RBC Capital Markets Government Finance team was pleased to facilitate three separate virtual Canadian Public Sector Debt Issuance roundtable discussions in early December 2022 again. Similar to past years, participants included representatives from the Canadian Federal Government, federal agencies, provincial issuers, non-agent crown issuers, municipal issuers, offshore SSA maple issuers, and institutional investors.

The discussions focused on the current economic environment in Canada, trends in borrowing by public sector issuers in 2022 and expectations for 2023, and ESG themes as these market participants continue to navigate the pandemic recovery and the challenges associated with the central bank rate hikes. This publication summarizes these conversations along with key insights and takeaways from issuers and investors in the Canadian public sector. We thank all the participants who dedicated the time to share their views and experiences.

Public Sector Issuers Roundtable Report

1. Strong Growth in 2022 Gives Way to Uncertain Outlook for 2023

Canada emerged from the pandemic with strong economic growth. The positive momentum supported an improvement in Provincial revenues through the year, which allowed many Provinces to revise their fiscal deficit estimates significantly lower than originally forecasted, with many Provinces reporting surpluses. However, elevated inflation, geopolitical concerns and high interest rates represent headwinds to future growth and will be top of mind as the Provinces prepare their 2023 budgets and consider the need for additional fiscal cushioning in the event of an economic slowdown or recession scenario.

2. Inflation

The effects of higher inflation are being felt on the capital investment side by the Canadian provinces due to increases in materials costs and labour shortages. However, the prudent budgeting processes for many provinces allow for fiscal contingencies to help offset the financial blow of rising inflation.

3. Interest Rates

The focus of monetary policy in Canada is expected to shift from a question of ‘how much higher will rates go?’ to ‘how much longer will central banks keep rates at higher levels?’

4. Higher Cost of Debt Has Been Manageable

Issuers noted that they are not yet concerned about the impact of rising debt servicing costs; with many noting that interest rates and debt servicing costs remain low from a historical perspective.

5. Housing Affordability Challenges

There are cyclical factors and structural factors that are currently working in different directions within the housing market and are expected to continue through 2023. Higher interest rates drove a significant increase in Canadian mortgage rates in 2022 resulting in a spike in home ownership costs. Affordability was also negatively affected by a significant housing supply shortage across the country. Cyclical economic factors are looking weaker, which poses the potential for downside risks to the housing market in 2023.

6. Increase in ESG Issuance

Canadian public sector ESG issuance volumes reached a record high in 2022, notably with the Government of Canada’s inaugural C$5 billion Green bond providing a boost to the Canadian ESG market. While Ontario and Quebec continue to lead the provincial green bond issuance space, there has been a surge in ESG activity from pension asset managers this year. Provinces who have not yet issued an ESG bond emphasized that they would like to eventually embed ESG into all their programs, and are mindful of the impacts of labeled ESG issuance on the overall liquidity in their conventional financing activities.

