This article was originally published by RBC Wealth Management.

Frédérique Carrier, Managing Director and Head of Investment Strategy discusses how investors can approach the latest nascent innovation.

Looking back at 2017, cryptocurrencies stole the headlines, with Bitcoin enjoying a spectacular sixfold increase in value. Despite this interest, we surmise that cryptocurrencies are unlikely to replace fiat, or traditional, money. However, the technology which underpins cryptocurrencies, blockchain, could have wide-ranging implications in many industries and for investors in the medium-to-long term.

Crypto creep?

Cryptocurrencies use decentralised technology called "blockchain" that enables users to make and receive payments and store money anonymously without the need of an intermediary. Bitcoin, with a market cap approaching that of McDonald’s, is the most recognised, and makes up over two-thirds of the market capitalisation of the top 10 cryptocurrencies. Given its astonishing ascent and with more cryptocurrencies emerging, many are questioning whether they are the future of money.

Top five cryptocurrencies

| Cryptocurrency | Price (USD) | Market cap (USD billions) | Initial date |

|---|---|---|---|

| Bitcoin | $10,067.30 | $168.2 | 2009 |

| Ethereum | $472.76 | $45.4 | 2015 |

| Bitcoin Cash | $1,561.31 | $26.3 | 2017 |

| Ripple | $0.28 | $10.9 | 2012 |

| Bitcoin Gold | $332.76 | £5.5 | 2017 |

| Litecoin | $93.59 | $5.1 | 2011 |

Source: RBC Capital Markets, RBC Wealth Management, Coinmarketcap; data as of 28/11/2017

Despite this year’s hype, Eric Lascelles, RBC Global Asset Management’s chief economist, believes cryptocurrencies are unlikely to replace traditional money in the short and medium term for several reasons.

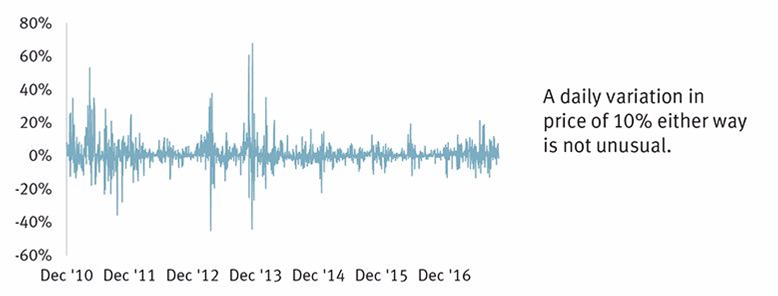

Firstly, they are not a store of value as are traditional currencies. After all, we hold our countries’ currencies because we expect to trade them for a future good or service in an economy backed by a legal, political, and economic system. Bitcoins are not created by a central bank, but by a network and complex algorithms, or computer instructions. Secondly, there is no legal recourse as cryptocurrency ownership is anonymous—hence, no one to pursue in case of a theft, or hack. Finally, their value is both “unstable and widely unpredictable,” as depicted by the chart below.

Daily change in Bitcoin (BTC) price %

Source: RBC Wealth Management, Bloomberg; data as of 11/7/17

Finally, their value is both “unstable and widely unpredictable,” as depicted by the chart directly above.

In the long term, full replacement of traditional currencies is unlikely, in his opinion, though he acknowledges this picture is somewhat hazy. The biggest advantage of using cryptocurrencies at the moment is the ability to transfer money not only cheaply, as it is a peer-to-peer system which cuts out the middle man, but also without being detected. In effect, they can be used to evade the supervision of unlawful money transfers.

Lascelles surmises that governments are likely to intervene. China banned Bitcoin earlier in 2017, as it was being used to elude capital controls and transfer funds out of the country. Even in countries without capital controls, governments are likely to want to pin down fund flows to track taxation and potential criminal activities. Because cryptocurrencies do not enable this, Lascelles expects governments are likely to regulate them ever more tightly if their popularity grows. And as more pressure is put on cryptocurrencies to leave a paper trail, the cheapness of transferring funds could also erode, making them less attractive instruments, in his view.

While not necessarily displacing fiat currencies, cryptocurrencies could change the global economic system as more individuals use them and more companies launch them, according to RBC Capital Markets. Certainly, it is an area of increasing policy focus.

Chain reaction

While there are hurdles to cryptocurrencies replacing traditional money, the underlying technology, blockchain, seems to hold considerable promise and could redefine several industries’ rules of operation, in particular those with recordkeeping at their core.

