Q: How has the surge in SPACs impacted the IPO and M&A markets?

Amir: We have a very favorable marketplace for SPACs right now. First, institutional shareholders have become more receptive to SPACs because they can be attractive from a yield and a risk/reward perspective. Second, there’s a healthy pipeline, with an influx of high-caliber institutions and entrepreneurs participating in various stages of a SPACs lifecycle such as Fidelity, Wellington, T. Rowe, Fortress Investment Group, William Foley, and Richard Branson. And lastly, the market has a robust back end, with participants showing greater willingness to facilitate these deals than they did in the past.

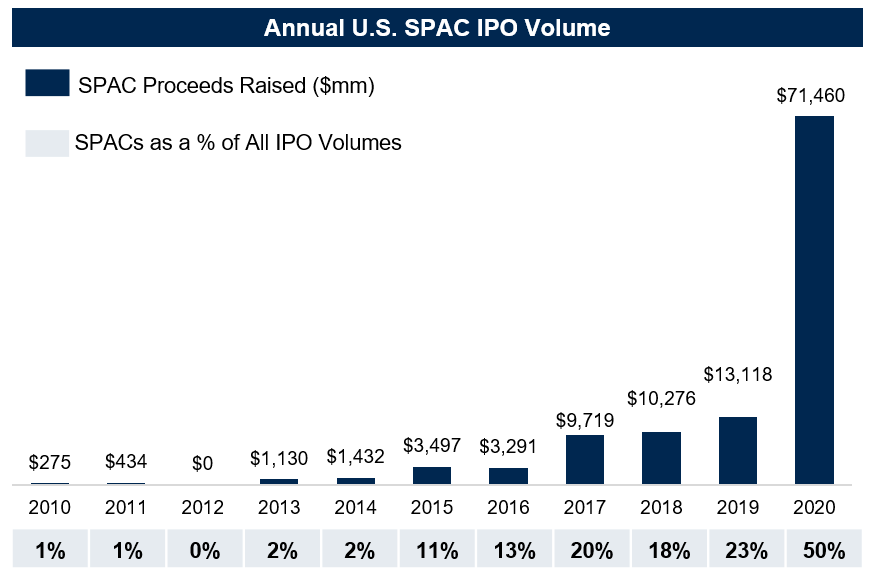

Michael: Approximately half of IPO issuance comes from SPACs right now, so we’ve definitely reached an inflection point. Wider acceptance of SPACs as a core capital markets product, as opposed to their former position as more of a “fringe” offering, has fostered a greater understanding of what SPACs can achieve from an investment return standpoint. I think last spring’s pandemic-induced market volatility, which hampered companies’ ability to go public, really helped bring SPACs into the spotlight.

Source: Dealogic; as of 12/07/20. Note: Includes U.S. IPOs with base deal value greater than $100mm.

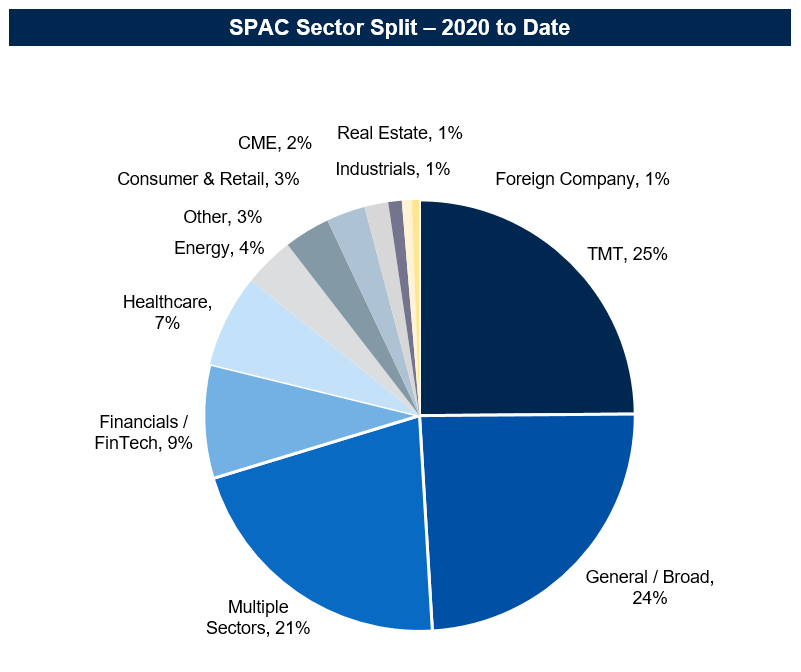

Q: What industries currently have the most traction with SPACs?

Amir: Technology, Media & Telecom mandates currently comprise nearly 25% of 2020 SPAC volume, but General / Broad SPACs are close behind with 24% of the market. Both Financials / FinTech and Healthcare represent a smaller share, but they’re both gaining traction.

Source: Company Filings; as of 12/07/20. Note: Includes 2020 YTD U.S. SPACs with base deal value greater than $100mm.

