Global Financial Institutions Conference 2021

March 9-10

2021 heralds a unique operating environment for Financial Services. With net interest margins at multi-decade lows, revenue growth challenges, juxtaposed with loan loss reserve releases and an abundance of capital, leadership must contend with a shifting economy and the vagaries of the coronavirus. Delivering higher profitability for shareholders is the key driving force behind improving shareholder returns, in our bank analysts’ opinion. As investors, leaders and senior management teams survey the post-pandemic landscape, we ask; who will emerge as the most profitable companies, the acquirers and the acquirees?

Please contact your RBC Institutional Salesperson to attend this year’s premier event for financial institutions, investors and thought leaders.

Over the last ten years, the banking industry has steadily rebuilt its profitability. Prior to the COVID-19 pandemic, 2019 was the fifth consecutive year of record core profitability for the US banking industry. While bank stocks underperformed in 2020, as the pandemic drove elevated loan loss provisioning and a deeply unfavorable rate environment, RBC’s bank analysts believe the stocks are set up well to outperform in 2021.

The key factor driving stronger earnings this year will be the expected economic recovery on the back of a vaccinated population and a receding pandemic. Our bank analysts believe, in this environment, banks should recover too.

The quality of credit

While revenue growth is likely to be subdued, particularly in the first half of the year, this should strengthen as net interest margins stabilize on a potentially steeper yield curve, and loan growth accelerates, in our bank analysts’ opinion. The government’s aggressive economic and fiscal stimulus in response to the pandemic ignited the recovery, with GDP expanding and unemployment slowly improving.

