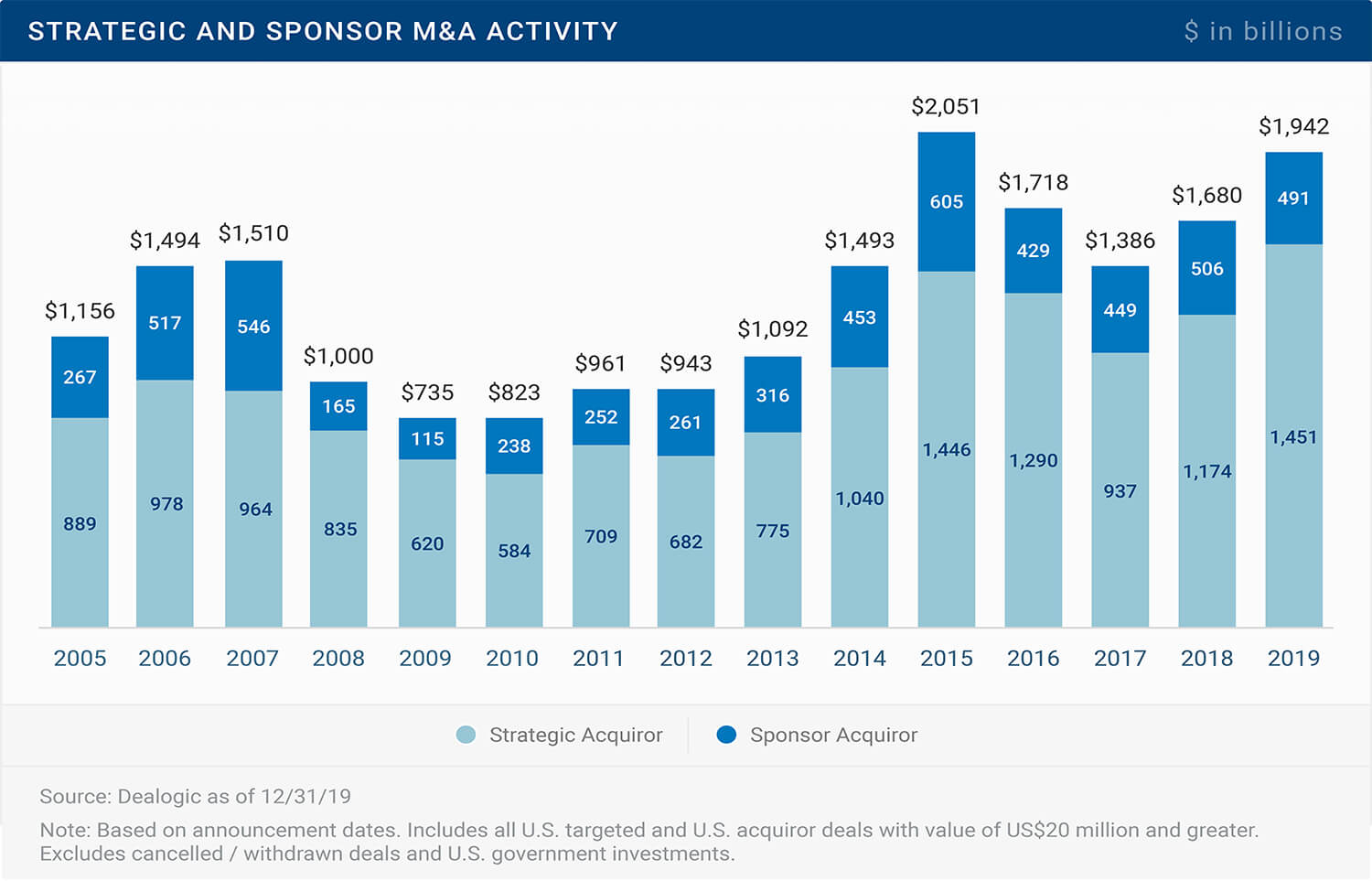

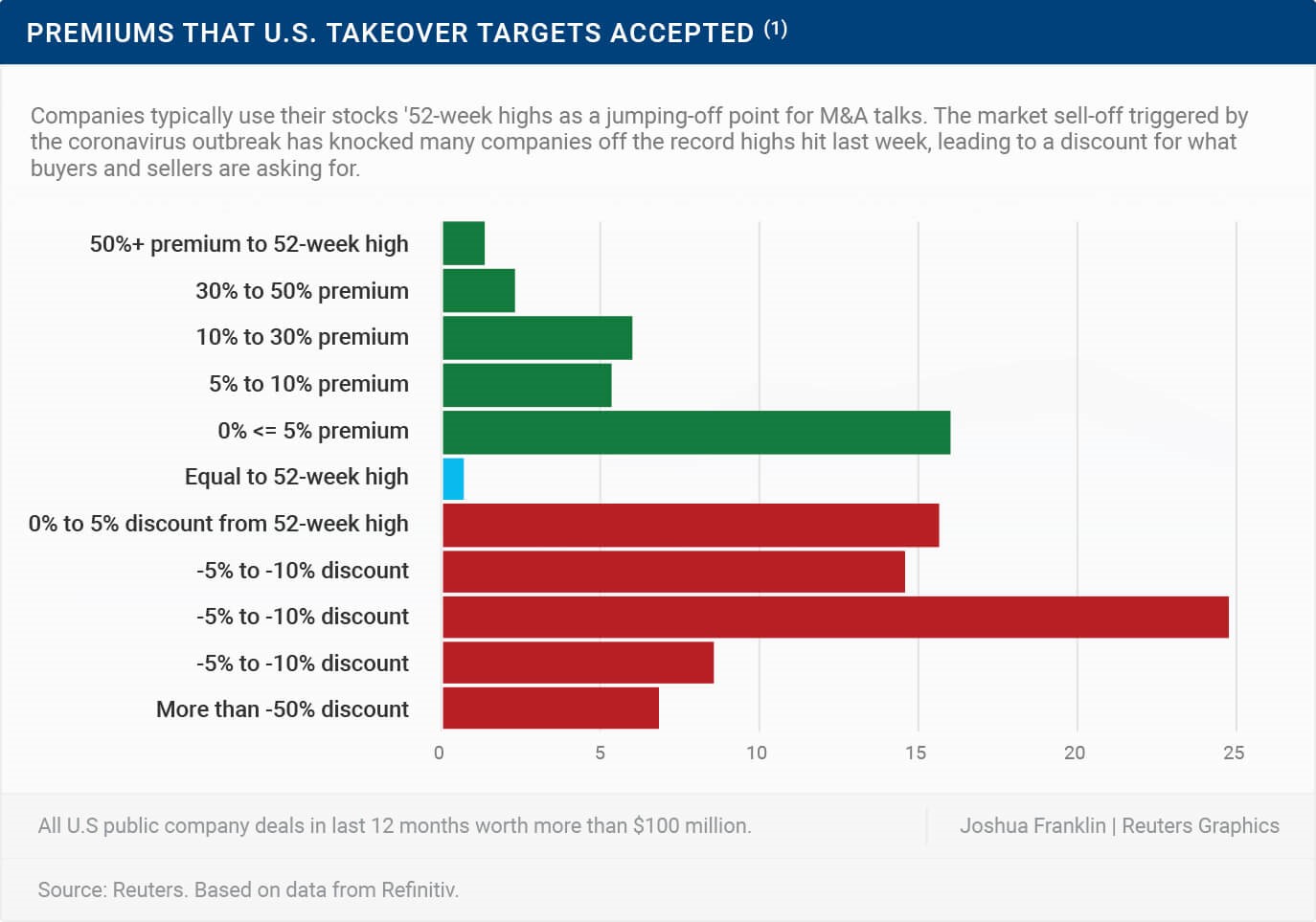

On the buy-side, while the market decline theoretically makes targets cheaper for private equity, the fluctuations can also make sellers and shareholders hesitant to agree to transactions.

