This article was originally published by RBC Wealth Management.

Chronic underperformer

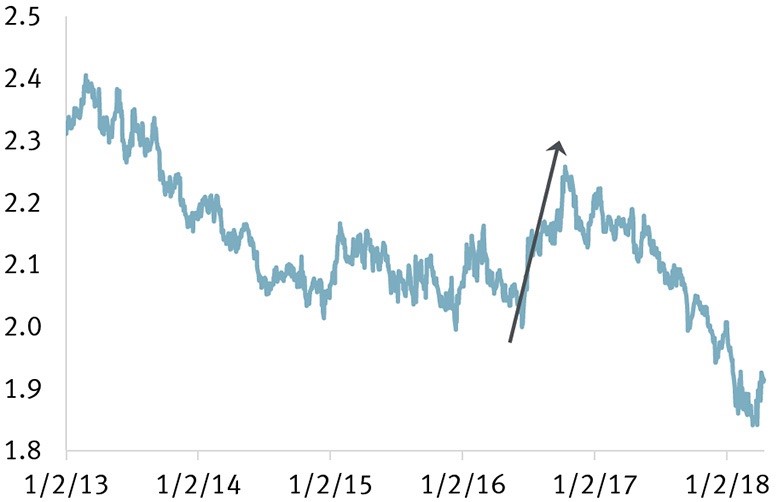

While UK equities weathered the storm of the great financial crisis relatively well, they have lagged since the recovery took hold. In particular, since the Brexit referendum in June 2016, investors have voted with their feet.

Other than a brief spell of outperformance in local currency terms in the wake of the vote as the weak pound boosted exporters, to which the FTSE All-Share Index is heavily exposed, UK equities have suffered substantial outflows. The positioning of institutional funds has become overwhelmingly underweight as investors have been attracted to regions with clearer upside potential, such as the U.S. with its tax reform, Japan with Abenomics, and Europe and its cyclical upswing.

The FTSE All-Share’s painful underperformance

The Brexit vote boost was short-lived.

Source - RBC Wealth Management, Bloomberg; data through 4/13/18

A value case emerges

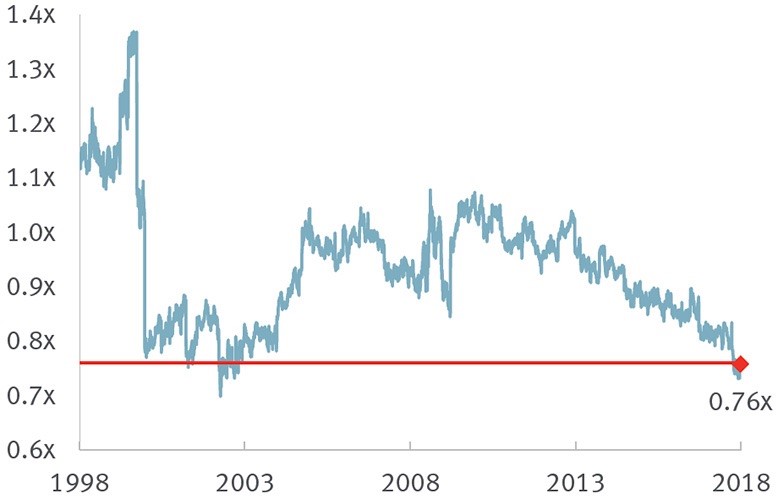

As a result of poor performance, several valuation measures are now as low as they have been for a long time.

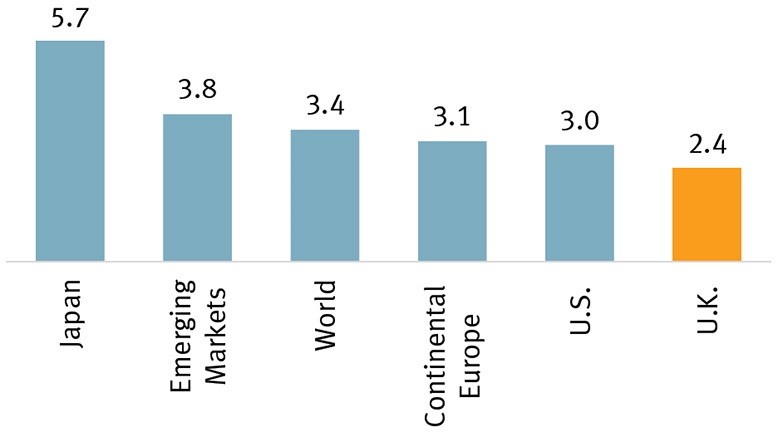

The dividend yield in particular has caught our attention. For the UK equity market as a whole, the yield is now above 4 percent, a threshold which traditionally has indicated healthy performance going forward. The yield has seldom been so high, exceeding the 4 percent level on only five occasions since the market trough of 2009. Moreover, the gap between the UK’s dividend yield and the average yields offered in other regions has widened considerably, with the UK offering more than 1.5x the average yield of other developed markets.

