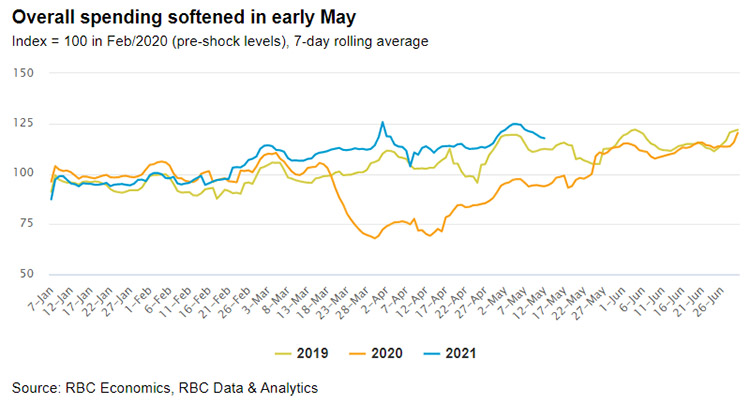

- Overall retail spending edged lower again in May – controlling for ‘normal’ seasonal movements – but held above pre-pandemic levels. Spending on retail merchandise is tracking lower (4% in May to-date) but still resilient compared to last year’s collapse.

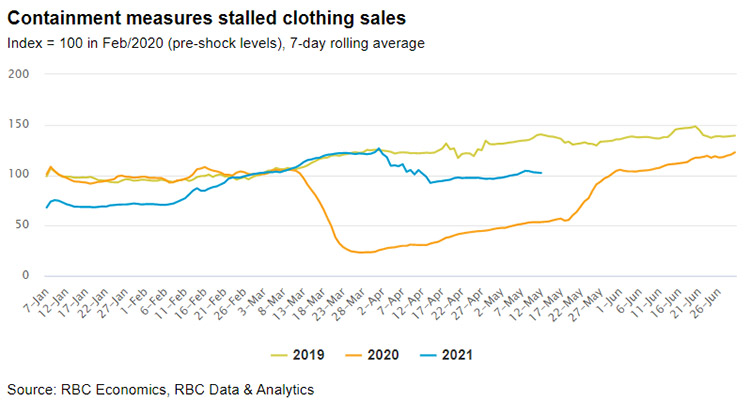

- COVID sensitive spending remained anemic amid continued restrictions.

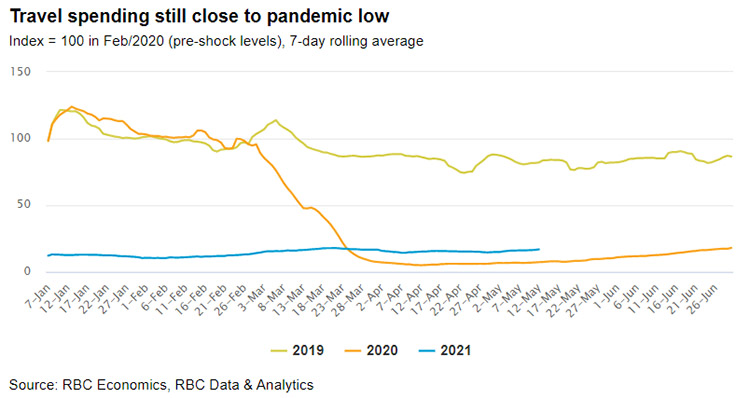

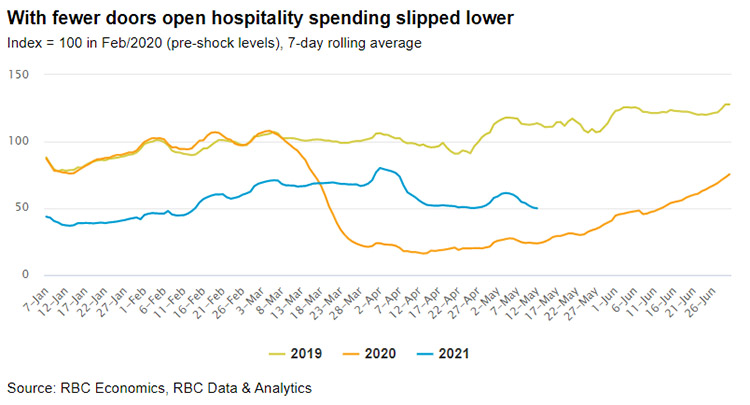

- Spending in travel and hospitality sectors still exceptionally weak.

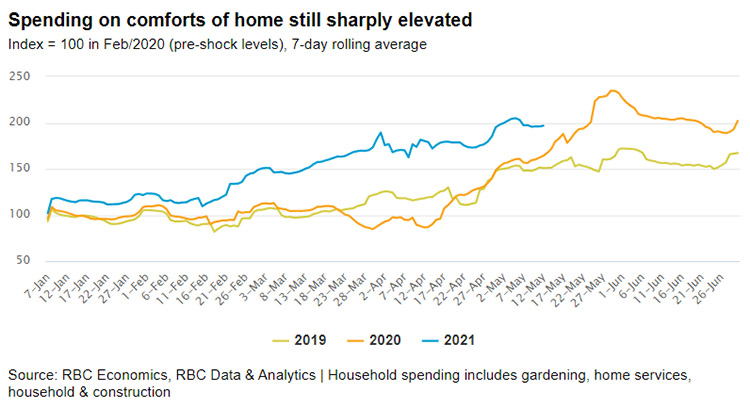

- Household spending still expected to surge as virus containment measures ease.

To view past reports, please visit the COVID Consumer Spending Tracker.

RBC’s consumer spending tracking report uses RBC Data & Analytics’ proprietary database of anonymized card transactions by Canadian clients. The data are an accounting of merchant transactions that are divided into various spending categories covering tens of millions of weekly card transactions worth billions of dollars each week. Transactions, both in person and online, are classified into 11 broad spending groups: Dining, Education, Finances, Groceries, Health, Household, Shopping, Transport, Travel, Utilities, and Other. Within each group, the data are further classified: for example, shopping covers merchants classified as clothing stores, hobby shops, electronics stores, and jewellers, among others. We exclude purely financial transactions such as cash advances and insurance from spending.

We examined changes in the value of all transactions in these areas using a 7 day rolling sample starting January 1st of each year that is indexed to pre-covid levels which are calculated as the average spending for the month of February 2020. To examine the impact of seasonal factors, we also show each’s year spending profile which depicts monthly trends in spending. Online spending volumes are estimated based on the presence of an RBC card at the time of the authorization. Protecting your privacy and safeguarding your personal information is a cornerstone of our organizational ethics and values and will always be one of our highest priorities. The underlying data for this analysis was aggregated based on transaction date, region and merchant category, and cannot be used to identify any individual client or merchant. For additional information please visit www.rbc.com/privacy.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.