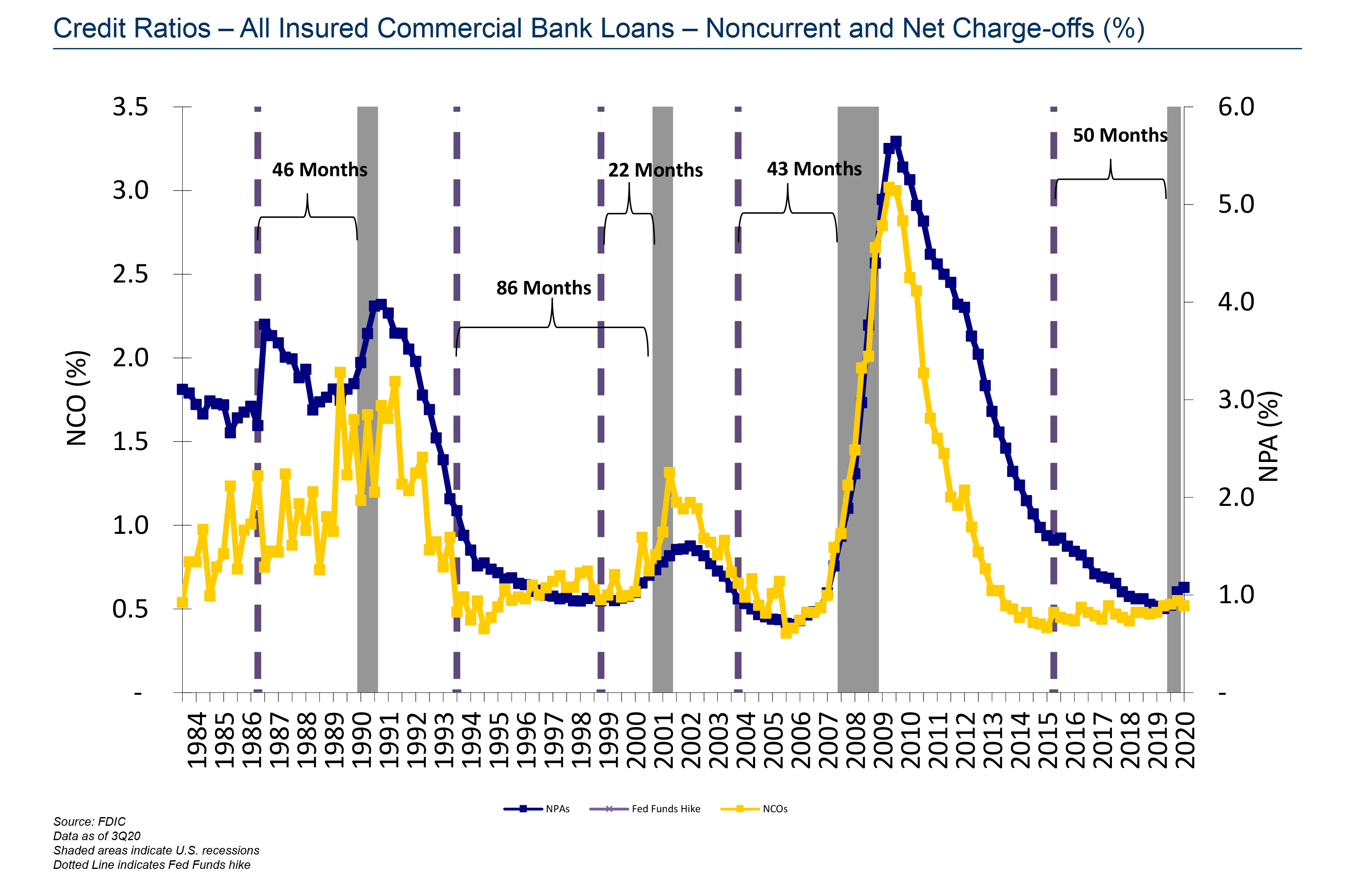

Despite the negative impact of the pandemic on the domestic, and global, economy, credit quality has remained remarkably resilient in 2020, with only manageable losses so far as shown in the graph above. Our bank analysts believe, credit losses are likely to rise and peak in mid to late 2021but loan loss reserves have been built-up by the banks to cushion the blow from higher credit losses. The combination of government stimulus, forbearance actions by the industry and changes in borrower behavior appear to have helped to stave off the worst of potential credit outcomes.

Large banks were forced by new accounting rules to provision against life of loan losses, significantly building reserves for most of 2020, against credit losses which are likely to fall well below the peak of the last downturn according to our bank analysts. This provisioning activity likely peaked in 1H20, and as a result, lower and/or negative provisioning should support improved earnings growth year-over-year.

Capital action plans ahead

Along with building up reserves last year, banks have spent the years since the 2008 financial crisis building up profitability and returning excess capital to shareholders. For the top 20 banks, the average decline of the fully diluted shares outstanding from the peak level was 24%. The Federal Reserve lifted share repurchase suspensions for the largest banks beginning in 1Q21 and dividend payments are expected to be maintained until the income limitations are lifted for capital action plans according to our analysts.

Right now, these plans are limited to the average of the prior four quarters’ net income, which will keep the amount available down while 1Q20 and 2Q20 are in the formula. But as the year progresses, these should increase. Moreover, once the 2021 Comprehensive Capital Analysis and Review (CCAR) stress test results come out in June, the current limitations are likely to be lifted in our analysts’ opinion. These regulatory changes are expected to support and expand share repurchase programs, which were already being announced by most banks in the weeks following the Fed’s announcement.

Capital action plans also include dividends, which should indicate that dividend growth will resume. On average, the top 20 banks’ dividend five-year compound annual growth rate was 19% and banks are likely to steadily increase their dividends through 2021 and into 2022. This should be supported by their earnings recovery and the greater flexibility in dividend payout ratios once capital action plan limitations are lifted.

The macro risks

According to our bank analysts, the strong economic recovery in the last few months of 2020 gives us grounds for much optimism going into 2021 for a strong recovery as the pandemic recedes. However, risks remain for the year, tied to the uncertainty of the pandemic and the nature of the recovery. If new variants should prove resistant to the vaccine, the recovery may be uneven, leading to a less favorable environment.

This same factor could also cause credit quality to deteriorate, if losses are more drawn-out or more severe than expected. Alternatively, our bank analysts believe a stronger than expected expansion could lead higher inflation, forcing the Fed to re-assess its monetary policy, although the probability of that scenario is not high in 2021. An alternative scenario is that interest rates remain low for longer than expected or even go negative, which would put pressure on net interest margins.

Outside of the pandemic, there is still a new administration in the White House, whose policies may impact the banking sector. President Biden’s has suggested support for a progressive tax code that could potentially raise the corporate income statutory rate to 28% from 21%, which could adversely impact the profitability of US banks. He has also said he supports increased regulation, which could prove negative to the sector.

