Early results from local real estate boards showed red hot activity in many areas around the country. But the bigger story might be that COVID-19 is now prompting more people to sell. New listings increased strongly in Toronto, Ottawa and Vancouver. We think this in part reflects the pandemic altering the housing needs of many current owners—who are opting to move, something they might not have considered just a few months ago. This wasn’t the case everywhere, though. New listings fell in Calgary, which led to slightly fewer transactions there in August. Buyers nationwide are demonstrating a stronger preference for single-detached homes. Sales in that category vastly outpaced condos. Even in Calgary, detached home sales were up from a year ago, which contrasted with transactions involving condos falling substantially. This growing penchant for single-detached homes is supporting stronger price increases in that category. That, too, is a Canada-wide trend. We expect single-detached and condo valuations to continue to diverge in the period ahead.

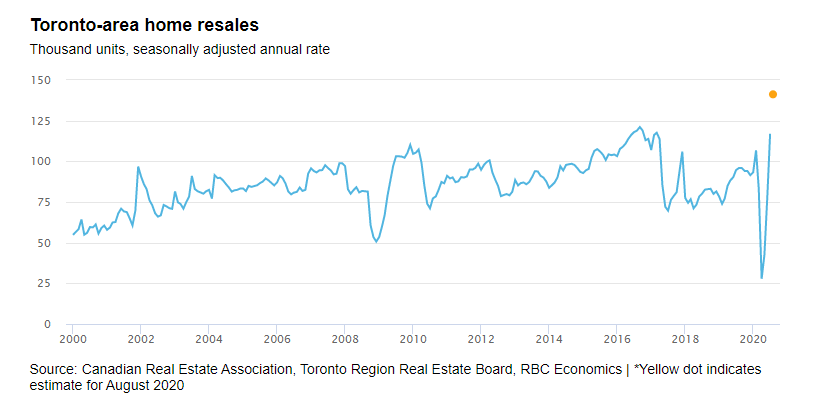

Toronto Area

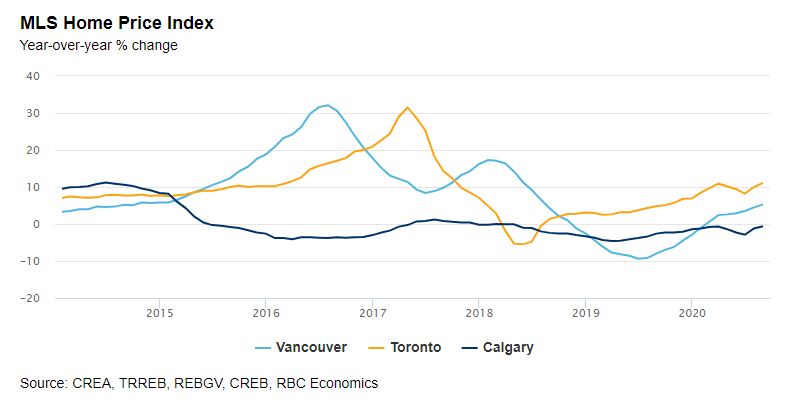

A 57% y/y surge in new listings set the stage for another outsized increase in home sales (up 40%) in August. By our calculation, sales jumped more than 20% from July’s near-record level. Clearly, the area market has fired on all cylinders this summer, making up for the major disruption caused by COVID-19 in the spring. The Toronto Region Real Estate Board noted low-rise home categories (including single-detached homes) were the main drivers of activity and price growth. Demand-supply conditions are very tight in these categories, with intense competition between buyers. Conditions are more balanced in the condo segment, however, where new listings rose sharply last month. The MLS Home Price Index (HPI) overall accelerated to 11.1% y/y from 10.0% in July. The single-detached index set the fastest pace (up 11.8%), while the condo index’s increase was more subdued at 8.9%.

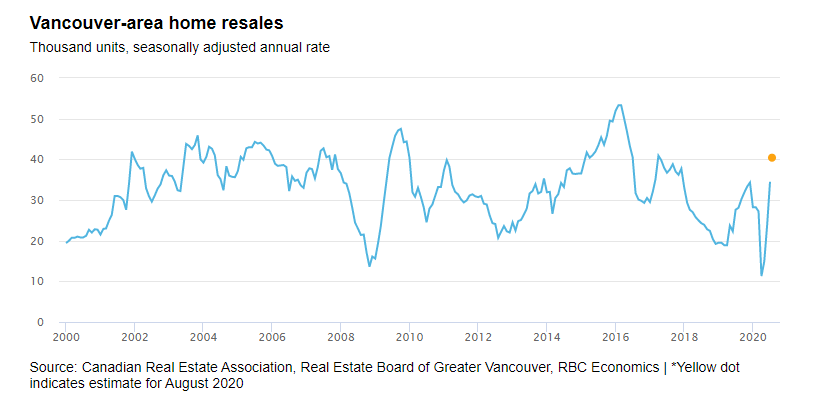

Vancouver Area

The market rally continued in earnest with home resales recording a solid 37% y/y gain (translating to a 17% advance over July on a seasonally-adjusted basis). Yet this was dwarfed by a massive 55% y/y growth in new listings. Demand-supply conditions eased a little as a result but remained generally balanced. This provided sufficient support for further (slight) price acceleration overall. The MLS HPI climbed to 5.3% y/y in August, up from 4.5% in July.

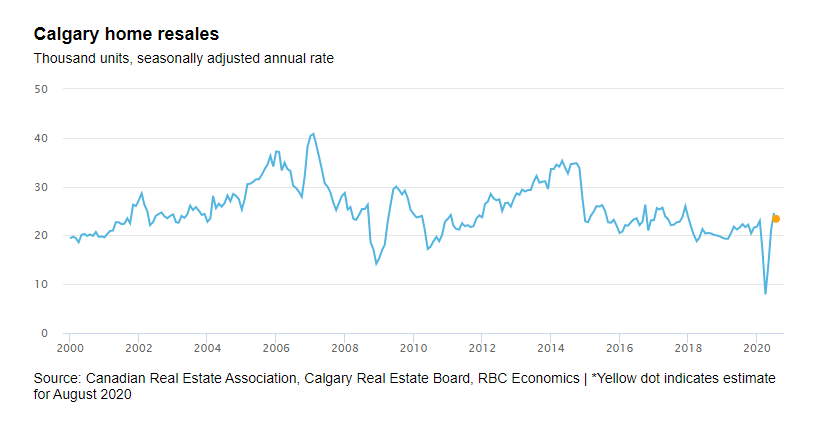

Calgary Area

July’s solid sales momentum stalled in August. A drop in available supply is partly to blame. New listings fell 8.6% y/y, bucking the trend among early reporting markets. This contributed to home resales slipping 0.1% y/y or almost 5% relative to July on a seasonally-adjusted basis. The weakness was entirely concentrated in the condo segments where sales plummeted 20% y/y. By contrast, single-detached home sales continued to climb 5.5%. Property values also diverged between these two categories. The condo HPI declined 1.5% y/y whereas the detached HPI was up 0.9%. Overall, the MLS HPI continued to trend slightly lower, coming in 0.6% below the year-ago level.

See Full Report

Robert Hogue is a member of the Macroeconomic and Regional Analysis Group, with RBC Economics. He is responsible for providing analysis and forecasts for the Canadian housing market and for the provincial economies. His publications include Housing Trends and Affordability, Provincial Outlook and provincial budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.