This month, our experts discuss the rise of the China asset class in two parts: Firstly, in an audio recording with Daniel Rico and Alvin Tan, they discuss the growing global interest in Chinese financial assets and the domestic policy issues that has sparked. Secondly, our Asia FX Analyst Alvin Tan expands on the topic of foreign investor interest in Chinese assets and its drivers.

What do you think is the main benefit for investors to think of China as an asset class?

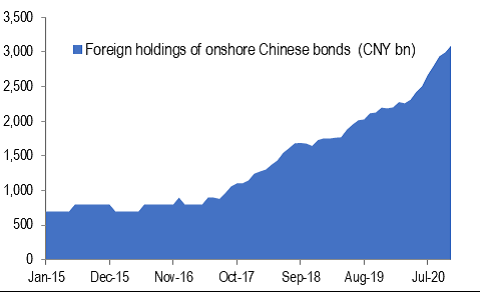

Global investors have indeed shown growing interest in Chinese financial assets. For example, it is striking that foreign holdings of onshore Chinese bonds doubled in US dollar terms between mid-2018 and the end of 2020. This happened in the midst of the growing geopolitical rivalry between the US and China, and the trade war. This growing foreign interest grew out of a combination of increased Chinese opening of the domestic financial markets to foreign investors, and also the latter’s interest in Chinese assets in a world of low or negative bond yields. Institutional investors also find the liquidity in Chinese financial assets attractive compared to many other smaller emerging markets. Moreover, Chinese fixed income securities provide strong diversification benefits, given their low correlations to both developed market equities and bonds. And it is in this diversification potential that Chinese bonds could develop into a separate asset class from EM bonds.

The Chinese Renminbi, is one of the best performing currencies in the last 12 month, despite COVID-19, and economic slowdown. Clearly portfolio flows have been an important factor for the recent performance. How do you think this is will play out moving forward?

The growing interest in Chinese assets is a fundamental tailwind for the renminbi, which is a topic we have discussed previously. That said, there is also growing concern among some Chinese policymakers of the dangers of large sustained foreign capital inflows on domestic financial stability. The lessons of the 1997 Asian financial crisis are still relevant in this regard. While Beijing has endorsed capital account liberalization, the capital account remains heavily restricted due to fears of capital flight. This imbalance could become problematic as capital inflows accelerate, while outlets for domestic capital remain more limited. Outflow channels were in fact tightened in 2016 through 2017 when there was a surge of outflows. More recently, the scaling back of the Belt-and-Road Initiative has curtailed another major capital outflow channel.

The interest from Beijing to increase the renminbi internationalization but keep a tight control of who participating in the local markets, seems contradictory. What direction, do you think policy makers will take moving forward?

China faces troublesome contradictions between (1) a growing openness to foreign participation in its financial markets, (2) a desire to further renminbi internationalization, and (3) its unwillingness to relinquish control of the capital account and the exchange rate. So Beijing is trying to juggle these three balls in the air. At some point, a more decisive policy direction will need to be taken, but there doesn’t appear to be a consensus at this point. So the juggling will persist. In the interim, the growing capital inflows into China’s financial markets will continue to exert upward pressure on the renminbi, not least because the outflow channels remain limited, but the authorities will also continue to lean against the speed of the appreciation. So a further rise is expected, but not at the speed we saw last year.

The rise of the China asset class

By Alvin T. Tan, Asia FX Strategist, RBC Capital Markets

Royal Bank of Canada, Hong Kong Branch

Foreign investor interest in Chinese financial assets has accelerated as China liberalizes its financial markets. Alvin T. Tan, Asia FX Strategist, RBC Capital Markets, explains the factors influencing this trend in a report published on December 17, 2020.

Global institutional interest in Chinese financial assets has grown significantly in recent years. This is a consequence of two key factors:

1.The liberalization of China’s financial markets, driven by a desire to shift a traditionally bank-dominated financial system towards one where capital markets play a larger role. Related to this is a push to raise the sophistication of the financial system through greater foreign participation.

Source: Bond Connect, RBC Capital Markets

2.Increased market access has been embraced by foreign investors who find compelling expected returns in Chinese assets, amid a world of low-to-negative yields in developed markets and limited liquidity in smaller emerging markets.

Foreign investor interest in China remains high

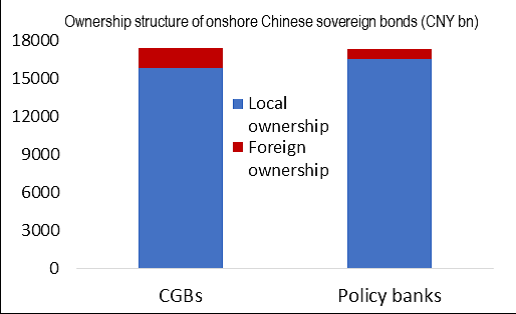

Despite the growing US-China rivalry and the pandemic-driven global economic crisis, it’s remarkable to see that foreign investor interest in China’s financial markets remains high across equities and bonds. This is clear when we track the growth of foreign holdings of onshore Chinese bonds, which have doubled since mid-2018 by US$230bn at current exchange rates. This interest is mostly focused on Chinese government (CGBs) and policy bank bonds that together comprise 37% of the Chinese onshore bond market. Nonetheless, the foreign holdings of these sovereign bonds remain relatively low, at less than 10% of outstanding CGBs and 5% of policy bank bonds.

Source: Reuters, RBC Capital Markets

Why the rising interest in Chinese bonds?

Foreign investors are interested in Chinese bonds for two main reasons: Firstly, they offer good yields. China’s single A-rated sovereign debt offers an attractive yield around 3% with core inflation at 0.5%. However, the more important fundamental reason is the huge diversification benefits provided by Chinese debt securities, and it is in this that Chinese bonds have the potential to be a new global asset class separate from other EM bonds.

We found that Chinese bonds have very low correlations to both developed market equities and fixed income, and one factor is because the Chinese debt market has only started to be liberalized. The correlations will gradually rise over time as the liberalization proceeds and the Chinese market becomes more integrated with global markets, but this is likely to be a long-term process. The other factor is a somewhat different economic and policy cycle in China relative to the developed economies.

In the interim, the recent sizeable foreign capital inflows into Chinese financial markets are likely to be sustained amid a global economic recovery. This will bolster China’s already positive external balance, and add to the appreciation pressures on the Chinese yuan.

“Interest in fixed income is mostly focused on Chinese government (CGBs) and policy bank bonds that together comprise 37% of the Chinese onshore bond market.”- Alvin T. Tan, Asia FX Strategist, RBC Capital Markets

Alvin T. Tan authored “The rise of the China asset class” published on December 17, 2020. For more information about the full report, please contact your RBC Capital Markets representative.