With current polls suggesting Biden to be in the lead ahead of the 2020 U.S. Election, we explore the impact of a potential Biden administration on the U.S. technology sector. Leaving aside the issue of corporate tax rates – which would be higher under a Biden administration – the likely differences between a Trump and a Biden administration are relatively nuanced, with a few exceptions.

Required Conflicts Disclosures

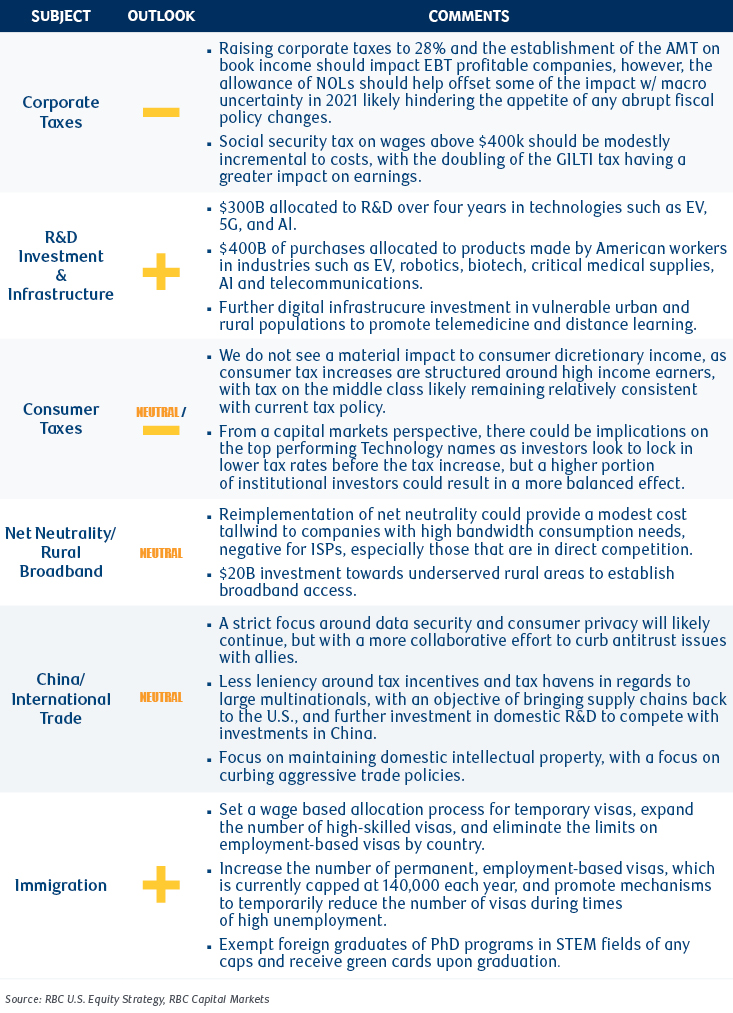

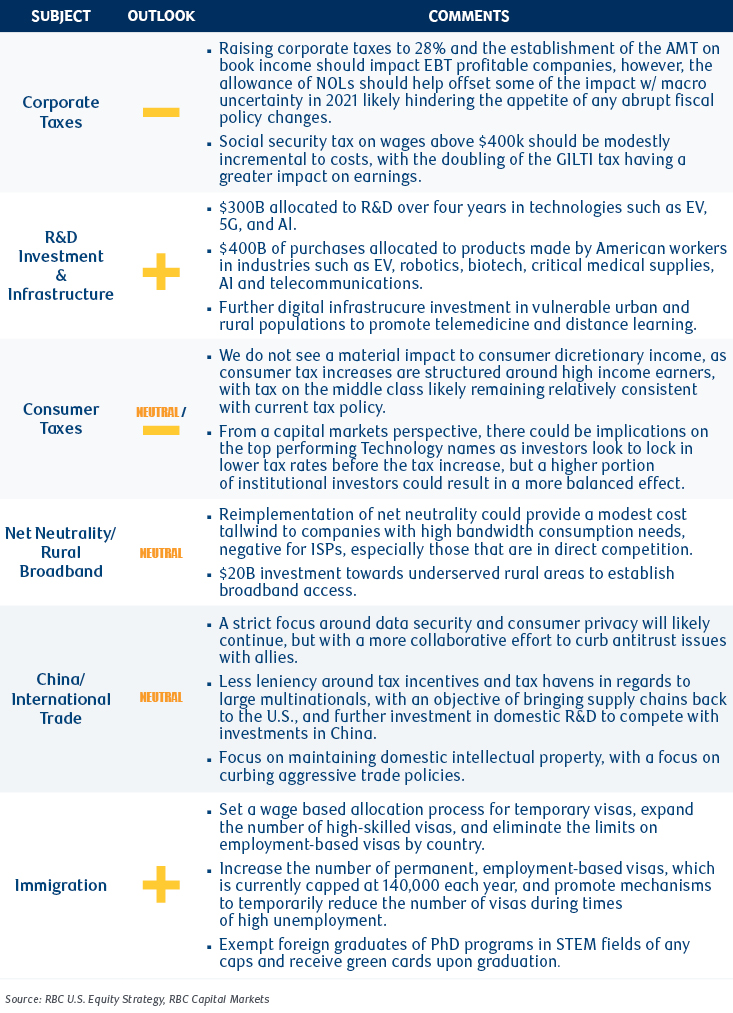

There are six key issues to monitor under a potential change in administration:

1.Corporate Tax Rates

Biden’s proposed increase in corporate taxes rates to 28% (up from 21% currently) is the dramatic difference between the two candidates. This would have the most material negative impact on the tech sector of the six key issues outlined.

2.Anti-Trust

With the Department of Justice and the Federal Trade Commission reportedly poised to file suits against both Alphabet and Facebook, and Biden’s relatively moderate public statements on Big Tech, a Biden administration might actually be modestly positive for the tech sector on this issue.

3.Research & Development Investments and Infrastructure

The Biden campaign’s statements on investing $300B in 5G, Artificial Intelligence and EV technology suggest that a Biden administration might have a comparably positive impact to innovate and introduce new products and services.

4.China Trade & Technology Issues

The Trump administration has clearly taken a much more aggressive approach to China on trade and technology issues (e.g. a potential ban on TikTok) than prior administrations. However, we suspect that this is reflective of a generational shift among U.S. policymakers and that a Biden administration would generally continue a similar approach.

5.Immigration

In terms of supporting the expansion of high-skilled visas, the Biden administration would appear clearly more favorable for the U.S. tech space when compared to the Trump administration. Biden states that he would increase the number of permanent, employment-based visas, which is currently capped at 140,000 each year, and promote mechanisms to temporarily reduce the number of visas during times of high unemployment.

6.Gig Economy Regulation

Biden has publicly praised AB5, the California legislation that essentially requires ride-sharing companies to provide full-time benefits to its contract employees. This could pose a challenge to the rideshare and food delivery industries.

Mark Mahaney, Managing Director, Internet Research Analyst at RBC Capital Markets, authored the research report “Tech Eye on the Election” published on September 22, 2020. For more information, please contact your RBC sales representative.