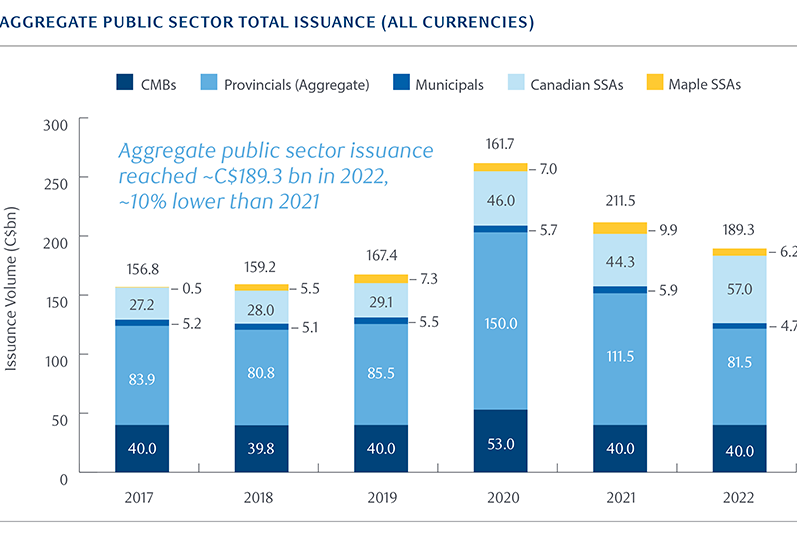

7. Overall Issuance Levels Expected to be Steady in 2023

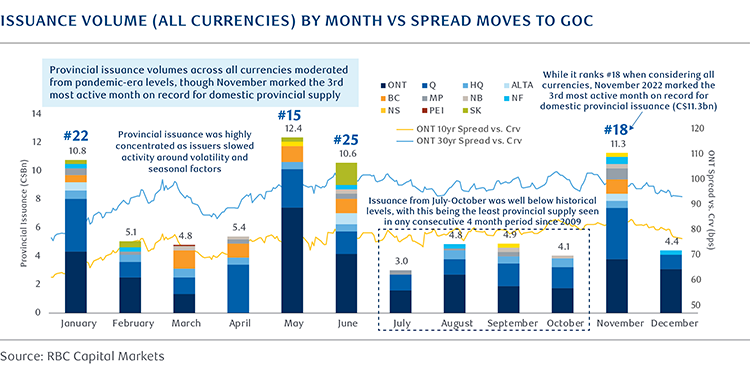

Bond issuance by the Canadian provinces returned to pre-pandemic pace in 2022. The domestic market absorbed much more of the total provincial new issue supply then in prior years and issuers commented that it was more difficult to find favourable issuance conditions in the latter half of the year. Pension asset managers are increasingly active issuers in the Canadian market and are working towards a more provincial-like issuance pattern. The outlook for debt issuance by the Canadian public sector in 2023 is expected to be similar to the volume seen in 2022 as the provinces balance improving revenue growth against of the impacts of higher expense growth and the potential for an economic downturn.

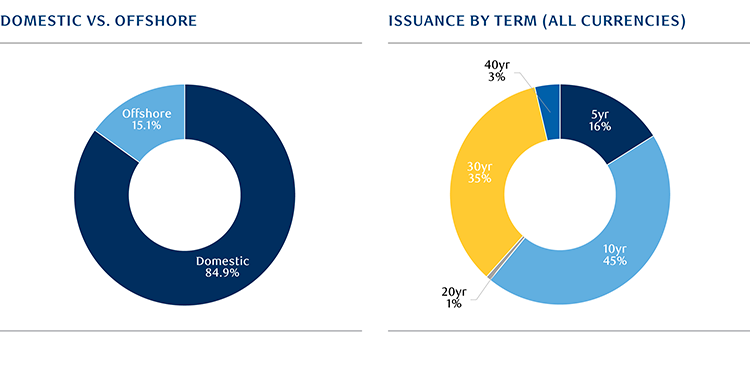

8. International Market Dependent on Relative Financing Opportunities

There was a significant decrease in offshore market issuance for the Canadian public sector in 2022, as relative financing opportunities were not as robust as issuers had hoped. The Provinces noted that they are still committed to issuing in international markets to diversify their funding base and will continue to actively monitor relative financing levels for offshore issuance opportunities in 2023.

Source: RBC Capital Markets

SSA Maple Roundtable Report

1. Funding Programs Normalized with Increased Private Placement Activity

SSA Funding requirements continue to normalize from 2020 peaks as the demand for COVID-related funding eased. At the same time, they faced more challenging conditions given the volatile market backdrop amid series of economic data releases and central bank rate hikes. Attractive funding conditions in the EUR market through most of the year took the pressure off key markets such as USD. Most issuers saw an uptick in private placement activity – much of it driven by interest in ESG themed issuance.

2. Currency Selection, Market Volatility and Investor Demand

Navigating a volatile market backdrop in 2022, SSA issuers tended to rely on their home currencies for at least 50% of their funding. While currency diversification remains a common goal, the final currency mix of SSA issuers’ funding programmes were ultimately determined by investor demand as well as cost of funds. In addition, more challenging execution conditions and timing constraints around central bank events and economic data releases made for narrower and more crowded issuance windows. Issuers generally expect EUR to continue to offer attractive opportunities in 2023 but also expressed interest in maintaining a presence in USD as well as other currencies such as AUD, CAD, GBP and NOK.

3. ESG Framework Standardization

2022 marked a successful year in thematic bond supply with SSA issuers diverging from the traditional Green projects to a wider range of themes such as gender, biodiversity, blue, and health. SSA issuers further embedded ESG initiatives to areas beyond bond origination by increasing their ESG offerings to their own customers while incorporating a more systematic approach on data and reporting transparency. Market participants noted that ESG investors continue to grow in sophistication as is reflected in their ability to absorb data usability and other disclosure.

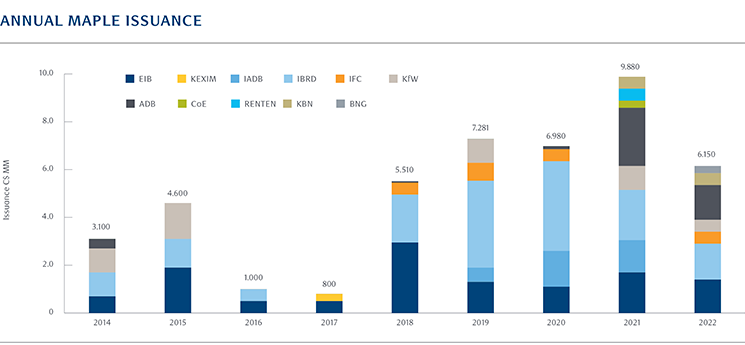

4. Maple SSA Issuance Moderated in 2022

Maple issuances totaled C$6 billion this year compared to the C$10 billion seen in 2021, however the breadth of ESG issuance has increased with 7 out of 8 offerings this year being a theme bond. Despite a strong desire on the part of SSA borrowers to access the CAD market, higher funding costs relative to other currencies and the comparatively short issuance windows this year resulted in lower CAD supply in 2022. Market participants remain optimistic that 2023 will offer more stable issuance windows, a broader selection of maturities, and continued growth of the investor base in CAD.