Other measures also point to undemanding valuations. The UK’s 12-month forward price-to-earnings (P/E) ratio relative to the MSCI World Index’s P/E is in line with its 15-year average. The valuation argument is more starkly favourable on a price-to-book value (P/BV) basis, with UK equities trading at a 15-year low relative to global equities. This relative cheapness could be attributed to the UK’s comparatively large exposure to Resources and Financials, two sectors which have de-rated over the past 10 years, but even excluding them, the P/BV of the UK relative to global equities is below its 10-year average.

The FTSE All-Share P/BV relative valuation to MSCI World

Relative valuation is at its lowest level in 15 years.

Source - RBC Wealth Management, Bloomberg; data through 4/11/18

Finally, from a bottom up perspective, free cash flow yields for many sectors, including Resources, Technology, Retail, and Pharmaceuticals, are above 6 percent, another sign that more compelling value is emerging.

These relatively low valuation levels suggest investors have been discounting fears of an economic slowdown and the impact on earnings of a now stronger pound relative to the U.S. dollar.

A defensive market

We also note that the UK corporate sector’s earnings respond comparatively less to changes in global industrial production, given the relatively large exposure to defensive sectors, with Pharma, Consumer Staples, Telecom, and Utilities making up more than one-third of total market capitalisation. As such, UK equities tend to underperform when global leading indicators improve, but to outperform when they have peaked, as seems to be the case today.

Change in EPS given change in global industrial production

The UK corporate sector is the least sensitive to changes in global industrial production.

Source - RBC Wealth Management, national research correspondent

Risks to our view

We shy away from upgrading to Overweight, however, as we continue to be cautious regarding the UK’s short-term economic prospects.

The economy has been relatively resilient since the Brexit vote, thanks to the Bank of England’s (BoE) injection of monetary stimulus shortly after the referendum. RBC Capital Markets, LLC Senior UK Economist Sam Hill points out that this came not only in the form of a 25 basis point (bps) cut in the Bank Rate, but also as a quantitative easing programme in which £65B of Gilts and £10B of corporate bonds were purchased, in addition to the Term Funding Scheme1 that is now worth £127B. Moreover, the UK benefited from an improving global economic backdrop during the period.

Yet the UK’s economic resilience may be tested in the future as the BoE has started to unwind its monetary stimulus. RBC Capital Markets expects 25 bps rate hikes in Q2 2018, Q1 2019, and Q4 2019.

Business investment is likely to continue to be compromised as Brexit uncertainty is far from being resolved. A Brexit transition deal has been agreed upon between the UK and the EU27 that would guarantee a continuation of the status quo, though without any voting rights for the UK However, it has no legal basis and the agreement will not be confirmed until the Withdrawal Treaty is ratified by the UK Parliament, the European Union Parliament, and each EU member-state’s parliament, a process which could take until early 2019.

As such, there is still an uncomfortably high risk of a “hard” or no deal Brexit, which we would put at between 20 percent and 25 percent. Such an outcome would be a negative shock to the UK economy, though the full impact would depend on arrangements regarding tariffs, regulation, and immigration.

Consumers may benefit from inflation having peaked and no longer eroding disposable incomes, but with household balance sheets somewhat stretched and given Brexit uncertainty, a splurge in consumption to offset weak investment is unlikely, in our view.

Finally, given the UK economy is dominated by the service sector, future trade deals struck by the UK after Brexit would need to target openness in the service sector in order to materially improve the UK’s trade outlook. But these complex arrangements are difficult and time-consuming to arrange.

Strategy

Thus, as long as there is no growth shock to the economy—either through Brexit or an escalation in protectionism—the underweight institutional positioning, extreme valuation levels, and defensive nature of the equity market all pave the way for better relative performance for UK equities going forward, in our view.

We maintain our bias towards exporters or companies which generate a significant portion of revenues abroad. The pound has been strong against the dollar since early 2017, but on a trade-weighted basis it is still 12 percent below its peak 2015 level, and therefore provides a tailwind to revenue growth. Growth in the UK’s important markets (Europe, Asia) also should help. Protectionism is a headwind, but revenues from the U.S. make up some 20 percent of the UK’s total revenues, with much of it deriving from operations located in the U.S., rather than via exports.

1 The Term Funding Scheme provides funding to financial institutions at rates close to the Bank Rate in order to encourage them to provide loans at lower rates to households and businesses.