RBC CM’s Five ESG Themes for 2020

Rise of Inclusive Capitalism

Environmental, social, and governance matters have moved beyond being a fringe function to one that is embedded into all major corporate and investment decisions. Sustainability, in our view, is a disruptive force to business practices, investment strategies and government policies, not unlike how advancements in technology have changed the world we live in today. New capex projects for industrial companies will be evaluated not only by their internal rate of return but also their environmental footprint. Human capital investments for professional services firms will reflect a more strategic and impactful approach to diversity. Boards of Directors and executive management teams will increasingly own these issues and be unable to “pass them along” to a group of sustainability experts.

There is also a growing acceptance of the undeniable interconnectedness of environmental and social factors. We see the two major systems issues of our time as the twin challenges of climate change and socioeconomic inclusion. At times, these challenges are aligned and at others they conflicted. Regardless, we feel that one cannot be addressed without considering the effects on the other.

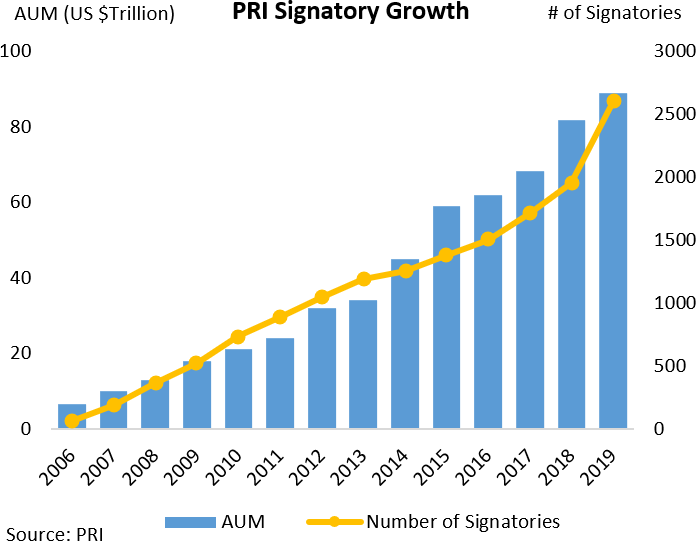

Investors, who have largely led this transformation, will continue to be the largest advocates, evidenced by the achievements by the Climate Action 100+ group in 2019. The number of signatories to the Principles for Responsible Investment (PRI) has grown from 63 with $6.5 billion in AUM in 2006 to 2,600 and represented over $89 trillion in collective AUM.1

In January 2020, BlackRock Chairman and CEO Larry Fink highlighted the asset manager’s deep responsibility to promote long-term value for its clients and noted that climate change has become a defining factor in companies’ long-term prospects.2 To place sustainability at the center of its investment approach, BlackRock plans to make sustainability integral to portfolio construction and risk management, exit investments that present a high sustainability-related risk, and strengthen its commitment to sustainability and transparency in its investment stewardship activities.3

Similarly, businesses are responding. The Business Roundtable’s release in August 2019 of a “Statement on the Purpose of a Corporation” effectively announced an end to the principle of shareholder primacy, or the idea that the sole purpose of a company is to maximize financial returns. This group, which represents ~200 CEOs of the largest companies in the United States, committed to take a wider range of stakeholders into account, pledging to deliver value to customers, invest in employees, deal fairly and ethically with suppliers, support the communities in which they work, and generate long-term value for shareholders.4 We have also seen a growing number of company-specific commitments to ambitious long-term ESG targets: Amazon announced that it would be carbon-neutral by 2040 and will purchase 100,000 electric vehicles, German-based building materials company HeidelbergCement pledged to create carbon-neutral concrete by 2050, and the Kellogg Company committed to improve the lives of 3 billion people by the end of 2030 by addressing global food security, climate, and wellbeing.5 Recently, Microsoft committed to be carbon negative by 2030, remove from the environment all of its historical carbon emissions by 2050, and deploy USD 1 billion of its own capital in a new Climate Innovation Fund to accelerate the development of carbon reduction and removal technology.6

Sustainable Finance for All

Innovation is a cornerstone to growing the Sustainable Finance market. In 2019, a variety of new sustainable finance products tailor-made for specific industries and geographies were issued, including transition bonds, bonds linked to the UN Sustainable Development Goals (SDGs), and the world’s first sustainability-linked derivative. 2020 will be continue to be characterized by further innovation as the market moves beyond a pure use of proceeds approach to also embrace a sustainability linked approach. The sustainability linked approach allows for a much broader application, allowing more complex financial structures to tie performance to ESG metrics. We feel that in order to address the environmental and social issues that we are faced with today, a multitude of approaches is required, allowing for breadth and depth at the same time.

