In this report, our EM FX Strategists discuss the impact of local yield curve shapes on EM FX vs USD in light of the rise in US yields this year.

Key takeaways

The fast rise of US rates created unexpected consequences for EM yield curves

We expect that investors will continue to seek diversification in EM Asia, and that EM economies with more stable fiscal outlooks are likely to outperform in the medium-term

A bear steepening of an EM local curve coincides with EM FX depreciation vs USD

A widening in the spread between EM1s10s and US1s10s coincides with a weaker EM FX against USD and vice versa

EM FX is likely to depreciate against the USD in scenarios where both the US & EM curves bear steepen or the US curve bear steepens by more than the EM curve bull steepens

Putting everything together...

The fast rise of US rates created unexpected consequences for EM yield curves and although not completely unpredicted, the speed of the move caught investors off guard and triggered the de-risking of negatively convex trades. As the global economy is expected to recover and inflation fears start to pop-up in many countries, we looked at the relationship of local rates vs US rates via outright spread differentials but also by the curve shape or the spread of spreads.

The recovery optimism in the US, boosted by new record increases in NFP, is driving expectations that US growth will rebound higher. At the same time, this will raise questions about an eventual Fed tapering. The combination of steeper curves in DM & EM will present a hurdle for a sustainable EM FX outperformance vs USD as steeper DM yield curves mechanically imply that EM local assets will have to carry a larger risk premia.

Winners and losers…

While we expect that investors will continue to seek diversification in EM Asia and remain market-weight or even underweight high beta EMs, we also expect that EM economies with more stable fiscal outlooks (e.g. MXN, CLP, PEN) are likely to outperform in the medium-term as they would be the prime candidates for bull flattening and duration becoming more attractive (with all else equal – i.e. US spread stable). Meanwhile, countries with higher fiscal risks (e.g. BRL, COP, ZAR) are likely to have steeper curves relative to those with better fiscal outlooks.

A bear steepening of an EM local curve coincides with EM FX depreciation vs USD…

Based on our analysis, EM FX tends to depreciate against the USD when the local yield curve bear steepens and appreciate when the curve bull flattens.

One reason why EM FX weakens against USD when the local EM curves bear steepen is that the long-end yields rise to price in the deterioration in fiscal dynamics as investors require more compensation for the higher risk (e.g. ZAR or BRL) and reduce duration risk.

On the flipside, it makes sense that EM FX appreciates vs USD when the local yield curve bull flattens as the long-end yields are falling faster than the short-end yields and this may be a function of an improving fiscal outlook and higher demand for long duration trades.

…but it also matters how the local curve moves relative to that of the rest of the world.

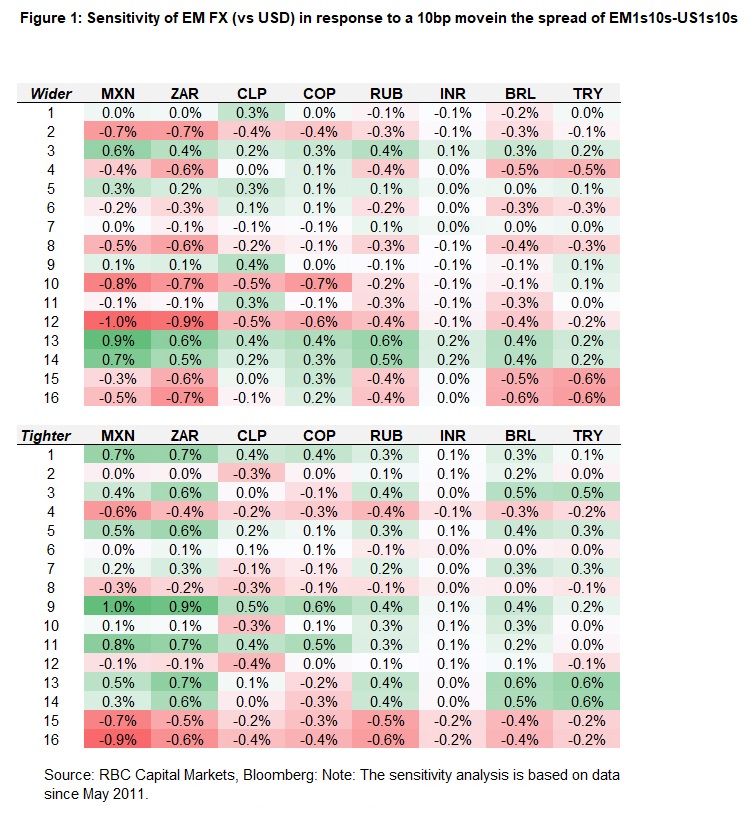

An analysis looking at the impact of changes in the spread of spreads between EM1s10s and US1s10s yield curves on EM FX vs USD shows that a widening in the spread between EM1s10s and US1s10s (e.g. EM curve steepens more than the US curve) coincides with a weaker EM FX against USD and vice versa.

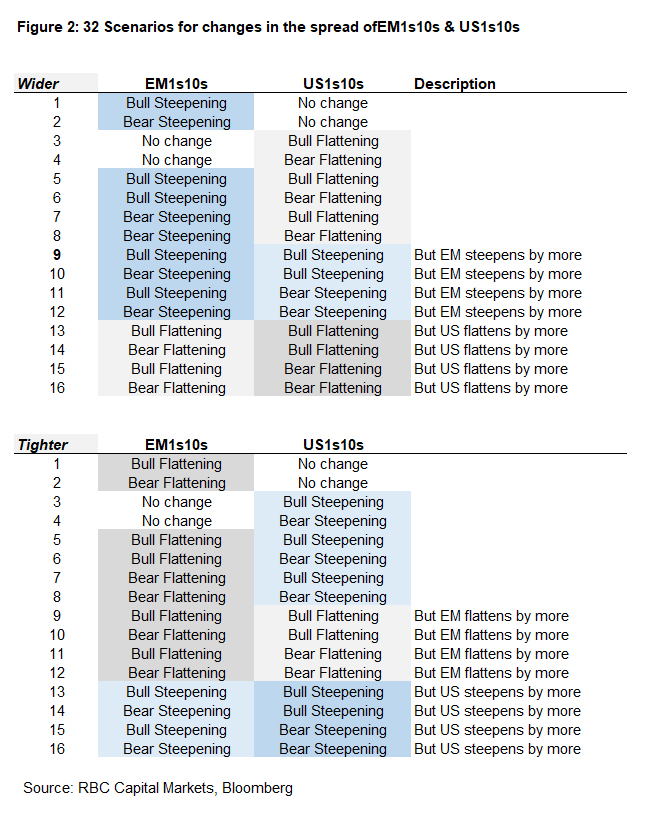

Does it matter if it is the long-end or short-end of the local or US rates driving the relative differences?

Yes, we ran a sensitivity analysis looking at 32 scenarios in how the independent variables (long/short-end local or US rates) may cause the spread of spreads to move +/-10bps and calculated the EM FX sensitivity to these shocks. Overall, the results suggest that EM FX is likely to depreciate against the USD in scenarios where both the US and EM curves bear steepen (doesn’t matter which one steepens more) or the US curve bear steepens by more than the EM curve bull steepens.