Report Highlights

The Rise of Sovereign Wealth Funds (SWFs)

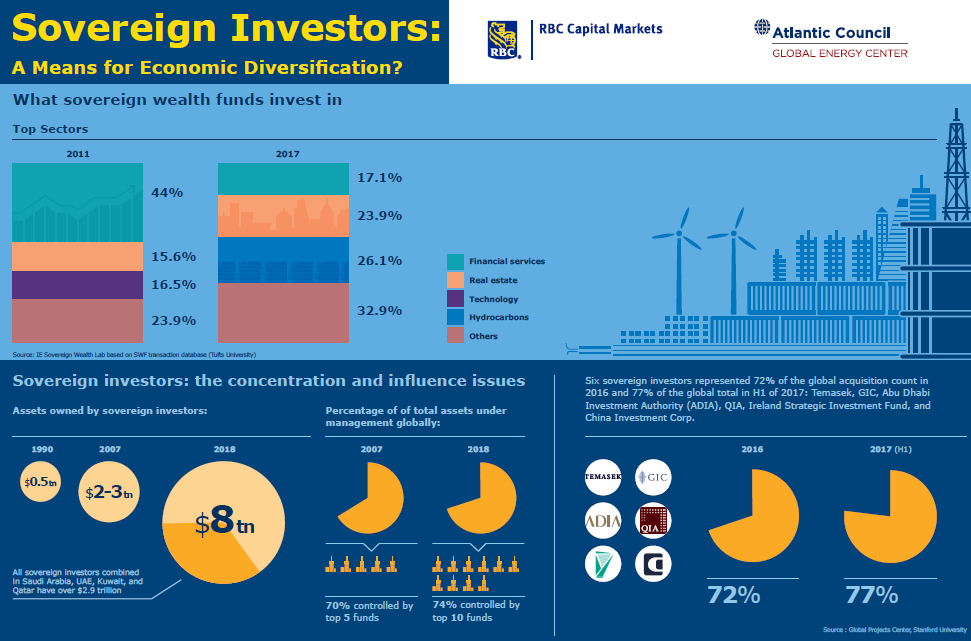

Since the establishment in 1953 of the Kuwait Investment Authority (KIA), considered to be the world’s oldest ‘sovereign wealth fund’ (a term actually coined only in 2005) roughly 50 countries have established SWFs, with close to half launched in the early 2000s. In the last two decades, they have witnessed significant growth, from US$500 billion of assets under management in 1990 to U.S.$7.45 trillion today, with all sovereign investors combined in Saudi Arabia, UAE, and Kuwait managing over US$2.6 trillion dollars of assets.

The Concentration Issue

Six sovereign investors represented 72% of global acquisition count in 2016 and 77% of the global total in H1 of 2017: Temasek, GIC, Abu Dhabi Investment Authority (ADIA), Qatar Investment Authority, Ireland Strategic Investment Fund, and China Investment Corp. In terms of assets allocation, the past years have also seen a switch. In 2011, a large bulk of investments by SWFs went to financial services (44%). Last year, most investments were made in tech (26,1%), followed by real estate (23,9%) with financial services (17,1%) in third place only. As for geographies, if Europe received 43% of investments in 2011, in the first half of 2017, over three quarters of the deals were mostly distributed among the United States, India, United Kingdom, China, Singapore, and Australia.

The Influence Question and the Singapore Example

There are concerns centred around the relationship between sovereign investors and governments and questions of influence. The International Forum of Sovereign Wealth Funds (IFSWF) was created to “promote transparency, good governance, accountability, and prudent investment practices whilst encouraging a more open dialogue and deeper understanding of SWF activities”. The 30-member organization created the Linaburg-Maduell Transparency Index (LMTI) to rate sovereign investors on transparency. Singapore’s Temasek, which manages a fund worth 308 billion Singaporean dollars, received a 10/10 rating. Singapore is seen as a model worldwide for the way it has used revenue at its disposal to plan for the long-term.