Transition Bonds

According to the Financial Times, 2020 could be the year of “olive” finance.7 Transition bonds, which are tied to clear targets for decarbonizing businesses, are seen as promising to help industries traditionally considered less-than-green become more sustainable and produce less carbon and waste.8 According to AXA Investment Managers, the demand for sustainable investments is so strong that it cannot be satisfied by traditionally green industries alone; as such, lending to the larger universe of “brown” industries, and encouraging them to become greener along the way, can help fill the gap.9 In 2019, we saw a handful of transition bonds were issued and the product appears to be poised to ramp up in 2020.

Among the fifteen recommendations in the final report of Canada’s Expert Panel on Sustainable Finance, released in June 2019, was the development of a Canadian green-and transition-oriented fixed income taxonomy. To action the recommendation, in October 2019 the Canadian Standards Association (CSA Group) established a Technical Committee to develop a Canadian Transition Finance Taxonomy. The taxonomy is intended to be additive to existing globally recognized standards and taxonomies, and reflect the most significant opportunities for greenhouse gas emissions reductions within a natural-resources based economy.

UN Sustainable Development Goal (SDG)-linked Products

The UN Sustainable Development Goals (SDGs) have become the globally accepted framework for measuring environmental and social impact. In September 2019, Italian energy group Enel SpA launched a first-of-its-kind USD 1.5 billion bond linked to the UN Sustainable Development Goals (SDGs). The terms and conditions of the five-year bond include a key performance indicator to which Enel has committed to achieving by 2021: to increase its renewable energy installed capacity to at least 55%, from 46% as of H1 2019, of total capacity.10sup>There is a growing availability of tools which facilitate the integration of the SDGs across all areas of finance, facilitating the measurement of both financial and sustainability related impact.

Derivatives and Other Applications

Other potential applications for linking sustainability targets exist in the derivatives and foreign exchange market. August 2019 saw the development of the world’s first sustainability improvement derivative (SID). SBM Offshore, a Dutch company that supplies floating production solutions to the offshore energy industry, linked the credit spread of their interest rate swap to their overall ESG performance, as scored by ESG research and ratings provider Sustainalytics.11

Collateralized loan obligations (CLOs), which are investment vehicles that contain pools of leveraged loans, are also seeing the integration of sustainability considerations. In 2019, two US CLOs incorporated explicit ESG investment restrictions, prohibiting debt issued by companies that make or sell landmines, chemical weapons, and thermal coal.12Another CLO, aimed at improving financial inclusion in emerging markets, drew $124 million from the US development finance agency OPIC and will provide capital to over 5 million microfinance borrowers, 81 percent of whom are women.13

We believe that 2020 will continue to see innovation in the derivative and foreign exchange markets with sustainable finance products that link to sustainability targets, and in the CLO market, a move beyond an exclusionary approach toward more impact-oriented products.

Growth of Sustainability-Linked Loans (SLLs)

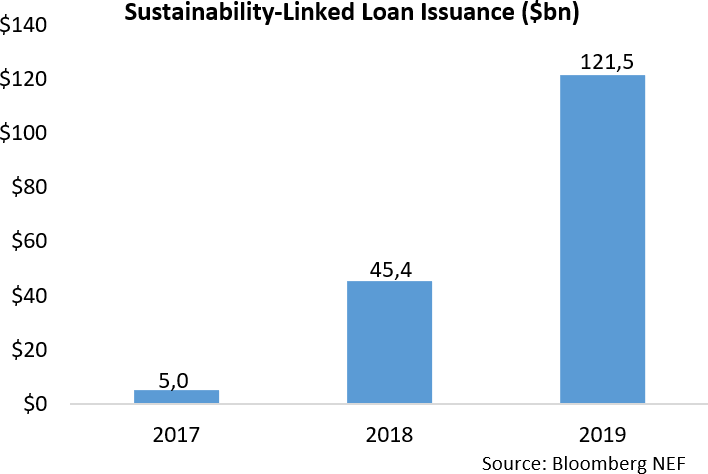

SLLs are loans with pre-specified sustainability targets and the potential for interest rate reductions, provide borrowers with targets and an incentive to improve the sustainability profile of their companies. Although green bonds still account for 77 percent of all sustainable debt issued, according to Bloomberg NEF.14 sustainability-linked loans now comprise 10 percent of the global market. Sustainability-linked loans have increased in popularity in recent months and are the fastest-growing subset of sustainable debt, reaching over $100 billion in volume in 2019 after only three years on the market.15

Since sustainability-linked loans have the capacity to tailor the approach to the borrower, they can be applied across multiple sectors, including housing, hospitality, chemicals, utilities, and consumer goods.16 To date, RBC has participated in approximately 20 SLLs in Europe, North America and Asia Pacific across a variety of sectors, including Utilities, Energy, Industrials and Consumer Products.

