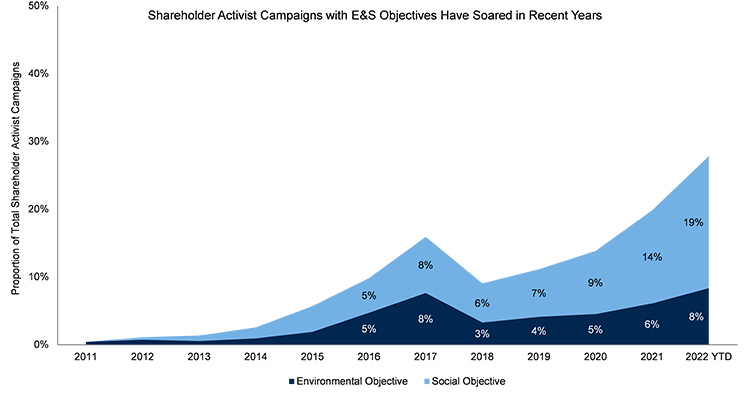

- Shareholder activist campaigns with environmental and social (E&S) objectives have accelerated over the past five years: between 2016 and 2021, activist campaigns with an environmental or social objective doubled as a proportion of campaigns overall

- The rise of E&S shareholder activism is driven by three major trends: widespread investor recognition of ESG as a fundamental driver of value creation, the rise of stakeholder capitalism, and an increased focus on socioeconomic inequality amplified by the COVID-19 pandemic

- RBC Capital Markets partners with our clients to help them navigate a changing global environment and to provide solutions, insights, and advisory services on best practices in ESG integration across corporate strategy, disclosure, and investor engagement

Environmental & Social Objectives Feature Prominently in Recent Shareholder Activist Campaigns

Shareholder activism can be understood as a spectrum of activities that a publicly traded company’s shareholders can undertake with the objective of prompting change within the company. Activities can take a variety of forms, from proxy contests to shareholder resolutions, and span a range of financial, strategic, and sustainability-focused objectives. While activist shareholders have long focused on governance topics such as board composition and executive remuneration, campaigns championing specific environmental and social objectives have soared in recent years. Between 2016 and 2021, campaigns with an “E” or “S” objective doubled as a proportion of all campaigns, from 10% to 20%.(1) Institutional investors are increasingly demonstrating a heightened focus on transparency and accountability through detailed reporting on stewardship efforts, and in 2021, cast 40% of their voted shares in favor of environmental and social proposals, the highest level in at least five years.(2)

Source: S&P Capital IQ, April 2022.

Recent shareholder engagement during the 2022 proxy season reflects growing pressure from investors on public companies to enhance both their disclosure and performance on E&S matters. Early data suggests a marked focus this year on topics related to climate change and emission reduction targets, diversity and inclusion, and human rights. This edition of Sustainability Matters explores the rise of environmental and social objectives in shareholder activism, discusses key growth drivers, and shares an outlook for important themes that we expect to emerge in the future.

Climate Change and Human Capital Emerging as Central E&S Campaign Objectives

In late 2020, a small hedge fund called Engine No 1 acquired a tiny (0.02%) stake in ExxonMobil and launched a proxy contest to overhaul the company’s board, arguing that the oil major faced an “existential business risk” and that its financial underperformance and approach to climate were intertwined.(3) Engine No 1’s campaign gained support from large institutional shareholders and prevailed, winning three seats on Exxon’s board with a mandate to position the company for the transition to a low-carbon economy.(4) The hedge fund’s success was a watershed moment in demonstrating how a shareholder with a relatively small equity stake can clearly articulate the linkages between climate risk and financial risk, capitalize on the support of large institutional investors, and effect strategic change.