Reasons for optimism

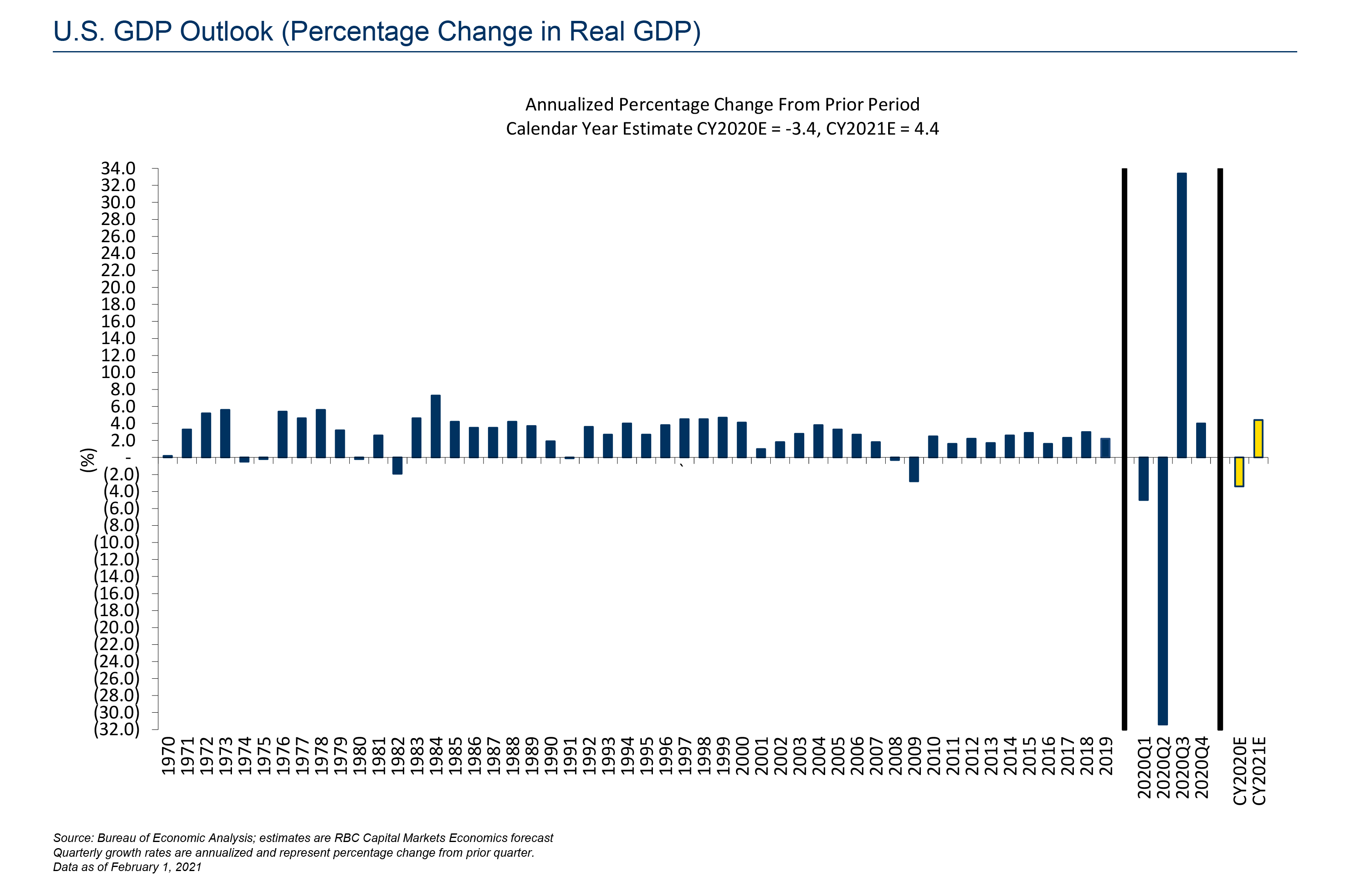

The effects of the pandemic have wreaked havoc throughout the world. In the U.S., though real GDP contracted 3.4% in 2020, the steepest decline in over 70 years, the contraction took place in the first half of the year and ended the year growing 4.0% in the fourth quarter following a 33.4% jump in growth in the third quarter. The growth achieved in the 4Q20 is expected to continue in 2021 with the economy forecast to expand 4.4% according to the economists at RBC. Importantly, recent data shows in the U.S. the number of positive coronavirus infections have declined 40% and hospitalizations declined 26% from their January peaks according to the Covid Tracking Project. Furthermore, with the warmer spring weather approaching (viruses are generally less likely do not thrive in warmer weather) and the number Americans being vaccinated increasing daily, the terrible effects from the pandemic are likely to decline as the year progresses. Though there is a risk of new variants of the virus to contend with, the pandemic trends according to the Covid Tracking Project, are heading in the right direction. As a result when the U.S. reaches herd immunity and the virus finally runs its course, consumer confidence which remains constrained according to the Conference Board data, will likely surge in our bank analysts view, which should lift consumer and commercial activity to support an expanding economy in latter 2021 and into 2022, in their view.

A strong and expanding economy bodes well for the banking sector as the sector is a product of the economy. Additionally, the industry should experience higher levels of profitability, stock buybacks and dividends which should lead to stronger shareholder returns in 2021 than 2020, according to our analysts. Lastly, consolidation of the industry should continue in 2021 as we expect to see large bank mergers as well as small bank acquisitions. Based upon data from the FDIC, economies of scale and efficiencies generated from mergers and acquisitions most times lead to improved profitability for the consolidated entity.

Gerard Cassidy, Managing Director, Head of U.S. Bank Strategy, Jon G. Arfstrom, Managing Director, Financial Services Equity Research, U.S. at RBC Capital Markets, authored the research report “2021 U.S. Banks Outlook: Are We There Yet?” published on December 17, 2020. For more information, please contact your RBC sales representative.