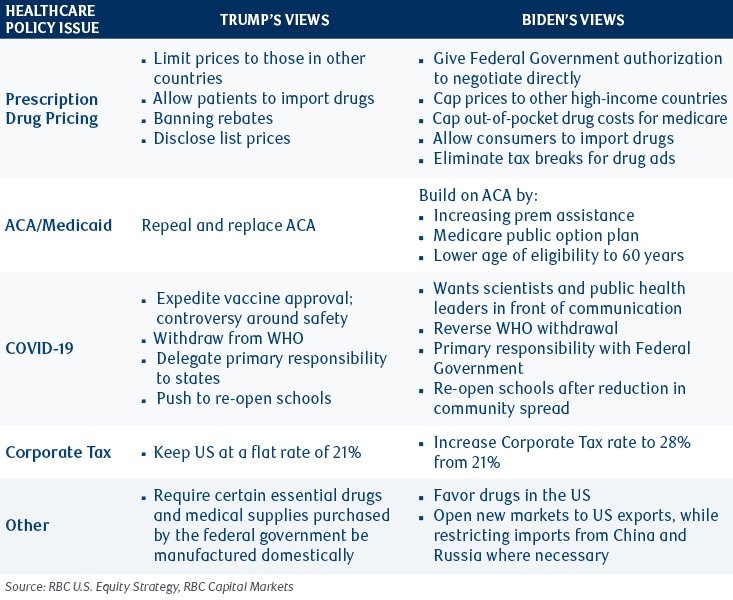

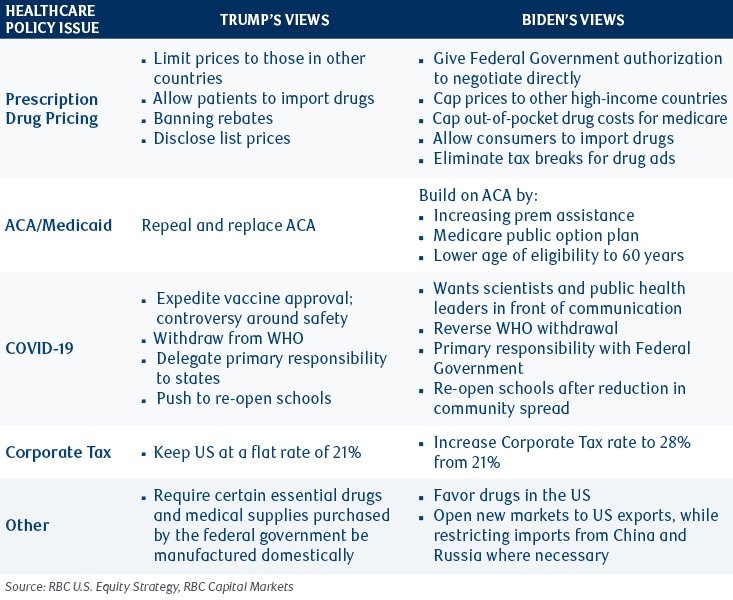

Drug pricing, the Affordable Care Act, pandemic response, value-based care and telehealth: what can we expect for the healthcare sector following the 2020 U.S. election? Our Healthcare Equity Research team hosted a policy call on September 30, 2020 with John Brooks and Yvette Fontenot, former members and healthcare advisors to Republican and Democratic administrations, to uncover how the different potential Presidential and Congressional election outcomes may impact healthcare policy. We summarized some of the views that these expert policy consultants shared.

Disclosures and Disclaimers

A Trump re-election will likely see a continuation of the current healthcare strategy

Lowering prescription drug prices will likely continue to be a top priority for the current administration if Trump is re-elected, and "most favored nation" (MFN) reference pricing is expected to remain a primary tool. However, there could be significant challenges to administer such a plan, because Medicare Part D prices are negotiated by individual plans in a decentralized manner, making it complex to dictate a new pricing schema.