Source: RBC Capital Markets

Municipal Treasurers Roundtable Report

1. Cautious Outlook

Municipalities are approaching the 2023 budget planning process with higher inflation, interest rates, immigration and shelter program spending top of mind. Municipalities benefited from the economic rebound in Canada but are cautious about a recessionary environment in the upcoming year, as it could lead to higher operating costs to support social services, shelter systems and public health programs which could place more burden on municipalities.

2. Support from Federal and Provincial Levels of Government

Canadian municipalities had a significant amount of monetary assistance from the Federal and Provincial levels of government throughout the pandemic. These COVID related funding are likely starting to dial back in the upcoming year and municipalities with large transit systems who received extra support during the pandemic are anticipated to incur higher operating costs in 2023.

3. Transit

Municipalities with responsibility for transit saw an increase in ridership compared to last year, however not all saw a recovery back to pre-pandemic levels due to the new hybrid work environment. Regions with stickier ridership such as students have seen more of a bounce back. In addition, the volatility in the commodities market also had an adverse impact to the cost of transit this year, with some municipalities noting each cent of fluctuation in gas prices costs the municipality thousands of dollars. Transit operators will continue to experience headwinds based on what the “future of work” will look like, as well as unpredictable gas prices.

4. Interest Rates

A topic affecting individuals around the globe, municipalities noted that there are a few areas affected as a result of the higher rate environment. Firstly, there have been delays or pauses in housing development within cities due to higher interest rates, which is pushing housing and rental prices up on the back of Government of Canada’s target of half a million immigrants each year by 2025. Secondly, a recession will cast additional impacts on City services with higher expenses on subsidies, food banks and shelter systems, which would put pressure on municipality budget. Canadian municipalities are not permitted to budget for operating deficits and must plan to cover any unforeseen shortfalls in their operating budgets within a year.

5. Borrowing Programs

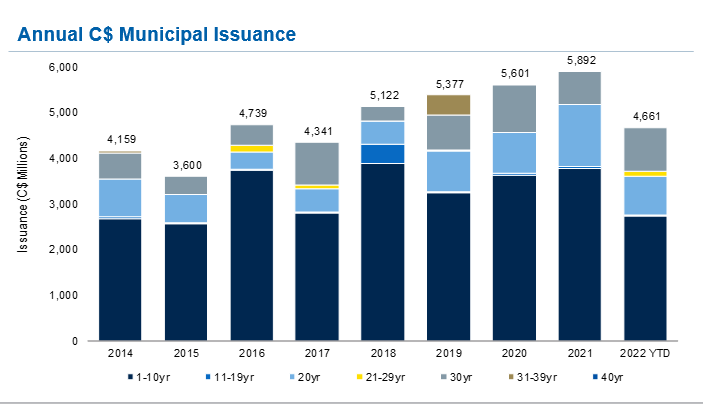

Canadian municipalities continue to offer investors attractive value relative to other government credits as local governments must balance their operating budgets. There was a total of C$4.4 billion in Canadian municipal issuance in 2022, moderating from the record high of C$5.9 billion in 2021. MFABC is expected to increase their funding needs in 2023 due to refinancing after a slightly lower 2022, and Toronto having increased their borrowing from C$1 billion to C$1.2 billion last year is expected to continue issuing similar terms next year. Issuers such as Region of York who remained on the sidelines in 2022 are expected to return to the market in 2023, and Region of Waterloo who have been a consistent issuer in the space will return to the market in spring as well. Large Canadian municipal issuers are expected to continue to focus on 10-year, 20-year, and 30-year bullet maturity issuance, while smaller municipal issuers are expected to issue via 1-10 year and 1-20 year serial debenture issuance.

6. ESG

The market continues to evolve with more issuers looking to update or create new ESG frameworks to include social use of proceeds in addition to green use of proceeds. The ESG performance report published by City of Toronto has served as a great example for other municipalities to follow in the coming years. Investors continue to show solid demand in ESG issuances and while it may be difficult to quantify the relative pricing benefit given volatile markets, it is clear that these labeled bonds have been very well oversubscribed allowing issuers to upsize their transactions.

Source: RBC Capital Markets

In addition, we encourage you to view the RBC Government Finance Public Sector Debt Market update that is published monthly. The December 2022 edition includes a year-end recap of issuance trends by the Canadian governments in 2022.

- Domestic issuance in 2022 totaled C$136.5 billion, represents a decrease of 2.3% from the C$139.7 billion seen in 2021, though remains well above issuance levels of the pre-pandemic years

- Supply in the municipal market (ex. Quebec) reached just C$4.7 billion during 2022, marking the lowest supply total for the market since 2017 when supply reached just C$4.3 billion

- Maple SSA supply ended the year at C$6.2 billion, down 37.8% from the record C$9.9 billion seen in 2021. Though supply declined on a year-on-year basis it remained relatively in line with the three year average from 2018-2020 (C$6.59 billion)

Government Finance Public Sector Debt Market update

Contact info:

RBCCM Government Finance

RBCCMGovernmentFinance@rbccm.com

416-842-7756