Q: What is RBC Capital Markets doing to build the SPAC pipeline?

Amir: SPACs have both Equity Capital Markets (ECM) and M&A elements to them. In order to have a successful practice, we’re applying both my M&A and Michael’s ECM expertise to develop a robust pipeline, as well as how to execute that pipeline with an eye towards public investors’ perception of a potential transaction. This approach is really resonating with our clients and it’s helping us win new mandates. There has been incredible growth in SPACs over the past few years, and there have been more proceeds from SPACs year to date than in the last 10 years combined.

“ More proceeds from SPACs have been raised year to date than in the last 10 years combined. ”

- Amir Emami, Co-Head, SPAC Coverage

Q: How does your approach to SPACs differ from your competitors?

Michael: Our practice is really designed to focus on the entire lifecycle of a SPAC, not simply on executing the IPO. Our team helps source, analyze, structure and execute on potential merger candidates. After the M&A is announced, the narrative becomes king. Our clients need to be well represented in the marketplace and our highly-tenured equity sales force also helps support that narrative. Finally, where appropriate, our highly-ranked equity research group may play a critical role in continuing to monitor the post business combination company.

“ After the M&A is announced, the narrative becomes king. ”

- Michael Ventura, Co-Head, SPAC Coverage

Q: How does your team manage the underwriting risks associated with SPACs?

Amir: We manage risk by focusing on the right clients. We’re selling both a structure and a SPAC sponsor team, so our approach is to partner with groups where we have conviction.

Michael: We definitely are not built to “be everything to everyone”. We take a very methodical approach to mitigating risk by working with our M&A team and collaborating with our sector-focused investment banking and equity capital markets partners to pick the right business opportunities that align with our platform and where the RBC brand and our sector expertise can have the highest impact for our clients.

Q: Can you provide a few examples of some recent SPAC deals?

Amir: In 2017, we were joint bookrunners on Mosaic Acquisition Corp’s $345 million SPAC IPO and the exclusive private placement agent on their $150 million forward purchase agreement private placement. We then provided financing and capital advisory expertise to Mosaic on its merger with Vivint Smart Home, a $4.2 billion deal which closed in January 2020. We also acted as financial advisor and capital markets advisor to Fortress Value Acquisition Corp. on its merger with MP Materials for approximately $1 billion [announced July 2020]. Most recently, we were joint bookrunners on Horizon Acquisition Corporation’s Horizon I and Horizon II SPAC IPOs.

Mosaic Acquisition Corp.’s $4.2 Billion Merger with Vivint Smart Home

Transaction Overview:

Mosaic Acquisition Corp’s Merger with Vivint Smart Home

Mosaic Acquisition Corp.’s $4.2 Billion Merger with Vivint Smart Home” and "Fortress Value Acquisition Corp.’s $1B Merger with MP Materials

- Mosaic raised $345M in its IPO in October 2017.

- In September 2019, Mosaic announced its merger with Vivint Smart Home (VVNT).

- Considerations included approximately $35M in cash from Mosaic, $926M in Vivint shareholder equity, and $303M in PIPE proceeds from Blackstone and Fortress Investment Group LLC among others.

- Upon closing of the $4.2B transaction, Vivint shareholders owned approximately 63% of the company.

Target Overview:

Vivint Smart Home

- Vivint is a leading smart home company that delivers integrated smart home products and cloud services to 1.5M subscribers across 98% of Canadian and U.S. zip codes.

- Vivint offers smart home products, professional installation, nationwide in-home service, and 24/7 professional monitoring and customer care.

- Vivint was acquired by the Blackstone Group in September 2012.

Fortress Value Acquisition Corp.’s $1B Merger with MP Materials

Transaction Overview:

Fortress Value Acquisition Corp.’s Merger with MP Materials

- Fortress Value Acquisition Corp. (FVAC) raised $345M in its IPO in April 2020.

- In July 2020, it announced its merger with MP Materials (MP).

- Considerations included approximately $345M in cash from FVAC, $920M in MP shareholder equity, and $200 PIPE proceeds from Slate Path Capital, Chamath Palihapitiya, and Omega Family Office among others.

- Upon closing of the $1B transaction, MP shareholders owned approximately 62% of the company.

Target Overview:

MP Materials

- MP produces approximately 15% of global rare earth materials used to develop defense systems, smartphones, drones, and electric vehicles.

- MP operates a green mining and processing facility and is one of the lowest-cost producers of rare earth concentrate.

Q: Do you think SPACs will make traditional IPOs obsolete?

Amir: SPACs provide an interesting alternative to traditional IPOs, but they’re not for every type of company. Traditional IPOs aren’t going away. SPACs may offer efficient execution, certainty of valuation, and can include earn-out structures. Each transaction is forward-looking rather than historical. Both shareholders and issuers have become much more receptive to them over the years. But I think the market is certainly big enough to support all three paths to becoming public: SPACs, IPOs, and Direct Listings.