Last year, for deals over $100m, more than 60% of sellers agreed to deals that priced their shares above or at a discount of no more than 10% of their 52-week highs.

It is also leading to extra nervousness about the potential impact of a global slowdown on the earnings of a target company, particularly as it is difficult to predict second-order effects. The price may have declined, but you have to ask whether you are just trying to catch a falling knife in some cases, because they may decline even further.

On the sell-side, PE firms are being very careful in assessing when they can hit the market. They’re asking questions such as; when are buyers going to be able to best finance this? Are buyers ready to do a transaction, and what’s happening to the prices on strategic deals in the public markets?

Conditions in the leveraged finance markets are also unsettled by the coronavirus, further impacting the ability of private equity firms to deploy their considerable dry powder (though they continue to look at structured opportunities such as Private Investment in Public Equity, or PIPEs, that do not rely on the debt markets).

And in terms of alternatives, the one potential exit of taking a company public is certainly closed right now.

“The price may have declined, but you have to ask whether you are just trying to catch a falling knife in some cases, because they may decline even further.”

- Vito Sperduto

The state of PE today compared to the 2008 financial crisis

Like all business owners, PE firms are supporting the employees and customers of their portfolio companies in their efforts to navigate the turbulent situation. That also includes a focus on prudent liquidity management given the core expertise of the PE community.

At the same time, the major firms are keen to identify new opportunities to take advantage of the demand for capital.

It is important to contrast the state of PE today versus the state of the industry after the global financial crisis.

Pre-2007, many PE firms had undertaken very sizable deals and were peak leveraged. The scale and suddenness of the shock affected many of their portfolio companies and as a result, in the immediate aftermath of the crisis, they were in protection mode with the extension of bank credit facilities and the re-equitization of deals to prevent them from falling apart.

Today there will clearly be some casualties in certain sectors. However, the PE industry as a whole is in better condition overall.

One important factor is the record levels of dry-powder they currently hold.

Also, the largest sum of money last year, 60% of global deal volume, was spent on doing add-on transactions. By completing these deals at lower prices, PE firms have been buying down their multiples and, as a result, producing better returns on a long-term basis. They’ve been much more operationally minded in how they improve the companies they own. And they have been putting in larger equity checks in these transactions than they have historically.

It will be extremely helpful to have healthier businesses in their portfolios, and many of our sponsor clients are already looking for opportunistic ways to play the downturn.

While it can remain hard to get the attention of a corporate counterparty, we believe PE is going to be a bigger player in the next couple of years than it was post the 2008-09 crisis.

How are PE firms adapting?

Due to the excess of liquidity and the profusion of competitors, PE firms themselves have become much more structurally flexible in the last couple of years.

They've looked at minority investments. They will be putting money to work not just in control situations but also to recapitalize stressed companies.

There has been a growing search for investments with a longer tail to them. It means the required targeted returns come down on the assumption they can be generated over a longer time period. It can make sense for an investor who is weighing up earning 2% on a 30-year treasury versus looking for an 8% cash-on-cash return that can last a long time.

Specifically, there has been a tremendous interest in infrastructure finance. We believe infrastructure funds are going to see a lot of opportunities. They are long return funds, their return hurdles are lower, they're not as levered when they do their transactions and they are going to continue to be producing assets.

There has also been a diversification of pools of capital. There are a lot of investments from sovereign wealth funds and pension plans, who are both Limited Partners (LP), direct investors, and co-investors in many transactions.

The fact that their LP investments have gone to larger positions with a concentrated group of PE firms is also a sign that they’re better positioned to take advantage of emerging opportunities.

Updated April 1, 2020