While major economies have been knocked off balance, they’re not falling head over heels. RBC Wealth Management’s Kelly Bogdanova, Vice President, Portfolio Analyst, explains why they expect modest gains from equities in 2019 and why it is important to distinguish between slow, unimpressive growth (which seems to be shaping up for 2019) and very low or negative growth (which is not on the radar screen). This article was originally published by RBC Wealth Management.

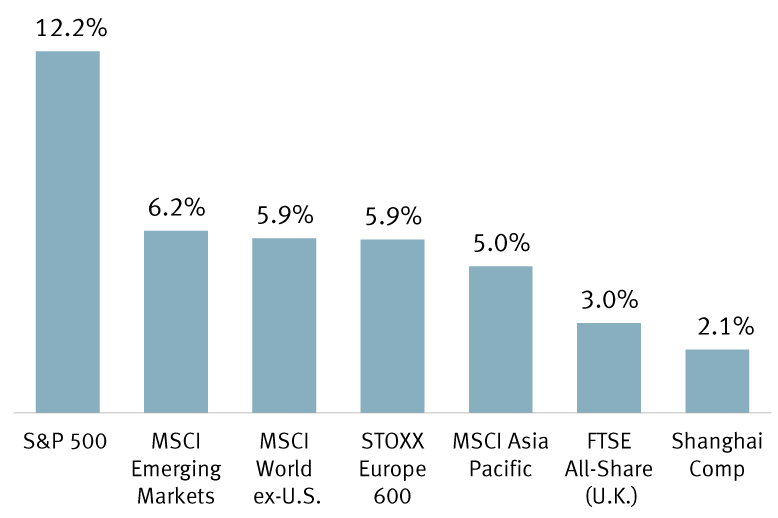

The equity market rebound following the December rout and Christmas Eve low shows a wide divergence between the haves and have-nots. The U.S. market has shot up well ahead of other major indexes, while China and the U.K. have lagged meaningfully, and the rest are in the middle of the pack.

But the reality is that all major markets continue to face challenges. Economic concerns were one of the causes of the December selloff and they have not gone away despite the market bounce. Data are signaling the largest economies lost momentum late last year and will likely slow further this year. High-profile prognosticators such as the International Monetary Fund have lowered global and country growth estimates—capturing greater-than-usual attention from the business and mainstream press corps.

With all of this economic angst, it’s important to distinguish between slow, unimpressive growth (which seems to be shaping up for 2019) and very low or negative growth (which is not on the radar screen). In our assessment, certain industry and geographic segments are stumbling, for sure, but the major economies are not tumbling toward recessions. This is one of the key reasons we remain comfortable holding overall equity positions at the Market Weight or benchmark level in portfolios.

The U.S. is far outpacing other major indexes

Index performance since the low on December 24, 2018

Source - RBC Wealth Management, Bloomberg; data through 1/23/19

Slow growth déjà vu?

Big S&P 500 rebound and all, there are vulnerabilities in the U.S. economy. Weaker housing and auto trends have been building for months.

A slower rate of manufacturing activity in December and signs that it could decrease further surprised investors. Businesses’ capital spending plans are also being pared back. We think the momentum for these segments will hinge on whether the U.S. and China reach a trade accord, and whether the Trump administration backs away from other tariff threats, including on Europe’s auto industry.

The government shutdown is making it more difficult than usual to assess the health of the U.S. economy. While private sector data are available, key data gathered by government agencies are not being published. Once the shutdown ends, the market will be forced to absorb a deluge of economic reports, which could heighten volatility.

RBC Global Asset Management recently lowered its 2019 U.S. GDP forecast from 2.50 percent to 2.25 percent. The consensus forecast is still at 2.50 percent, but we think it will come down. Even with the aforementioned challenges, GDP should be supported by ongoing, positive consumer trends. By no means would an economy expanding around the 2.25 percent level be troubling, but it would be below the average of previous expansion cycles.

Drifting in the doldrums

The European economy is in a state of malaise, especially in the largest countries: Germany, France, and Italy. Part of it has to do with one-off factors such as an auto regulatory change and poor weather impacting Germany. Trends in France pulled back when the Yellow Vest movement gained steam. Italy’s economy has suffered from its budget squabbles with the EU, although that seems to be abating. And then there is the U.K. … still constrained by Brexit uncertainties that are unlikely to lift in the near term.