Reporting Standards Come of Age

Currently, there is no widely adopted standardized framework for ESG reporting or for defining and measuring sustainable business activities and no means to compare ESG factors across companies, sectors and geographies. This is perhaps the largest area of concern amongst all stakeholders including regulators, central banks, stock exchanges, investors and corporate reporters. The lack of comparable data and a globally accepted reporting taxonomy has undoubtedly hindered growth. However, there is cause for optimism as market participants are aligned to support the development of reporting standards.

Regulators and governments also have a role to play. The European Union is leading the way in terms of transparency around data and standards. On December 18, 2019 the European Council and the European Parliament reached a political agreement on the EU’s “Taxonomy Regulation”. The Taxonomy Regulation provides for a general framework that will allow for the progressive development of an EU-wide classification system for environmentally sustainable economic activities. Once the Taxonomy Regulation is implemented, it will become a mandatory reference for sustainable financial products in Europe.

In Canada, the Expert Panel on Sustainable Finance put forth recommendations to “define and pursue a Canadian approach to implementing the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)”.17 To implement the TCFD recommendations, the Expert Panel recommended that the Government of Canada adopt a phased “comply-or-explain” approach, starting with large companies and Crown corporations, provide clarity to issuers on the recommended scope and pace of implementation, and work with government and industry partners to clarify the materiality of climate-related financial disclosures.18

In the US, the Commodity Futures Trading Commission (CFTC) has begun to assess the financial risks associated with climate change and possible mitigation steps, announcing the formation of a sub-committee to examine climate-related market risks.19 In recent months, the Securities and Exchange Commission (SEC) has taken an increasing interest in ESG funds, sending examination letters to a number of investment managers that market ESG-related offerings.20 According to Bloomberg, the SEC has largely focused on advisers’ criteria and methodology for determining an investment to be socially responsible.21

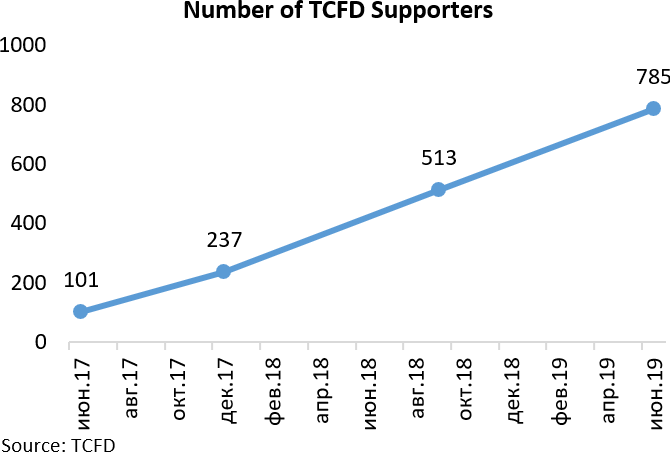

Companies and investors are increasingly adopting two key reporting frameworks: the Sustainability Accounting Standards Board (SASB), which provides a set of standards to report sustainability information across a wide range of issues, ranging from labor practices to business ethics, and the Task Force on Climate-related Financial Disclosures (TCFD), which provides a framework for evaluating and reporting climate-related risks.22 The number of TCFD supporters has grown significantly since the release of the TCFD Report in June 2017. Last year, SASB began reporting on early adopters of its standards; as of November 2019, the number of reporting companies stood at 79 across 19 countries.23

“Rainbow Washing” Risks Increase

Green washing is widely viewed as the marketing of positive environmental impacts which may be without substance or authenticity. Rainbow washing extends that term to refer the UN SDGs and the colours reflected in the 17 goals. “Green-wishing” is a new term within the sustainability world that refers to the establishment of long-term environmental goals or ambitions (i.e. carbon neutral by 2050) but without the demonstrated ability to articulate a path to get there.24

We think 2020 will be a “gap year” as an increasing number of companies across all sectors and geographies embrace sustainability related disclosures and targets but before we have rigorous standards and audits in place. The risk therefore is that this is done to check a box and is not fully integrated in a company’s management strategy and ambitions. We see considerable financial and reputational risks when products and structures that do not meet established global best practices. There are equal and parallel risks within the investment management business as the significant increase in ESG funds and solutions require enhanced due diligence and communication to ensure they are delivering what the name of the fund suggests.

