Trump Card

This week's World Energy Congress and the Joint Ministerial Monitoring Committee (JMMC) meeting in Abu Dhabi will likely provide crucial clues about how far OPEC’s most powerful players are willing to go to get prices on a firmer footing. While there are signs of potential “green shoots” in the physical market, sentiment still remains quite bearish due to ongoing fears about the inimical impact of trade wars on demand. The last time there was a demand-driven price collapse during the 2008 financial crisis, OPEC removed just over 4 mb/d from the market. While prices did not recover to the 2008 high of $146/bbl, they did rise from the low of $37/bbl in Dec 2008 to $78/bbl by the end of 2009; which was the price that Saudi officials indicated that they were aiming for at the start of that year.

The production cut lift looks much lower this time around. According to our estimates all else equal, if the OPEC producers trim another 1 mb/d per day from current levels, they will eliminate the OECD crude inventory overhang and reach their five-year average target in less than half a year. This is not an insurmountable task in our view. While we do not expect the JMMC statement to contain an announcement of a deeper collective cut, Saudi Arabia will likely double down on its “whatever it takes” message and stress that it will be seeking better compliance from its fellow producers. The Kingdom is already over-complying with its official OPEC cut commitment and Aramco officials have indicated plans to reduce their customer allocations across all regions by 700 kb/d in September. In addition, distressed producers like Venezuela are set to see further declines as the US sanctions ’ noose tightens. Nonetheless, it may prove easier to clean up the physical market than to overcome skepticism about the ultimate efficacy of its strategy in the age of Trump. OPEC’s burden is to show that it still has the appropriate tools to arrest price declines driven in no small part by White House policy. In that respect, its challenge is not entirely dissimilar from the central bankers who struggled in Jackson Hole with how to fit trade policy uncertainty into their response frameworks. The Saudi Oil Minister, Khalid Al-Falih (KAF), likes to invoke Mario Draghi but he may in fact be Jerome Powell’s kindred spirit. OPEC peers must be able to demonstrate to the oil market’s newer players — including the macro and quant funds — that they still have the ability to alter directional dynamics and that its actions will not simply be nullified by a new trade war tweet.

State of the Union

While OPEC has little control over President Trump’s social media missives, the sovereign producers can try to address lingering concerns about their resolve. For example, there is still a view that Saudi Arabia will soon tire of ceding market share to US producers and resume maxing out production to try to price these competitors out of business. As we have already noted, the Kingdom seems committed to bearing the burden of adjustment for now. A return to the 2015 lows would put a heavy burden on the country’s finances and cause a greater reliance on debt financing and/or drawing down foreign exchange reserves. Another round of fiscal retrenchment measures in turn could provoke a perilous public backlash and will likely be avoided. It is worth remembering that in the midst of the Q4 2018 price washout, the Saudi leadership opted to announce a budget which contained an official 7% spending increase. The prosperity for loyalty bargain still remains largely intact despite the ongoing efforts to overhaul the economy and the revenue number remains of ultimate importance to the men in the palaces. The planned IPO of Saudi Aramco also likely necessitates staying the course on the cuts, and going deeper if needed, as the current price environment is seemingly sub-optimal for a successful listing. The Aramco sale is one of the Crown Prince’s signature Vision 2030 policy initiatives and is aimed at generating billions of dollars in AUM for the Public Investment Fund (PIF). As of October 2018, the PIF had $320bln in AUM and the aim is to have that figure climb to $400bln in 2020 and reach $2tln by 2030; thereby becoming the largest sovereign wealth fund in the world. That PIF is the primary vehicle by which MBS hopes to achieve his diversification goals and break the reliance on oil as the ATM for the Saudi state. The recent government shake-up, including the appointment of PIF head Yasir Al-Rumayyan as Chairman of Saudi Aramco, is a clear sign of the importance that the Crown Prince assigns to the IPO, in our view. It is certainly relevant to ask whether Saudi leadership’s incentive to support oil prices will wane following a successful Aramco listing. We believe that this will ultimately hinge on how successful the broader Vision 2030 reform effort is in meeting the economic aspirations of the nearly 60% of the population that is under the age of 30.

Russia’s commitment to the OPEC partnership is also continually questioned and the country’s inconsistent compliance record has also fed speculation that it may be seeking a separation. Certainly, the Russian corporates have not hidden their continued displeasure with restraining output and they do not capture the windfall gains of higher oil prices due to the tax structure. Thus, they have a very strong financial incentive to maximize volume. However, the treasury is a clear beneficiary of higher prices and while Russia may have a lower budget breakeven than the vast majority of OPEC producer states, we believe the extra revenue is certainly beneficial as President Putin faces a new wave of economic protests in the country and softening poll numbers. Moreover, as we have repeatedly noted, Moscow has gained enormous soft power benefits from the arrangement as it has seen its strategic influence in the Middle East, Africa and Latin America soar since the signing of the Declaration of Cooperation. The Moscow-Riyadh bilateral relationship has grown especially close. Hence, we expect Russian oil minister Alexander Novak to reaffirm the strength of the OPEC+ union in Abu Dhabi next week and to restate his commitment to bringing his production into conformity with the agreement. That said, we expect Russian compliance to remain spotty — along with that of the perennial non-performers Nigeria and Iraq — which would only increase the pressure on Saudi Arabia to shoulder the rebalancing burden.