Overall, a second Trump administration would probably result in even greater partisanship leading to little legislative activity. While President Trump's recent Executive Orders on drug pricing have created political talking points, we do not see meaningful impact resulting if he is re-elected, though headline risk would remain.

A Biden win could bolster healthcare infrastructure, but headwinds will likely endure

Drug pricing has been a signature issue for Democrats, and a Biden win could see Trump’s recent executive orders add pressure to continue the momentum on legislative action, particularly given strong consumer association of healthcare costs to drug pricing. Biden's drug pricing agenda centers around enhancing negotiation using a review board and external pricing benchmarks.

The Biden platform has increasingly shown desire to make COVID-19 a “never again” event, and one of the first legislative goals in a potential Biden win could be to look to increase capacity for testing, PPE manufacturing, provider availability, and bolster healthcare agencies and infrastructure overall. Though a strong desire has not yet materialized to getting rid of a filibuster, we sense that significant resistance to passage of COVID-19 legislation could serve as an impetus for moderates to become more open to this idea.

With a Biden administration likely to “double down” on the Affordable Care Act by making it more affordable and increasing ACA subsidies, any type of acceleration would require more political will, and both Brooks and Fontenot described that as lacking right now.

A toss-up for value-based care and telehealth

Neither candidate appears likely to accelerate the transition to value-based care. Both Brooks and Fontenot agreed that there was growing skepticism among lawmakers that any of the various demonstration projects were doing much to bend the healthcare cost curve. In short, both believe under either administration, VBC programs would continue on a small scale, but we are unlikely to see any large-scale policy shifts.

With regard to telehealth, we see it has bipartisan support, but more data is needed to set long-term policy. Temporary measures designed to ease access to telemedicine will extend into next year and both parties are interested in making some of these measures permanent.

Our Healthcare Equity Research team at RBC Capital Markets authored the research reports “Pharmaceuticals: Thoughts on 2020 US Election” and “Healthcare Policy Update: Our Take on the 3 Election Scenarios and ACA,” both published on October 1, 2020. For more information, please contact your RBC sales representative.

Featured Policy Consultants:

John Brooks, J.D. – Former Senior Advisor to the Secretary for Drug Pricing Reform

John Brooks was the former Senior Advisor to the Secretary of Health and Human Services – Alex Azar – for drug pricing reform, where he helped author the recent drug pricing executive orders. Prior to this, he was the Deputy Director for the Center for Medicare, an advisor on the Domestic Policy Council, and Counselor to the Secretary on Health Policy during the Trump Administration. Before joining the administration, he was the Department Head for Health Policy at Mitre. John Brooks completed his J.D. at the University of Virginia his MBA at Virginia Tech.

Yvette Fontenot – Avenue Solutions, Former Deputy Director of the Office of Health Reform

Yvette Fontenot is currently a partner at Avenue Solutions a DC based consulting and lobbying firm. Prior to this, she was the Deputy Director for the Office of Health Reform during the Obama administration and Senior Advisor to the White House, where she helped author major portions of the Affordable Care Act. In addition she has been featured on NBC and authored op-ed pieces in prominent publications such as Politico. Yvette Fontenot received her Masters in Public Policy from the University of Chicago and her B.A. in Public Policy from Duke University.

Our RBC Capital Markets Equity Research Contributors

Dr. Brian Abrahams

Co-Head of Biotechnology Research,

Dr. Brian Abrahams joined RBC Capital Markets in July 2017 as a senior analyst covering the biotechnology sector. He has 15 years of experience following large, mid, and small cap biotech companies, and prior to RBC spent time in biotechnology equity research at Jefferies, Wells Fargo, and CIBC World Markets / Oppenheimer & Co. He is a licensed non-practicing physician and holds a medical degree from the Albert Einstein College of Medicine. He did his undergraduate studies at Yale University, where he graduated magna cum laude with a Bachelor of Science degree in Molecular Biophysics & Biochemistry.