The important Europe–China trade relationship could also be playing a role. The latest round of slowing in China is likely having a knock-on effect in Europe.

So the much-hoped-for pickup in the European economy is being pushed off again. But similar to the U.S., much of the region seems free of recession threats, in our view.

We also continue to monitor ongoing challenges in China, which is facing slower economic momentum, debt constraints, and U.S. tariffs. The government’s recent stimulus commitments, including tax cuts, and the ability to do more should support the economy and equity market, but a breakaway pace is unlikely to develop even if a trade deal is inked with the U.S.

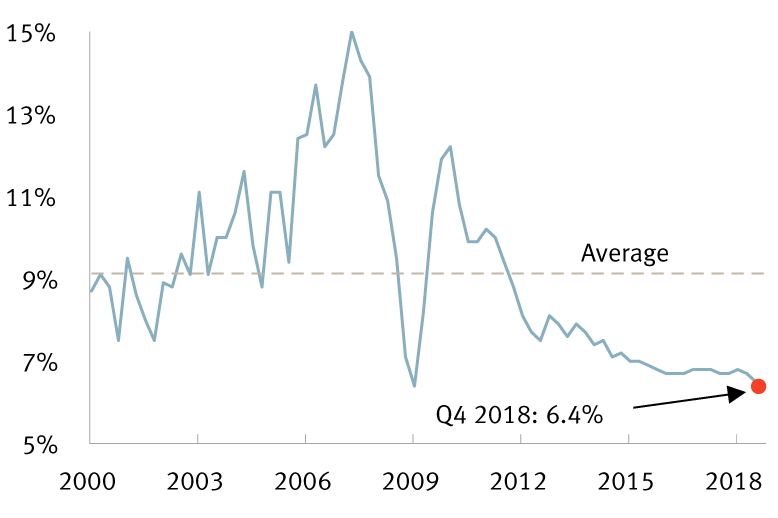

China’s 6.4 percent y/y GDP growth rate in Q4 2018 was its slowest pace since the global financial crisis. Part of the deceleration is by design, to wean the economy off of growth that is based on excessive debt accumulation. But not all of the weakness is by design. It will take more time for the authorities to work through this period; U.S. tariffs aren’t helping matters.

The Chinese economy continues to decelerate

China quarterly GDP growth (y/y %)

Source - RBC Wealth Management, Bloomberg, China National Bureau of Statistics; data through Q4 2018

Up to the challenge

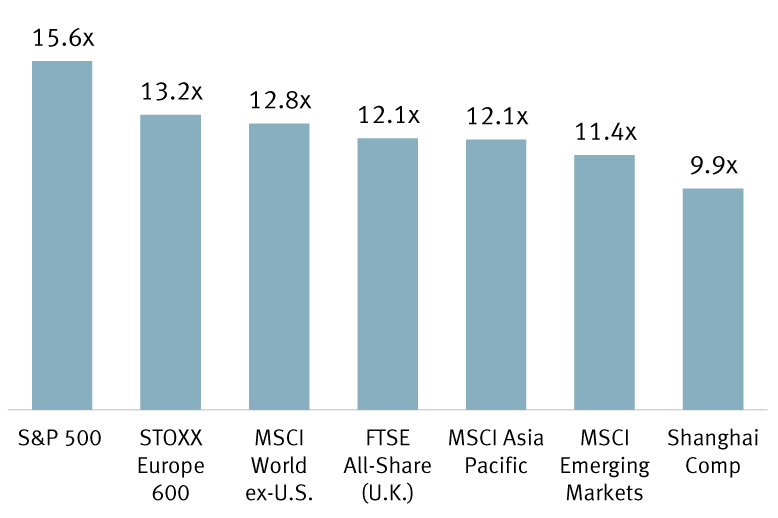

As long as U.S. GDP growth of two percent or so remains feasible and Europe and China stay near their current subdued trends without much more slippage, global equities should be able to deliver modest gains this year, particularly at these reasonable valuation levels.

Each of the major indexes is below its long-term average valuation

12-month forward price-to-earnings ratios based on consensus forecasts

Source - RBC Wealth Management, Bloomberg; data through 1/24/19

Each of these economies has been knocked off balance, but they are not falling head over heels into a contraction. They should be able to grow enough to support at least moderate earnings gains.

But returns could be uneven and vulnerable to additional volatility or downside. This requires vigilance and a willingness to be nimble if conditions start to change.

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.