Blockchain is in effect a giant database, or ledger, that can maintain an ever-growing list of data. It is a distributed ledger; it is not kept nor altered in a centralised manner by an institution, but collectively by users. All data “blocks” are encrypted—they cannot be changed or erased without leaving a record of previous blocks thanks to proprietary algorithms designed to protect data. As such, the data records seem to be manipulation-proof and much more difficult to hack.

Blockchain’s decentralised nature is considered less prone to errors, in effect making many aspects of recordkeeping simpler and safer, while dramatically reducing paperwork and costs. It is a potential solution for hard-to-maintain, complex databases.

To illustrate, blockchain could be used to keep track of the history of a car, with records of the initial purchase, the mileage, and where the car has been driven, as well as its repair history, making buying a used car much less of an adventure.

Blockchain and RBC

The financial services industry is one of the leaders in evaluating blockchain’s potential, and RBC is a case in point. In an interview with Reuters, while RBC CEO Dave McKay stressed the technology is still in its infancy, he asserted that by bypassing a centralised third party, blockchain can reduce frictions and expand banks’ payments and transfer network more easily with more flexibility than current systems. He believes the technology is likely to play an important role in the industry’s future, transforming the way money is moved and stored.

RBC, like many banks, has been experimenting with blockchain in its personal, commercial, and capital markets businesses. The bank recently announced the implementation of a blockchain-based shadow ledger for cross-border payments between the U.S. and Canada. The pilot project’s performance is being scrutinised by management, which is acutely aware of the need to clarify legal, regulatory, and security questions, including around the enforceability and reversibility of transactions. Other applications for banks would be keeping up with regulatory requirements around knowing their customers and applying anti-money laundering rules.

In time, if blockchain can help banks be more efficient and lower costs, it could also put cost-intensive payment systems, such as bank transfers and credit card payments, under pressure.

Chain links

The use of blockchain is also being observed outside banking. Consultancy PwC estimates that annual savings of $5B–$10B in reinsurance are possible with the application of blockchain, thanks to improvements to data processing and claims settlement, and the reduction in fraud it could bring. Major stock exchanges and clearing houses are also testing the technology.

Outside financial services, utilities could make significant use of blockchain technology to replace their current costly administrative networks that often require human input into many databases. Possible applications, according to PwC, include peer-to-peer retail and wholesale trading of energy as well as metering and energy consumption billing, among others.

There are also many ongoing projects to test the technology for logistics and supply chain management purposes. For example, retailers are piloting the technology for provenance and safety tracking of the goods they sell.

Unlocking the chain

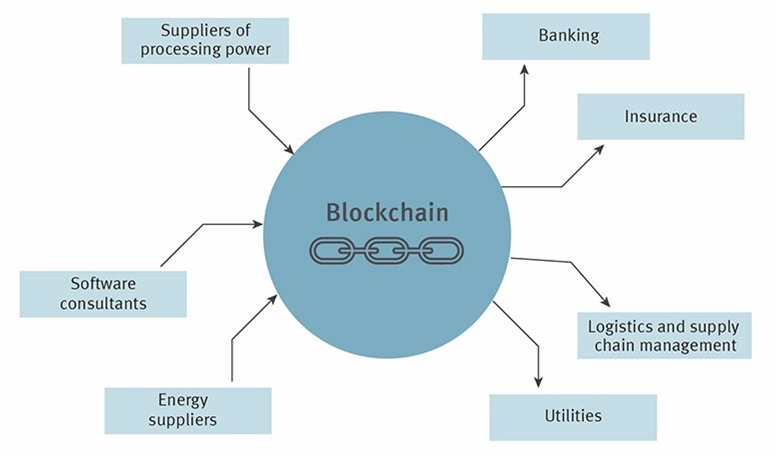

Blockchain ecosystem: Investing directly in blockchain is tricky

Source: RBC Wealth Management

Publicly listed pure plays on blockchain providers are few and far between and do not tend to have an established track record, which make them a risky proposition. Blockchain leaders within established business models make the most sense, though the technology is unlikely to influence group earnings at this stage.

Investors wanting exposure to this promising technology could also look at software consultants, tasked with testing or integrating the new technology. Hardware providers, such as companies making the processing units used to generate cryptocurrencies, could be an alternative, though these have already had a good run. Companies poised to benefit from successful implementation of this new technology are also possibilities, though several other factors are likely to determine share price performance in the short term.

It is still early days to gauge the impact of this new technology. More testing must be done as the security of blockchain might yet prove fallible in the hands of the hackers of the future. Moreover, the scalability of the technology has yet to be tested and, as it sucks up a lot of energy as a computer-based solution, its proliferation could yet be limited by the current capacity of the grid. Yet, its potential makes it a technology well worth watching closely, which we intend to do.