Our RBC Capital Markets Equity Research Contributors

Mark Mahaney is a Managing Director covering the Internet sector research at RBC Capital Markets. He has been ranked No. 1 in the Institutional Investor Poll for the Internet sector (2008-2012). He has also been ranked No. 1 in the Greenwich Institutional Investor Poll for the Internet sector, as well as the No. 1 earnings estimator and the No. 1 stock picker in the Internet retail segment by the Financial Times and StarMine. Mark has been covering Internet stocks since 1998. Prior to joining our research team, he worked on both the sell side and the buy side, including with American Technology Research, Morgan Stanley, and Citibank. Mark holds an MBA from Wharton Business School, an MA from Johns Hopkins' School of Advanced International Studies, and a BA from Amherst College. Prior to Wall Street, Mark worked in management consulting with Deloitte Touche Tohmatsu and with the US Department of State, the US Senate, and the Office of the US Trade Representative.

Shweta Kahjuria

Internet Research Analyst

RBC Capital Markets, LLC

Shweta Khajuria joined RBC Capital Markets in March 2018, and covers the Internet sector. Previously, she worked at JMP Securities, CRT Capital, and AllianceBernstein, and is a CFA Charterholder. Shweta has a Bachelor’s degree in Economics from Grinnell College and a Master’s degree in Applied Statistics from Cornell University.

Helima Croft

Managing Director and Global Head of Commodity Strategy and MENA Research, RBC Capital Markets

RBC Capital Markets, LLC

Helima is a Managing Director and the Head of Global Commodity Strategy and Middle East and North Africa (MENA) Research at RBC Capital Markets. She specializes in geopolitics and energy, leading a team of commodity strategists that cover energy, metals and cross-commodity investor activity. Helima is a member of the National Petroleum Council, a select group of individuals who advise, inform and make recommendations to the Secretary of Energy with respect to any matter relating to oil and natural gas. She also is a CNBC contributor, a member of the channel’s exclusive family of experts, is on the Board of Directors for the Atlantic Council, is a member of the Trilateral Commission, and is a Life Member of the Council on Foreign Relations. Helima joined RBC Capital Markets from Barclays, where she was a Managing Director and Head of North American Commodities Research. Prior to that, she worked in Lehman’s Business Intelligence group, the Council on Foreign Relations and the Central Intelligence Agency, where she focused on geopolitics and commodities. Helima has received many industry accolades throughout her career and received her PhD in economic history from Princeton in 2001.

