Highlights

- Growth in sustainable investing continues to accelerate and is evident in the pace at which asset managers are building their internal ESG capabilities by investing in specialized ESG talent

- Investors are increasingly collaborating on specific ESG topics, efficiently pooling resources to successfully advance progress on material sustainability issues

- Upcoming regulatory requirements and new reporting standards aim to standardize ESG disclosures and prevent greenwashing in the investment industry

- Asset managers must ensure their own ESG performance, especially in the area of Diversity & Inclusion, is robust in the face of increased scrutiny from asset owners

Introduction

The year to date has been full of disruptions that continue to have wide-ranging implications for communities, companies, and markets. Along with a health pandemic continuing to place stress on healthcare systems, there has been a steady, and necessary, spotlight on the issues of systemic racism and socioeconomic inequity that impact communities across the globe. It is with that backdrop that we have seen sustainable investing accelerate. Michael Jantzi, the founder of ESG ratings provider Sustainalytics, told a virtual audience at the Morningstar Investment Conference last month that COVID-19 has increased the growth and importance of sustainable finance.[1] That growth has been underpinned by record flows into sustainable funds globally, tremendous growth in the launch of new sustainable funds, and continued outperformance of actively managed sustainable funds in the year to date. In addition to the accelerated demand in the midst of COVID-19, we have identified key themes that will have implications for investors and this edition of Sustainability Matters focuses on emerging trends in sustainable investing that are particularly relevant for asset managers.

Despite the Disruption Caused by COVID-19, the Demand for Sustainable Investing Continues to Accelerate

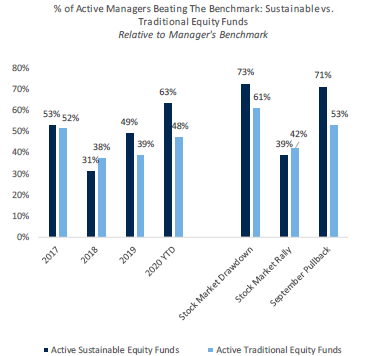

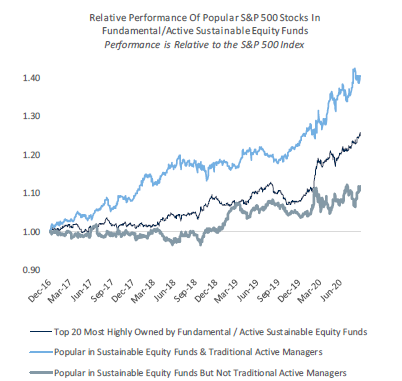

Research from RBC Capital Market’s US Equity Strategist Sara Mahaffy shows that inflows into the sustainable fund universe tracked by RBC Capital Markets (a global universe of Morningstar tracked US, global, and sector focused equity funds with meaningful assets invested in US equities; representing US$368B AUM) rose to new highs in 2Q20.[2] In addition, a basket of popular names in actively managed sustainable equity funds tracked by RBC Capital Markets has outperformed in 2020 and 63% of actively managed sustainable equity funds have beaten their benchmark in the year to date.[3]

Source: The ESG Scoop, Deep Dive Into the Holdings of Sustainable Equity Funds, September 2020

In Canada, our analysis highlights record flows into sustainable funds in 2020, including over C$800M into Canadian ESG ETFs in the year to date, which has already eclipsed the combined total from 2018 and 2019. Globally, in 2Q2020, ESG fund assets surpassed the US$1 trillion mark for the first time according to research from Morningstar.[4] The figure highlights the rebound in ESG assets after the initial COVID-19 sell-off, when assets fell 12% to US$846 Billion in Q1. The momentum of new ESG sustainable fund launches has also continued in 2020. 21 new funds were launched in the US in 1H2020, 15 in Canada, and 213 in Europe. In contrast to predominantly new offerings in North America, Europe continues to see asset managers convert traditional funds into sustainable funds with these repurposed funds representing 21% of the sustainable fund universe in Europe.[5]

Investor Collaborations Are Targeting Specific ESG Issue Areas

Collaboration is also increasing among asset managers and asset owners on specific ESG topics. In August, a group of 70 investors, representing over $16T in AUM, came together as part of the Institutional Investors Group on Climate Change (IIGCC) to develop the Net Zero Investment Framework.[6] The Framework aims to support asset owners and asset managers to decarbonize their investment portfolios in a manner that is consistent with a 1.5°C net zero pathway by 2050. The focus of the framework is to deliver emissions reductions and also increase investment in climate solutions that promote a net zero future.

