2022 – the accelerant towards tighter energy markets

Europe is facing a significant problem: the continent is short energy. RBC points out that data point to under-investment in new energy supply. Despite strong momentum in renewables, the absence of cheap Russian gas into Europe has led to a much tighter gas and power market, while also pulling on alternative sources of energy such as oil and gas. This has made it a challenging time for companies to deploy capital – despite commodity prices sending the required signals. Furthermore, supply chain issues and inflation are likely to make companies even more conservative. As a result, RBC expects a tight energy market will continue into 2023, translating into higher prices and sustained volatility.

Not all is lost

RBC believes the European energy majors have the willingness, available funding as well as the technical capabilities to help re-build the energy ecosystem over multiple time horizons:

- Today, short-cycle oil and gas investments could help plug the gap and reduce energy imports, particularly in Europe;

- LNG build outs need commitment on sales, and majors have a track record on both building out new capacity, as well as finding buyers for new gas; and

- Over the long term, the majors should continue to participate in accelerated renewables expansion across many geographies, while competitive pressures may fade if cheap capital becomes scarcer.

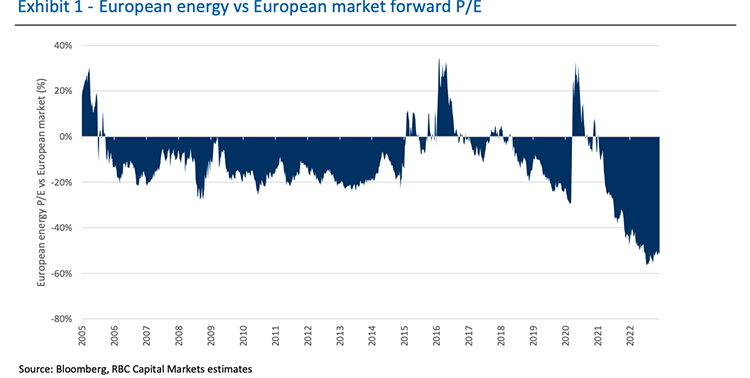

Time to (re)look at the transatlantic gap

RBC has been advising investors for most of 2022 to avoid the relative Euro vs US trade. European majors may look cheap, as windfall taxes, weaker economic outlook etc. could have driven flows away. In November, RBC argued that European names could rebound on a relative basis for several reasons, including strong potential for the European majors to present a narrative in early 2023 closer to their US counterparts, as the relative valuation gap is extreme (~25-year highs), as is the perception gap on the differing energy transition strategies. However, reality is closer, RBC reckons.

What to do when reaching buyback limits, debt is near zero...accelerate the strategy?

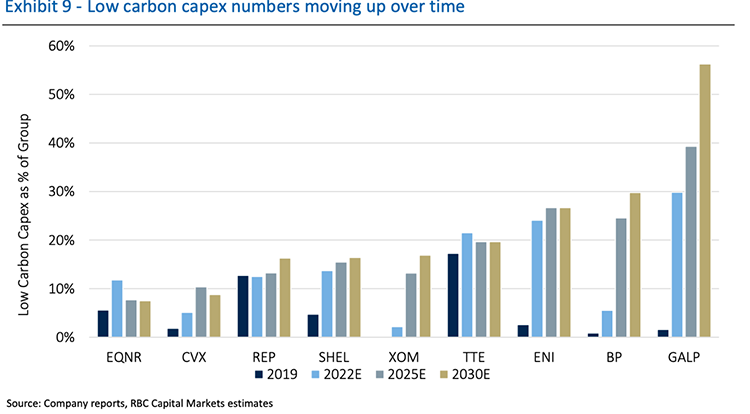

RBC’s energy analysts note that the majors seem to be maintaining discipline on capital spending and expects capex to rise 16% into 2023 - a mix between slightly higher activity, and inflationary pressures coming through.

In parallel, RBC estimates that the integrated energy names paid $130bn back to shareholders in 2022, split broadly 50/50 between dividends and buybacks and that it would be unwise for majors to aggressively increase base dividends, falling into the same trap of prior cycles. With net cash positions becoming more common, the next natural use of capital should grow the business or accelerate strategic plans. Given emissions frameworks with limitations on Scope 3 in particular, RBC believes large upstream acquisitions are difficult for European majors to execute but that the low carbon acquisitions seen recently could become more frequent.

Conclusion

RBC argues that amid the prospect of a much tighter global energy market going forwards across both oil and gas, the European majors look well placed to benefit not only today from higher prices, but over the medium term as they deploy capital to solve the energy shortage and drive the energy transition. Furthermore, valuations remain cheap relative to historical levels and compared to the wider market, earnings momentum looks resilient, while shareholder returns look set to remain at multi-year highs into next year.