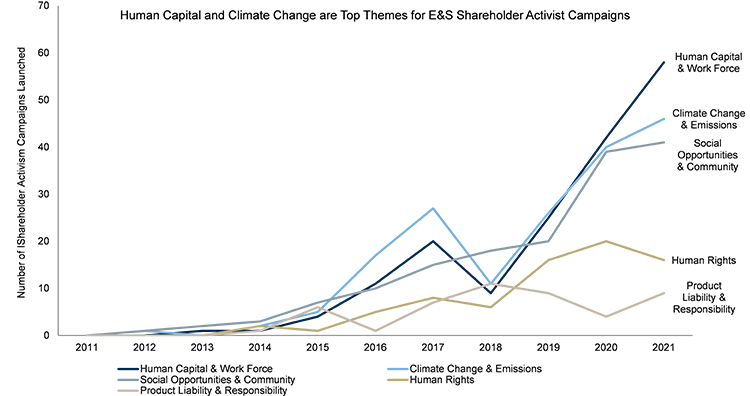

Campaigns focused on the themes of climate change and human capital have experienced some of the fastest growth among E&S shareholder activism campaigns in recent years. We see the rise of E&S shareholder activism as driven by three major trends:

- Investors increasingly recognize the connection between the effective integration of material ESG factors in a company’s strategy and operations and enhanced business resilience, competitive positioning, and financial performance. The world’s largest institutional investors have articulated their conviction in the potential of ESG to create value and increase the sustainability of corporates and markets more broadly.

- The shift towards stakeholder capitalism has brought the concept of long-term value creation to the forefront and drawn increased investor attention to the impact of social and environmental externalities on a wider group of stakeholders. With a long-term focus on customers, employees, communities, suppliers, and shareholders, the stakeholder-centric model represents an important departure from the theory of shareholder primacy by introducing a broader and more inclusive approach to value creation.

- The COVID-19 pandemic shone a spotlight on the role of social factors, such as human capital management, access to healthcare, and diversity, equity, and inclusion, as important levers of value creation and, if improperly managed, value destruction. The pandemic further reinforced the position of employees as a critical stakeholder group and provided investors with new data points to challenge companies on their performance and treatment of workers.

Source: S&P Capital IQ, April 2022.

E&S Shareholder Activism Trends on the Horizon

Looking ahead, we see a number of key trends that we anticipate will shape the future of shareholder activism focused on E&S objectives. The conflict sparked by the invasion of Ukraine brought the concept of corporate geopolitical responsibility to the forefront and is expected to be a focal point of discussion at many annual general meetings (AGMs) this year. Going forward, we anticipate that corporates, particularly those with operations or supply chains spanning fragile or conflict-affected regions, will increasingly articulate their commitment and efforts to defend human rights, navigate supply chain disruptions, and, where material, manage energy security concerns, across internal strategic planning and stakeholder-facing disclosures.

We anticipate climate to continue to ramp up in focus as investors call on companies to disclose credible, action-oriented plans to support a pathway toward achieving greenhouse gas (GHG) emission reduction targets. In our ESG Themes for 2022 report published earlier this year, we highlighted growing stakeholder expectations for corporates to disclose decision-useful information on corporate transition plans to achieve climate commitments. We anticipate investor expectations on climate to increase in terms of corporate disclosures on the tangible, tactical actions required to achieve both interim and long-term climate goals.

Looking ahead, we expect the complex social issues brought to light by the COVID-19 pandemic to remain an important area of focus for investors. Issues related to human capital continue to be acknowledged as financially material for a wide swath of industries; the Value Reporting Foundation, part of the recently-established International Sustainability Standards Board (ISSB), is completing a research project to assess the scope and prevalence of cross-cutting human capital management themes across 77 industries with a view to advancing to a standard-setting phase.(5) With social issues accounting for four of the top five themes for E&S shareholder activism campaigns in 2021, we anticipate that shareholder campaign objectives related to social risks and opportunities will continue to emerge as increasingly meaningful for years to come.

Closing Thoughts

The ongoing COVID-19 pandemic, geopolitical tensions, and overarching societal inequalities continue to shape the rapidly changing global landscape in which our clients operate. Corporates are faced with choices in terms of how best to provide transparency and accountability in an environment where investor attention to ESG performance has never been greater. RBC Capital Markets partners with our clients to help them navigate a changing global environment and to provide solutions, insights, and advisory services on best practices in ESG integration across corporate strategy, disclosures, and investor engagement.

(1) S&P Capital IQ, April 2022.

(2) https://corpgov.law.harvard.edu/2022/03/14/2022-proxy-season-preview/

(3) https://www.ft.com/content/5ab010de-43c8-4b60-80f2-020f01610eee

(4) https://knowledge.wharton.upenn.edu/article/engine-no-1s-victory-wake-up-call-for-exxonmobil-and-others/

(5) https://www.sasb.org/standards/process/active-projects/human-capital/