Efforts such as the Net Zero Investment Framework complement the breadth of investor coalition initiatives focused on ESG efforts, including the well-established Climate Action 100+. In fact, in September, the Climate Action 100+, which represents 500 investors with US$47T in AUM, announced its own Net Zero initiative, the Net-Zero Company Benchmark. The benchmark, set to be released in 2021, will assess the progress being made by the 161 largest GHG emitting companies in the world on achieving Net Zero emissions by 2050 or sooner.[7] The Net-Zero Company Benchmark builds off the Climate Action 100+’s successful track-record of achieving significant progress through engagement efforts including several focus companies making net-zero commitments over the past seven months.

Investors are also coalescing around topics related to social and governance factors. In April, The Investor Alliance for Human Rights, an initiative of by the Interfaith Center on Corporate Responsibility (ICCR), called on governments to use regulatory measures to require companies to conduct regular human rights due diligence related to their business activities. The Alliance, with members across 18 countries with US$5T in AUM, is focused on corporate engagement to promote respect for people’s fundamental rights and push for robust human rights policies.[8]

Regulatory Initiatives and Standards Aim to Provide Investment Clarity and Prevent Greenwashing

Regulatory bodies are increasingly focused on ESG disclosures with a view to promote investment clarity and minimize greenwashing concerns that have arisen regarding the true sustainable attributes of investments that are labelled as such. Upcoming regulations, particularly in Europe, have implications for managers on how they disclose the sustainability characteristics of their investments. In 2016, the European Commission established the High-Level Expert Group on Sustainable Finance (HLEG) which published its final report on developing a comprehensive strategy on sustainable finance for the EU in 2018.[9] In March of that year, the Commission released an action plan that reflected recommendations resulting from the report, including a proposal to regulate disclosures related to sustainable investments (“the Sustainable Finance Disclosure Regulation (SFDR)”). The SFDR was adopted by the EU Commission in December 2019 and comes into effect in March 2021[10] and is designed to promote more standardized labelling around sustainable financial products and prevent misleading claims about the sustainability attributes of an investment product[11] through mandatory ESG reporting.

In a similar effort, in August, CFA Institute, the global association of investment professionals, published a Consultation Paper for a new voluntary standard for ESG disclosure that the Institute hopes will provide greater transparency for investors, while supporting asset managers to clearly articulate the ESG attributes of their investment products. The CFA Institute’s “ESG Disclosure Standards for Investment Products” will focus on products with ESG-related features in order to equip investors with comparable data. The Standard is differentiating itself from other ESG-related standards, frameworks and taxonomies by not defining or labelling what constitutes an appropriate ESG or sustainable investment product. Rather, disclosures that follow the Standard will empower investors with information and data to make that decision on their own.[12]

As Firms Continue to Build ESG Capabilities, They Also Need to Think About Their Own Internal ESG Performance In the Face of Growing Scrutiny from Asset Owners

Asset Managers are recognizing the growth in sustainable finance and positioning themselves to take advantage of the burgeoning market. A recent 2020 study by the FT revealed that the number of professionals working in dedicated ESG roles at 27 of the leading investment managers has jumped 4X in 2020 from 2017. In addition, staff in dedicated ESG stewardship roles at those same firms increased 2X in that same period.[13] Stewardship teams lead discussions with board and management teams at portfolio companies on a wide-range of ESG topics and also participate in voting during the annual meeting process. One of the reasons cited by the FT for the increase in ESG personnel at investment firms is the opportunity that ESG expertise provides firms to differentiate themselves from competitors and meet the growing appetite for ESG integration from asset owners.[14]

