Key points:

- Current strong credit metrics will begin to normalize but healthy levels of loan loss reserves and de-risked industry balance sheets will provide resilience.

- The Federal Reserve’s monetary tightening policy will continue to drive net interest revenue through 2023 ahead of the expected easing in 2024.

- Fee revenues should strengthen in the upcoming year although labor inflation and continued robust technology spending will exert pressure on the growth in non-interest expenses.

Potential for strong performance

Although the weakening economic environment will likely lead to mild recession, US bank revenues should continue to benefit from higher interest rates and better growth in fee revenue. Underlying asset quality means that banks should perform in a manner reminiscent of the 2000-2001 period rather than the scenario at the time of the 2008-2009 global financial crisis.

Clarity on credit quality

The critical issue for banks will be evaluating the severity of credit losses over the next 12-24 months. Credit remains unusually strong. Provisions will be supportive of growth and more stability in reserve levels as credit begins to normalize, though we expect a lift in delinquencies, NPAs and NCOs in 2023.

“Regulatory reform has broadly de-risked the industry’s balance sheet, making it more resilient.”- Gerrard Cassidy, RBC Analyst.

Regulatory reform in response to the 2008-09 financial crisis, resulting in higher levels of capital and liquidity along with more robust underwriting standards, has broadly de-risked the industry’s balance sheet, making it more resilient in the face of economic and financial challenges.

We continue to believe credit losses will increase in time but remain manageable and well below the heights of the prior downturn. While credit costs are likely to rise in 2023 to reflect this normalization and ongoing loan growth, we believe that favorable revenue dynamics are more than sufficient to offset this in 2023.

Impact of monetary policy and interest rates

The Federal Reserve’s monetary policy will have a significant effect on the banking industry. The Fed is increasing short-term interest rates and pursuing its Quantitative Tightening (QT) strategy, making it costlier for borrowers and reducing liquidity in the financial markets. However, that rise in short-term interest rates has dramatically increased the industry’s net interest revenue growth by lifting net interest margins.

“The Fed can begin to ease off its aggressive tightening stance in the coming months.”

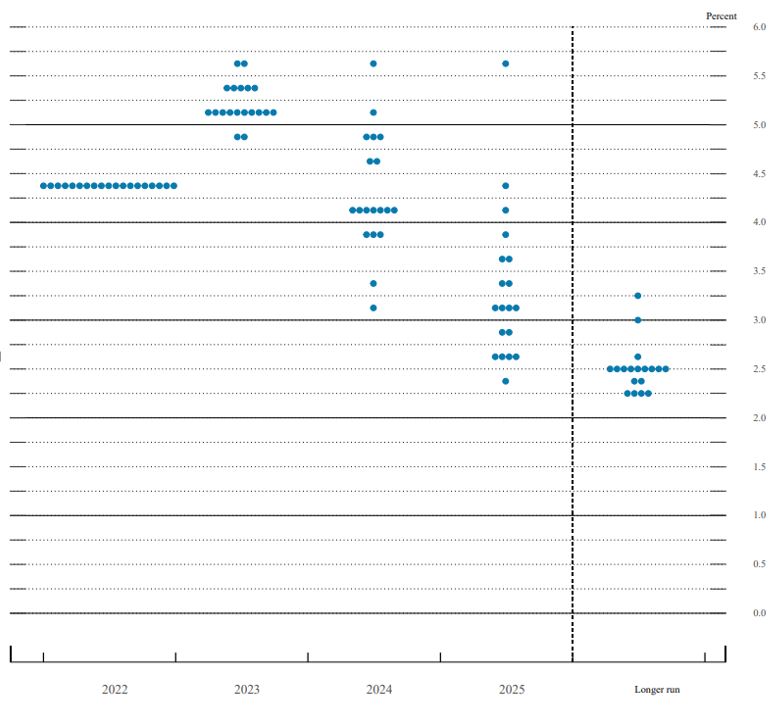

After raising the Federal Funds rate by 425-450 basis points (bps) since the first quarter of 2022 to combat elevated inflation, the Fed expects to continue to incrementally raise short-term rates in 2023, and potentially begin to cut rates in 2024 (See latest “dot plot” chart from the Federal Reserve on December 14th, 2022). Inflationary pressures are starting to ease suggesting the Fed can begin to back off its aggressive tightening stance in the coming months.

Exhibit 57 – Dot plot

Source: Federal Reserve Board (December 2022)

Our expectation is that the Fed reaches a terminal rate in the region of 5.00% to 5.50% in the first half of this year and takes no additional rate actions in the second half.

Fast forward on fees as loan growth slows

Total revenue growth in the banking industry in 2023 is likely to be similar to 2022 but the mix will change as net interest revenue growth slows and fee revenue increases in 2023. This expected slowdown, after the rapid margin expansion seen through most of 2022, will likely be due to a flat-to-lower net interest margin and decelerating loan growth.

Although loan demand also grew strongly in 2022, we are seeing signs of a slowdown to more modest levels across the consumer, mortgage and commercial categories. We expect fee revenues, however, to bounce back from the 2022 decline due to modest increases in capital markets, asset management, wealth management revenues and an increase in deposit and loan fees.

Higher wage pressures and ongoing heavy spending on technology and digital banking will increase non-interest expenses, but ongoing programs to further right-size branch networks will partially offset these expense challenges. The recent pandemic has accelerated shifts in consumer behavior and given management teams the confidence to further reduce their branch networks.

“The banking industry is entering 2023 with capital levels that can be supportive of returning shareholder’s capital and growth.”

The banking industry is entering 2023 with capital levels that can be supportive of returning shareholder’s capital and growth, while providing cushion if we do see more challenging economic conditions. We expect banks to take a more conservative approach to share repurchase activity, however, given the more mixed economic outlook and growth dynamics.

Gerard Cassidy authored “2023 U.S. Banks Outlook: Stiff Crosswinds,” published on December 8, 2022. For more information about the full report, please contact your RBC representative