Sean Dodge, CFA

Healthcare Equity Analyst,

RBC Capital Markets, LLC

Anton Hie joined RBC Capital Markets in 2009, and is covering the Healthcare Services and Distribution sector. Previously, he worked at Jefferies & Company, First Union Capital Markets, and J.C. Bradford & Co. in similar roles. Anton graduated from Vanderbilt University with degrees in German and Business Administration.

Anton Hie

Equity Analyst, Healthcare Services and Distribution Research

Anton Hie joined RBC Capital Markets in 2009, and is covering the Healthcare Services and Distribution sector. Previously, he worked at Jefferies & Company, First Union Capital Markets, and J.C. Bradford & Co. in similar roles. Anton graduated from Vanderbilt University with degrees in German and Business Administration.

Luca Issi joined RBC Capital Market in 2020, and is covering Biotech. Prior to RBC, he was an investor at Bain Capital Life Sciences, where he led private and public investments across biopharmaceutical, medical device, specialty pharma and tools & diagnostics. Prior to Bain, he worked in equity research at Cowen and Company, where he covered large cap pharmaceutical companies. He received his PhD in Biotechnology from Worcester Polytechnic Institute and graduated summa cum laude in Biotechnology from the University of Milan (MS) and the University of Varese (BS).

Kennen MacKay

Managing Director, Co-Head of RBC Biotechnology Research,

Dr. Kennen MacKay is a Managing Director at RBC and Co-Head of RBC Biotechnology Research. Kennen has over 10 years of biotechnology experience and previously covered the biotechnology sector at Credit Suisse and Citigroup. Prior to his career on Wall St., Kennen served as Director of the Michelson Prize and Grants under Los Angeles billionaire Dr. Gary Michelson, where he vetted biotechnologies for development in the non-profit setting. Kennen received his Ph.D. in Biochemistry and Molecular Biology from UCLA and his BA in Biochemistry from Colorado College, where he was a 4-yr Academic All-American on the swim team.

Frank Morgan, CFA

Managing Director, Equity Analyst, Healthcare Services Research

Frank brings over 30 years of experience in equity research and investment banking to our healthcare services team in Nashville. Over the years, he has earned recognition as a master stock picker in The Wall Street Journal’s “Best on the Street Analysts Survey”, and was named as a Blue Chip Analyst by Forbes.com and Zacks Investment Research in the medical care sector. He has also been named to the Nashville Business Journal’s “Healthcare 100” list. Frank’s views on healthcare have been quoted in many financial publications. He has also appeared on numerous TV and radio programs. Frank’s coverage includes facility-based healthcare services as well as managed care organizations, outsourced hospital services, home health, dialysis, and post-acute care.

Gregory Renza, M.D.

Equity Analyst, Biotechnology Research

Dr. Gregory Renza is an Analyst and Vice President of Biotechnology Equity Research at RBC Capital Markets. Previously, he served on the biotechnology equity research team at Jefferies as well as the specialty pharmaceuticals equity research team at Wells Fargo Securities. Prior to equity research, Greg worked in management consulting at Booz & Company (now Strategy& at PwC) and in strategy & business development at CVS Caremark (now CVS Health). Greg holds an A.B. in Biology from Brown University and an M.D. from Brown University’s Warren Alpert Medical School.

Randall Stanicky

Managing Director, Equity Analyst, Specialty and Generic Pharmaceuticals Research

Randall brings more than 20 years of experience to his role as lead analyst of RBC Capital Markets' Large cap, Specialty and Generic pharmaceuticals research team in New York with coverage of over 20 stocks. Randall joined our firm in 2013 following his tenure at Goldman Sachs and Canaccord Genuity, where he provided of the same sector. Prior to becoming a sell-side analyst, Randall followed healthcare stocks on the buy side at Citigroup Global Asset Management. Randall received a bachelor's degree in commerce from the University of British Columbia and he is a CFA charterholder and currently sits on the Board of Directors at the Children's Tumor Foundation. Randall is a Managing Director of RBC Capital Markets.