We are hopeful that rainbow washing risks will moderate as reporting standards come of age and the industry moves toward globally accepted definitions and labels for sustainable finance and products and responsible investment funds, similar to what we have seen in Europe with the Technical Expert Group “TEG” on Sustainable Finance. In the meantime, we direct our clients towards several industry resources, including the Sustainable Stock Exchanges (SSE) Initiative Report on Model Guidance on Reporting ESG Information, SASB ESG Integration Insights, TCFD Good Practice Handbook, Investment Association Responsible Investment Framework, ICMA Green and Social Bond Principles, and LMA, LSTA and APLMA Sustainability Linked Loan Principles.

Closing Thoughts

2019 was the year when sustainable finance went mainstream and we think 2020 is the year we see exponential growth. This was evidenced in the pushback against the long-held tenet of shareholder primacy, the accelerating popularity of innovative new sustainable finance products such as sustainability-linked loans, and the increased adoption and formalization of data and reporting standards. 2020 will see these trends continue to gather momentum although risks abound, namely around the intentionality and the authenticity of market participants.

1 Principles for Responsible Investment. “PRI Update Q4 2019.” https://www.unpri.org/download?ac=9539

2 BlackRock. “Larry Fink’s Letter to CEOs.” January 14, 2020. https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

3 Ibid.

4 Business Roundtable. “Statement on the Purpose of a Corporation.” August 19, 2019. https://opportunity.businessroundtable.org/wp-content/uploads/2019/12/BRT-Statement-on-the-Purpose-of-a-Corporation-with-Signatures.pdf

5 Winston, Andrew. “The Top Sustainability Stories of 2019.” Harvard Business Review. December 30, 2019. https://hbr.org/2019/12/the-top-sustainability-stories-of-2019

6 Smith, Brad. “Microsoft will be carbon negative by 2030.” January 16, 2020. https://blogs.microsoft.com/blog/2020/01/16/microsoft-will-be-carbon-negative-by-2030/

7 Tett, Gillian, Billy Nauman, Andrew Edgecliffe-Johnson and Patrick Temple-West. “Moral Money: 20 things to watch in 2020.” Financial Times. January 2, 2020. https://www.ft.com/content/d52684e0-2c09-11ea-bc77-65e4aa615551

8 BNP Paribus. “Sustainable Finance: Five Milestones in 2019.” December 20, 2019. https://cib.bnpparibas.com/sustain/sustainable-finance-five-milestones-in-2019_a-3-3285.html

9 Gross, Anna, and Tommy Stubbington. “The ‘transition’ bonds bridging the gap between green and brown.” Financial Times. January 3, 2020. https://www.ft.com/content/ff2b3e88-21b0-11ea-92da-f0c92e957a96

10 BNP Paribas. “Italian Energy Company Issues Groundbreaking SDG-linked Bond.” September 6, 2019. https://cib.bnpparibas.com/sustain/italian-energy-company-issues-groundbreaking-sdg-linked-bond_a-3-3063.html

11 ING. “Introducing the world’s first sustainability improvement derivative.” August 13, 2019. https://www.ing.com/Newsroom/News/Introducing-the-worlds-first-sustainability-improvement-derivative.htm

12 Temple-West, Patrick. “Impact investing creeps into the CLO market.” Financial Times. September 2, 2019. https://www.ft.com/content/14c8b0dc-cd5a-11e9-99a4-b5ded7a7fe3f

13 Ibid.

14 Kiladze, Tim. “Canada joints the new lending craze: sustainable loans with floating interest rates.” The Globe and Mail. December 16, 2019.

15 Shurey, Daniel. “Target setting in sustainability-linked loans: ambition, not afterthought.” Environmental Finance. January 13, 2020.

16 BNP Paribus. “Sustainable Finance: Five Milestones in 2019.” December 20, 2019. https://cib.bnpparibas.com/sustain/sustainable-finance-five-milestones-in-2019_a-3-3285.html

17 Government of Canada. “Final Report of the Expert Panel on Sustainable Finance.” June 2019. http://www.publications.gc.ca/site/eng/9.873337/publication.html

18 Ibid.

19 Bradford, Hazel. “CFTC to assess climate change risk and possible mitigation steps.” Pensions & Investments. June 12, 2019. https://www.pionline.com/article/20190612/ONLINE/190619920/cftc-to-assess-climate-change-risk-and-possible-mitigation-steps

