An analyst's "sector" is the universe of companies for which the analyst provides research coverage. Accordingly, the rating assigned to a particular stock represents solely the analyst's view of how that stock will perform over the next 12 months relative to the analyst's sector average.

Ratings:

- Outperform (O)): Expected to materially outperform sector average over 12 months.

- Sector Perform (SP): Returns expected to be in line with sector average over 12 months.

- Underperform (U): Returns expected to be materially below sector average over 12 months.

- Restricted (R): RBC policy precludes certain types of communications, including an investment recommendation, when RBC is acting as an advisor in certain merger or other strategic transactions and in certain other circumstances.

- Not Rated (NR): The rating, price targets and estimates have been removed due to applicable legal, regulatory or policy constraints which may include when RBC Capital Markets is acting in an advisory capacity involving the company.

Risk Rating:

The Speculative risk rating reflects a security's lower level of financial or operating predictability, illiquid share trading volumes, high balance sheet leverage, or limited operating history that result in a higher expectation of financial and/or stock price volatility.

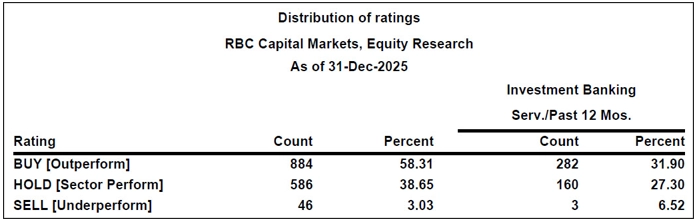

Distribution of ratings

For the purpose of ratings distributions, regulatory rules require member firms to assign ratings to one of three rating categories - Buy, Hold/Neutral, or Sell - regardless of a firm's own rating categories. Although RBC Capital Markets' ratings of Outperform (O), Sector Perform (SP), and Underperform (U) most closely correspond to Buy, Hold/Neutral and Sell, respectively, the meanings are not the same because our ratings are determined on a relative basis.