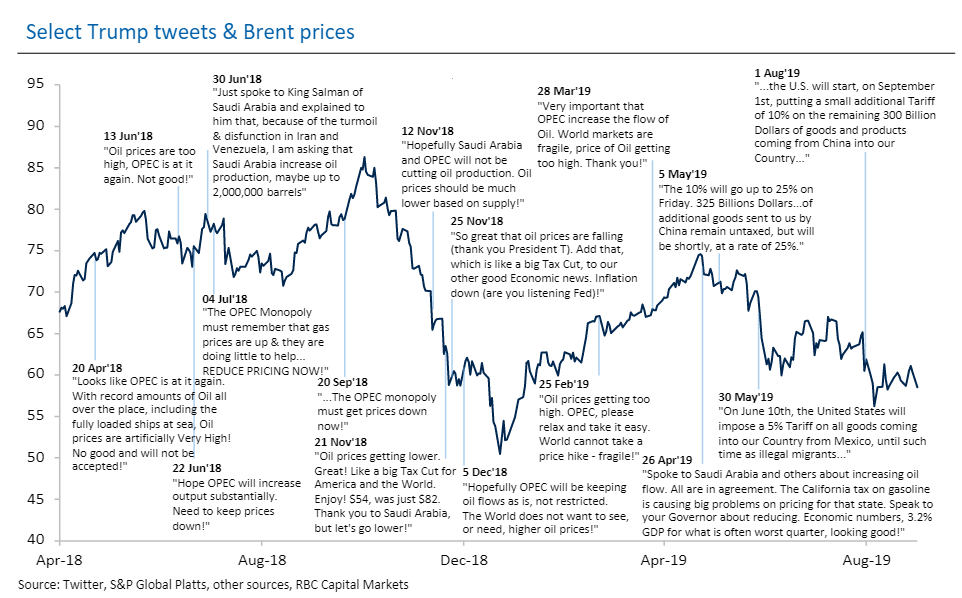

OPEC can also seek to address concerns that the White House can dictate production policy if it applies enough pressure. The memory of Saudi’s summer of 2018 surge still seemingly looms large; as evidenced by the fact that oil tumbled by more than 3% following President Trump’s April 26th tweet that OPEC had agreed to be helpful on output. Even though officials at the secretariat in Vienna cast doubt on the veracity of the exchange, the damage was done and prices did not fully recover. President Trump will undoubtedly want to keep oil prices contained in the run-up to the election and his advisors often cite the low prices as one of his signature successes. If prices were to move appreciably higher, the White House would likely engage in both a public and a ferocious back-channel effort to convince Saudi Arabia to open the taps. The fact that President Trump has enjoyed a warm relationship with Crown Prince Mohammad bin Salman will likely lead some market participants to conclude that MBS will actively seek to aid his re-election effort through a supportive oil policy. Since the December 2018 OPEC meeting, Khalid Al Falih has stayed on message about the Kingdom’s commitment to rebalancing the market and repeatedly noted that US shale producers have been a primary beneficiary of the production cuts. He even publicly rebuffed President Trump’s calls to “relax and take it easy” in February. Market participants will be watching closely whether Saudi officials continue to hold this line in the run-up to November 2020. Any indications of pre-election wavering, however, will bring the bears out of hibernation.

In Summary

Even if Saudi Arabia and OPEC+ can execute their production and messaging policy perfectly, oil will face headwinds if trade war fears worsen and the macro picture further darkens. Of course, OPEC’s task will be appreciably easier if there is an off-ramp to the trade dispute. It might even get an assist from the fraught security backdrop that persists in the Middle East. As we have previously noted, oil has become a “broken barometer ” for gauging the geopolitical pressure in what remains the world’s most important production region. While the media has focused on the potential for talks between President Trump and Iranian President Rouhani, they have given less attention to the worrying attacks on Saudi Arabia’s energy infrastructure and the shadow wars in Syria and Iraq. We continue to believe that the risk of an unintended escalation through miscalculation remains elevated and that a diplomatic breakthrough in the Iranian standoff will remain elusive unless President Trump is willing to put significant sanctions relief of the table. For now, fears of a full-blown trade war between Washington and Beijing continues to trump concern about a potential shooting war in the Middle East. Next week in Abu Dhabi, OPEC will have the chance to demonstrate its resolve to tackle the things in its power, while waiting like the rest of us to see which way the geopolitical winds will blow. OPEC may therefore have to adopt the classic self-help mantra of focusing on what it can control.