20 Levine, Matt. “The SEC is asking about ESG.” Bloomberg Opinion. December 17, 2019. https://www.bloomberg.com/opinion/articles/2019-12-17/the-sec-is-asking-about-esg

21 Ibid.

22 Lanz, Dustyn. “Five ESG trends for Canadian investors to watch for in 2020.” Globe and Mail. January 7, 2020. https://www.theglobeandmail.com/investing/investment-ideas/article-five-esg-trends-for-canadian-investors-to-watch-for-in-2020/

23 SASB. “SASB Annual Report 2018.” November 2019. https://www.sasb.org/wp-content/uploads/2019/11/SASB-Annual-Report-2018-w.pdf

24 Austin, Duncan. “Greenwish: The Wishful Thinking Undermining Sustainable Business.” July 2019. https://capitalinstitute.org/blog/greenwish/

Sources:

Austin, Duncan. “Greenwish: The Wishful Thinking Undermining Sustainable Business.” July 2019. https://capitalinstitute.org/blog/greenwish/

BlackRock. “Larry Fink’s Letter to CEOs.” January 14, 2020. https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

BNP Paribas. “Italian Energy Company Issues Groundbreaking SDG-linked Bond.” September 6, 2019. https://cib.bnpparibas.com/sustain/italian-energy-company-issues-groundbreaking-sdg-linked-bond_a-3-3063.html

BNP Paribus. “Sustainable Finance: Five Milestones in 2019.” December 20, 2019. https://cib.bnpparibas.com/sustain/sustainable-finance-five-milestones-in-2019_a-3-3285.html

Bradford, Hazel. “CFTC to assess climate change risk and possible mitigation steps.” Pensions & Investments. June 12, 2019. https://www.pionline.com/article/20190612/ONLINE/190619920/cftc-to-assess-climate-change-risk-and-possible-mitigation-steps

Business Roundtable. “Statement on the Purpose of a Corporation.” August 19, 2019. https://opportunity.businessroundtable.org/wp-content/uploads/2019/12/BRT-Statement-on-the-Purpose-of-a-Corporation-with-Signatures.pdf

Government of Canada. “Final Report of the Expert Panel on Sustainable Finance.” June 2019. http://www.publications.gc.ca/site/eng/9.873337/publication.html

Gross, Anna, and Tommy Stubbington. “The ‘transition’ bonds bridging the gap between green and brown.” Financial Times. January 3, 2020. https://www.ft.com/content/ff2b3e88-21b0-11ea-92da-f0c92e957a96

ING. “Introducing the world’s first sustainability improvement derivative.” August 13, 2019. https://www.ing.com/Newsroom/News/Introducing-the-worlds-first-sustainability-improvement-derivative.htm

Kiladze, Tim. “Canada joints the new lending craze: sustainable loans with floating interest rates.” The Globe and Mail. December 16, 2019.

Lanz, Dustyn. “Five ESG trends for Canadian investors to watch for in 2020.” Globe and Mail. January 7, 2020. https://www.theglobeandmail.com/investing/investment-ideas/article-five-esg-trends-for-canadian-investors-to-watch-for-in-2020/

Levine, Matt. “The SEC is asking about ESG.” Bloomberg Opinion. December 17, 2019. https://www.bloomberg.com/opinion/articles/2019-12-17/the-sec-is-asking-about-esg

Principles for Responsible Investment. “PRI Update Q4 2019.” https://www.unpri.org/download?ac=9539

SASB. “SASB Annual Report 2018.” November 2019. https://www.sasb.org/wp-content/uploads/2019/11/SASB-Annual-Report-2018-w.pdf

Shurey, Daniel. “Target setting in sustainability-linked loans: ambition, not afterthought.” Environmental Finance. January 13, 2020.

Smith, Brad. “Microsoft will be carbon negative by 2030.” January 16, 2020. https://blogs.microsoft.com/blog/2020/01/16/microsoft-will-be-carbon-negative-by-2030/

Temple-West, Patrick. “Impact investing creeps into the CLO market.” Financial Times. September 2, 2019. https://www.ft.com/content/14c8b0dc-cd5a-11e9-99a4-b5ded7a7fe3f

Tett, Gillian, Billy Nauman, Andrew Edgecliffe-Johnson and Patrick Temple-West. “Moral Money: 20 things to watch in 2020.” Financial Times. January 2, 2020. https://www.ft.com/content/d52684e0-2c09-11ea-bc77-65e4aa615551

Winston, Andrew. “The Top Sustainability Stories of 2019.” Harvard Business Review. December 30, 2019. https://hbr.org/2019/12/the-top-sustainability-stories-of-2019