MiFID II may be a European initiative but there is no question that its effect is being felt throughout the financial industry worldwide.

MiFID II may be a European initiative but there is no question that its effect is being felt throughout the financial industry worldwide. Since its implementation in November 2007, Markets in Financial Instruments Directive (MiFID) has effected much change. MiFID II is aiming to address the shortcomings of the original MiFID release and respond to lessons learned during the financial crisis by strengthening protection to investors and increase transparency.

Six-Part Feature

The RBC Investor & Treasury Services team has created a six part MiFID II series that explores how the transparency requirements set out in the MiFID II are reshaping the relationship between technology providers, regulators, and financial services firms.

MiFID II's sweeping reforms are set to transform the investment research industry, with the impact to be felt far beyond the European Union

October 19, 2017

MiFID II: the price of investment research

Download PDF

MiFID II's new costs and charges regime promises greater transparency and clarity for investors, but also leaves an operational burden for fund managers to meet stricter disclosure requirements

October 24, 2017

Fund managers face MiFID II costs and charges

Download PDF

MiFID II will simplify market access for non-European Union firms doing wholesale business but servicing retail clients will remain burdened by regulation

November 2, 2017

The challenges of third-country access under MiFID II

Download PDF

MiFID II will greatly expand the scope of transaction reporting and require asset managers to strengthen their data architecture

November 6, 2017

Transaction reporting under MiFID II

Download PDF

Rules that require investment firms to act in their clients' interests will be broadened to include the use of robo-advisers under proposed guidelines for MiFID II

November 27, 2017

MiFID II Meets the Rise of Robo-advisers

Download PDF

Stricter data sovereignty laws could raise new geopolitical barriers and may encourage asset managers to safeguard client data at home

December 7, 2017

The Question of Data Sovereignty and the Influence of GDPR

Download PDF

What Our Clients Are Saying

What Changes Are Investment Firms Making to Meet the Demands of MiFID II?

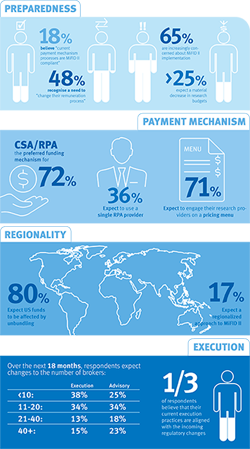

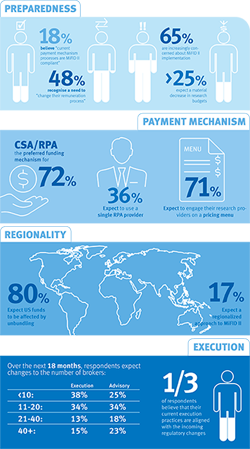

Earlier in 2017, RBC’s Market Structure team engaged with hundreds of buy-side clients through two market surveys to understand attitudes towards MiFID II compliance, progress made to date and approaches taken by impacted firms. The first global survey set out to understand the perceived impacts of the new regulation on the procurement of research and the processes supporting it such as unbundling of funds appointed for advisory services and those for trade execution. The second foray into the market sought to provide insights into execution practice across asset classes such as broker selection and transaction cost analysis. The infographics below summarize the findings of each survey. Click on the infographics to read the reports in full.

MiFID II Market Survey – Impacts on Research Procurement

With less than a fifth of respondents confident that their existing research payment mechanism would comply with the demands of MiFID II, a clear majority of buy-side firms saw the need to take action. Read the full report to find out which approach respondents favored to achieve full compliance and whether this would influence a more global alignment within their organizations.

MiFID II Market Survey – Impacts on Trade Execution

More than two thirds of respondents expect MiFID II to impact their execution processes with two thirds looking to consolidate broker lists and 40% expecting to see more trading through electronic channels. Read the full report to understand the regionality of these concerns as well as views on access to liquidity, transaction cost analysis and key benchmarks.