Report Highlights

Outlook: A Balanced State

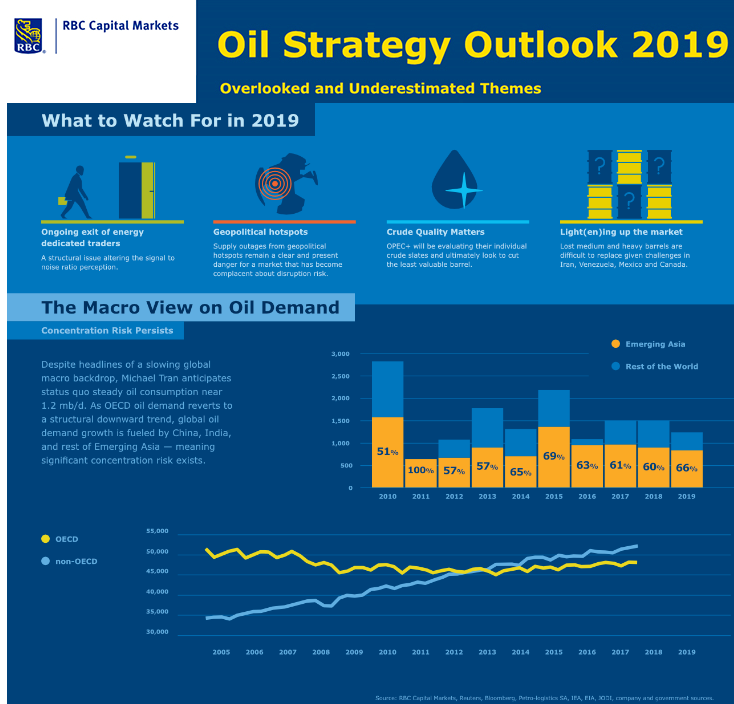

Due to OPEC’s resolve, Michael Tran expects the global oil market to return to equilibrium this year, in contrast to the prolonged periods of over and undersupply witnessed since the turn of the decade. According to Michael Tran, the market is currently oversold and expects WTI and Brent averaging U.S.$60 and U.S.$68/bbl in 2019, respectively. However, the parade of fundamentally driven energy-dedicated traders exiting the space presents a structural issue that muddles how investors interpret the signal to noise ratio.

Key Risks in 2019

The market may have become complacent about the potential disruption risk linked to supply outages from geopolitical hotspots. Another factor to watch is an unintended consequence of the OPEC cut: crude quality. This is because the cartel may ultimately look to cut the least valuable barrels when evaluating its individual crude slates. Those lost medium and heavy barrels may be difficult to replace given the challenges in Iran, Venezuela, Mexico and Canada. In terms of the macro view on oil demand, despite headlines of a slowing global macro backdrop, Michael Tran anticipates steady oil consumption near 1.2 mb/d. However, as OECD oil demand reverts to a structural downward trend, global oil demand growth rests on a handful of countries - China, India, and the rest of Emerging Asia, thus creating a concentration risk.

The One Indicator to Watch: Gasoline Margins

The market may be fixated on crude balances, and with poor gasoline margins potentially being the single biggest fundamental downside risk to the oil market for the year ahead. Refining gasoline in Asia is currently a money-losing proposition. As a result, it could set off a bearish domino effect, with weak gasoline margins originating in Asia cascading through to the Mediterranean, Northwest Europe and ultimately across the Pacific to the U.S.