Lori Calvasina

Managing Director & Head of U.S. Equity Strategy, RBC Capital Markets

RBC Capital Markets, LLC

Lori Calvasina joined RBC Capital Markets in 2017 as a Managing Director. Having spent nearly two decades as an equity strategist at major investment banks, Lori is an expert on the US stock market, and regularly represents RBC in the financial media on Bloomberg and CNBC. Prior to joining RBC, Lori was a senior equity strategist at Credit Suisse from 2010 to 2017, covering Small/Mid Cap Strategy from 2010-2014 and both Small/Mid Cap and US Equity Strategy from 2015-2017. She spent the first ten years of her career at Citi in a variety of roles including lead Small/Mid Cap Strategist from 2007-2010. In both 2008 and 2009 Lori was ranked #2 in the Small Companies category in the Institutional Investor All America Research team poll. Lori is a graduate of the University of Virginia and its selective Government & Foreign Affairs’ Honors Program. In 2019, she was named to Crains New York’s list of Notable Women in Finance.

Mitch Steves

Research Analyst, Hardware, Technology & Communications

RBC Capital Markets, LLC

Mitch Steves is an analyst at RBC Capital Markets primarily focused on Networking Equipment and Semiconductor companies. In 2016 and 2017, he was noted as a “Rising Star of Wall Street Research” according to Institutional Investor Magazine in three categories Telecom & Networking Equipment, Semiconductors and IT Hardware/EMS. He started at RBC in 2011 and launched coverage in 2015. Prior to this, he held positions at Gleacher and Company covering Hardware and Networking equipment and worked as an Investment Banker at Cowen and Company. He holds an Economics degree from the University of California Berkeley.

Matthew Hedberg

Analyst

RBC Capital Markets, LLC

Matt joined RBC Capital Markets in 2006. In addition to his 14+ years of software equity experience at RBC, he spent eight years in the software industry working with companies including GMAC and Accenture. While at RBC, Matt has published multiple white papers on the software industry and has deep knowledge of both public and private software companies. His software coverage universe focuses on infrastructure, security and big data-related names.

Alex Zukin

Managing Director and Software Equity Research Analyst

RBC Capital Markets, LLC

Alex Zukin joined RBC Capital Markets in August 2019, and is covering the Software Industry. Previously he worked at Piper Jaffray, where he was Managing Director & Technology Group Head, Senior Equity Analyst for Infrastructure & Application Software. Prior to that, Alex was a Managing Director & Senior Equity Analyst for Enterprise Software at Stephens & Co, where he started the Enterprise Software research effort.

Jonathan Atkin

Managing Director, Communications Infrastructure Investment Research Analyst

RBC Capital Markets, LLC

Jonathan Atkin is a Managing Director at RBC Capital Markets. His focus areas include telecom services, communications infrastructure, and cloud computing. During the last three years, Jonathan has received the #1 ranking from Institutional Investor in the Communications Infrastructure sector. He has also received #1 rankings from Thomson Reuters in Telecom Services and Real Estate Equities, a #1 ranking from the Wall Street Journal in Internet Services, and a #1 ranking from the Financial Times in Telecom Services. Before joining RBC, Jonathan was a senior consultant at BIA Companies focused on wireless strategy and valuation, worked in corporate strategy at Daimler-Benz AG, and was a policy analyst with the United States Congress. He has an MBA from Columbia University and BS and MS degrees in engineering from Stanford University. He is a two-time finisher of the Ironman triathlon.

Dan Perlin

Managing Director – Payments, Processors and IT Services Research, RBC Capital Markets

RBC Capital Markets, LLC

Dan Perlin joined RBC Capital Markets in 2009 as a Managing Director of Research covering the Payments, Processing and IT Services industry. He has more than 20 years of equity research experience and has held senior research positions at Wachovia Securities, Stifel Nicolaus and Legg Mason. Through his career, he has followed several industries including electronic processing, computer services, financial technology and industrial services. Dan has been recognized by Institutional Investor, the Financial Times and Forbes as a leading analyst in his industry group.