Consumer payments: The “gift” that keeps on giving

We believe Visa is in a great position to grab the $18 trillion global “jump ball” in cash and checks.

The company has systematically attacked this lucrative opportunity by expanding credentials, acceptance points, and driving user engagements. Visa is also uniquely poised to capture the shift to digital channels, as its share is three times that of the physical channel.

The roadmap: Capturing new payments sources and money movement

Here is how Visa plans to capture flows beyond its legacy core consumer payments businesses:

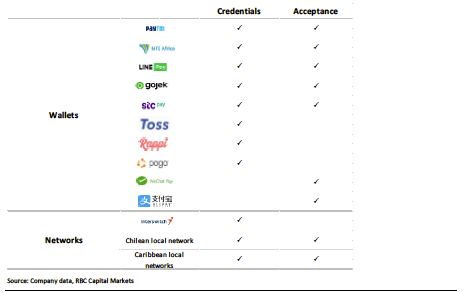

Increased credentials. While it already has a leading position in most markets with traditional banks, Visa plans to expand issuance with fintechs, neobanks, and digital platforms, embed Visa credentials in digital wallets, reach the unbanked through government partnerships, and drive tokenization to widen use cases.

Expanded acceptance. With wide acceptance at over 60 million merchant locations globally, Visa hopes to capture even more locations at mostly small cash-based businesses through QR codes, mPOS, and tap-to-phone. In developed markets, there are further opportunities across vending, laundry, gaming, parking, electric vehicle charging, rent and tuition.

Higher engagement. Visa is working on improving authorization rates, reducing ecommerce fraud and friction through tokenization and click-to-pay, and driving repeat usage through tap-to-pay and integrated payments.

With these three efforts, the market opportunity represents a ~$180 trillion opportunity and stretches its verticals to include B2B, insurance, payroll, and remittance, among others.

Physical + digital = more value added services

Visa’s effort to weave new value added services (VAS) across its global client base should not only enhance its growth prospects, but also deepen its relationships with existing and new clients, while continuing to diversify its revenue stream. By 2025, we believe VAS could represent a $7-$9 billion business practice, or about 20% of revenues at the high end. These services play a crucial role in boosting revenue growth by expanding core business payment growth and opening up new flows.

Visa's future

Visa’s fundamentals and business model are arguably one of the best in the world, as evidenced by its long track record of double-digit compounding growth. As the company fortifies its strategic roadmap to capture new secular growth opportunities in payments, we believe its double-digit growth engine will expand long into the future.