The ESG capabilities within a firm should be separated from another emerging consideration for asset managers: their own internal ESG performance. With the current spotlight on issues of socioeconomic inequality and diversity and inclusion, asset owners will expect that managers who promote the ESG prowess of their firms, have internal practices that meet or exceed the ESG considerations they are embedding into their investment portfolios.[15] A SEC hearing in July that focused on improving diversity in the asset management industry concluded that efforts require better data and disclosures of diversity policies from firms. The SEC has historically not used regulatory actions to promote Diversity and Inclusion in the financial industry but SEC Chairman Jay Clayton indicated that that the agency will explore opportunities to improve D&I efforts in the asset management industry.[16] Ultimately, progress will be accelerated through demand from asset owners for managers to have internal D&I practices that are reflective of what those firms expect of companies in their investment portfolios. The momentum has already started, signaled by a trend that has seen diversity-related questions becoming more prominent in request for proposals from asset owners to managers.[17]

Closing Thoughts

The growth in sustainable investing has continued to accelerate in 2020, weathering the market disruptions caused by COVID-19. This issue of Sustainability Matters focused on emerging trends in sustainable investing that are particularly relevant for asset managers. Going forward, we expect continued collaboration among asset managers, especially in specific ESG areas where resources can be pooled to maximize progress and results. In addition, asset managers should be aware and ready to respond to the regulatory headwinds that will continue to place added pressure for disclosures around the sustainability attributes and labelling of products. There is also an increase in the number of dedicated ESG personnel at leading firms, signaling the need and appetite for in-house ESG capabilities and talent. Alongside the growth of ESG personnel, we also identified the need for investment firms to critically evaluate their own internal progress on ESG issues around diversity & inclusion, particularly as interest in these issues ramps up from asset owners. Collectively, these developments solidify the move of ESG from a nascent, nice-to-have capability at top-tier firms to a requirement for any firm that wants to credibly compete and differentiate themselves in today’s marketplace.

- [1] https://www.ai-cio.com/news/pandemic-creates-watershed-moment-sustainable-investing/

- [2] RBC Capital Markets, The ESG Scoop, Our Deep Dive Into The Holdings of Sustainable Equity Funds for 2Q20, September 2020

- [3] RBC Capital Markets, The ESG Scoop, Our Deep Dive Into The Holdings of Sustainable Equity Funds for 2Q20, September 2020

- [4]https://www.morningstar.com/lp/global-esg-flows

- [5] Morningstar, European Sustainable Fund Flows: Q2 2020 in Review, July 2020

- [6] https://www.iigcc.org/news/16-trillion-investors-develop-first-ever-framework-for-net-zero-investing/

- [7] https://www.ceres.org/news-center/press-releases/climate-action-100-calls-net-zero-business-strategies-sets-out-benchmark

- [8] https://investorsforhumanrights.org/about

- [9] https://www.nortonrosefulbright.com/en/knowledge/publications/a5848ad7/global-and-eu-sustainable-finance-initiatives

- [10] https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/investor-disclosures-climate-related-information_en

- [11] https://www2.deloitte.com/lu/en/pages/sustainable-development/articles/eu-disclosure-rules-sustainable-finance.html

- [12] https://www.mondaq.com/hongkong/corporate-governance/986636/esg-disclosure-standards-cfa-institute-launches-consultation?

- [13] https://www.ft.com/content/2714da14-c12d-46b2-8ecf-9aba3f665fdf

- [14] https://www.ft.com/content/2714da14-c12d-46b2-8ecf-9aba3f665fdf

- [15] https://www.institutionalinvestor.com/article/b1mcy4g32ppgxw/Asset-Managers-Tout-Their-ESG-Strategies-But-Rarely-Live-Up-to-Those-Standards

- [16] https://www.fnlondon.com/articles/sec-called-to-help-diversify-asset-management-industry-20200717

- [17] https://www.avivainvestors.com/en-no/views/aiq-investment-thinking/2020/07/economics-ethics-diversity/