In this series we explore phantom liquidity and the implications for the next cycle.

Improving fundamentals, the end of a long cycle of oversupply, global inventories in line with historical levels: Michael Tran, Managing Director, Global Energy Strategy at RBC Capital Market believes all the indicators are supporting a period of firmer oil prices. However, beware of potential gap risks that could create violent price swings.

A change in paradigm

After the recent perpetual cycle of oversupply, Michael Tran’s view is that the market will alternate between periods of equilibrium and deficit in the coming years, kick-starting a new era of higher oil prices. He expects WTI and Brent to average $66 and $70/bbl this year, respectively followed by $64 and $68/bbl next year. This is supported by the healthiest global fundamentals in years, and the fact that the firming price floor should limit potential risk to the downside.

Confined pockets of oversupply

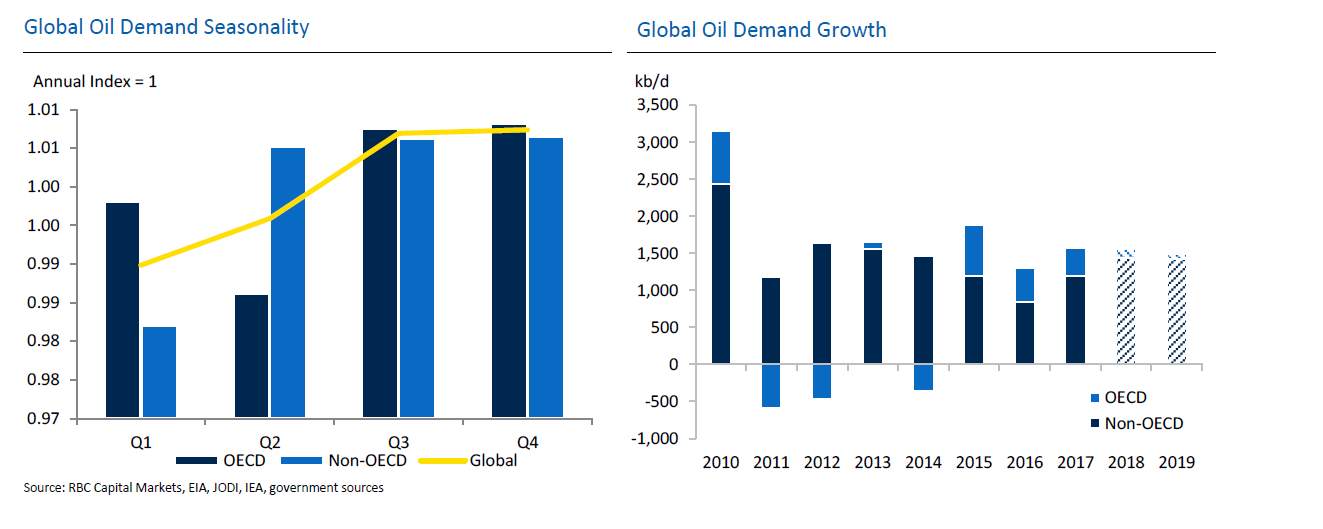

Despite global inventories reverting to historical levels, some temporary pockets of oversupply remained throughout the first quarter of this year in price sensitive regions like the North Sea. Michael Tran believes this is likely to be a seasonal rather than a structural phenomenon accentuated by the maintenance of US refineries, which traditionally takes place during the first quarter. Going forward, regional pockets of over and undersupply could emerge, leading to bumpy near term price action. Other factors, such as mainstream headlines on bearish US production growth or the bullish demise of the Venezuela story could create disproportionate price action. Especially as the herd mentality remains strong in the sector and ‘tourist traders’ quickly getting in and out of positions make for violent price swings.

Beware of spike risk

The backdrop of firming prices can at times be a bumpy ride. Intermittent supply outages have the potential to shock prices materially higher, and Michael Tran does not exclude the possibility that Brent prices could spike into the $75/bbl range or higher. The rally would be represent an ideal opportunity for oil producers to hit the reset button and smooth out future cash flows by layering in price protection at levels not seen in half a decade, especially late in the summer, when global demand peaks. To conclude, RBC’s commodity analysts is cautiously optimistic and sees near term dips as key buying opportunities given the firming fundamental framework.

Michael Tran discusses the outlook for crude oil price and production with Bloomberg's Vonnie Quinn and Shery Ahn on "Bloomberg Markets."