Iran - Dealbreaker?

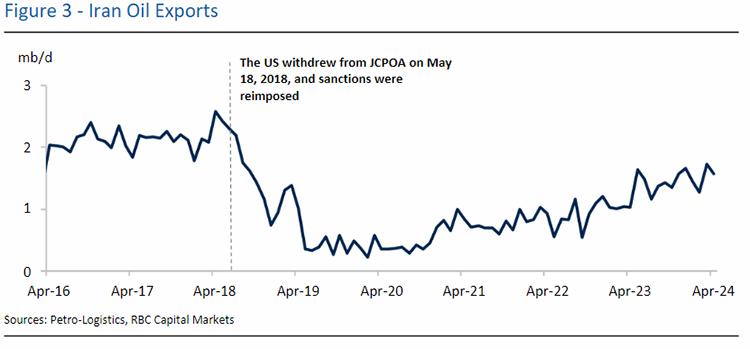

Iran seemingly represents one of the starkest foreign policy divergences that has oil market implications. On the 2020 campaign trail, Biden administration officials had signaled a strong willingness to reenter the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear agreement, noting that Iran had moved to the precipice of being a nuclear power after the Trump administration exited the landmark deal in 2018 and reimposed sanctions.

The expectation therefore was that a Biden victory would lead to the return of up to 1 million barrels per day (mb/d) of sanctioned Iranian oil. However, a revived JCPOA proved out of reach after the Supreme Leader balked at making major nuclear concessions without guarantees that sanctions relief would survive a change in the White House. And yet, a failure to formally resurrect JCPOA did not have negative impacts on Iranian oil exports, which were up more than 750 kb/d in April compared to when Biden took office.

Focused on keeping oil prices contained, White House officials have seemingly adopted a light touch sanction enforcement strategy to keep the market well supplied, even after October 7, when there has been heightened focused on the malign actions of Iran's regional proxies. With Iran having made further advances in its nuclear program—and some officials openly talking about obtaining weapons—would Biden try to revive JCPOA in a second term, maintain the unstable status quo, or rigorously enforce the sanctions to try to alter the regime's calculus?

The return of Trump would seem to herald a return to maximum pressure measures and a rigorous enforcement of energy sanctions. And yet, even the most well-placed Trump advisors concede that they would not look to remove large quantities of Iranian oil immediately unless they could get a backfill from the major Gulf producers to keep oil prices in check. They also readily admit that this could be a tall order given the lingering resentment over the way in which multiple American administrations have made energy asks of the Gulf producers.

Moreover, there's also an outlier view in Trump circles that the former president may look to make a deal with Tehran in order to reduce the need for a heavy security presence in the region. Those who subscribe to this minority view contend that former National Security Advisor John Bolton was acutely concerned that Trump would reach an agreement with Iran's then-Foreign Minister Javad Zarif at the 2019 UNGA meeting.

Gas - Hitting Play on LNG Exports?

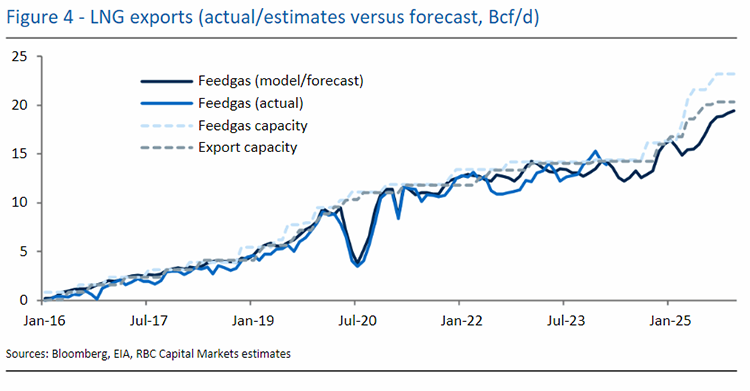

President Biden's decision to suspend LNG permitting approvals proved to be divisive with the oil and gas industry, and it is unclear at the time of writing whether it will garner him additional support from progressives and young voters. While the pause on non-Free Trade Agreement (non-FTA) LNG export approvals does have implications for projects that otherwise would have reached Final Investment Decision (FID) this year, there are a whole host of projects currently under construction and planned to come online before the end of 2028 that are unaffected by the pause and thus should be coming online regardless.

This means that from current peak capacity of over 14 billion cubic feet per day (Bcf/d), Corpus Christi Stage 3, Plaquemines, and Golden Pass will push that number to 21 Bcf/d before the end of 2026. Then Port Arthur and Rio Grande LNG should come online over the following two years and push total peak export capacity above 25 Bcf/d before the end of 2028. This puts any implications from the current ban in the 2029-30 period (when projects that might have reached FID this year could target as start dates). By that point, the US will have increased export capacity by nearly 80% versus today's level. In any case, the pause will likely be lifted or canceled by this time next year, independent of the election outcome.

If Trump were to win the election, it seems fair to assume that this pause will simply be canceled. But in another Biden administration, the pause could very well be behind us, as Energy Secretary Granholm said in March that the pause would be lifted within a year. In that scenario we'd expect to see approvals resume, albeit possibly with an added climate-related hurdle included in the public interest analysis. We remind readers that even more projects are already approved (which could push the total to well above 40 Bcf/d), and even if most of those do not eventually come online, other projects will likely make progress in 2025 and beyond, adding to total export capacity on top of the 25 Bcf/d currently under construction.

While the US balance has the resources to supply current and further export growth, by 2030 the policy debate around the appropriate total export capacity may be in the limelight. Regardless, while the pause could have project-specific and timeline-specific implications, we would find slipping construction timelines for current projects more worrisome. Moreover, we still do not know whether climate pragmatists or idealists would be ascendant in a second Biden administration.

Inflation Reduction Act - Repeal Realities

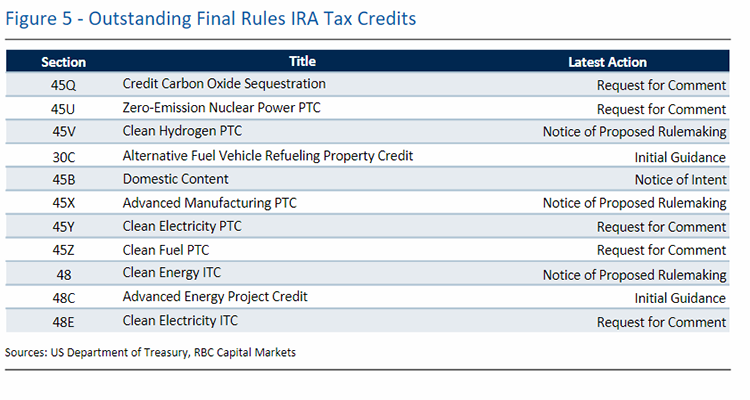

In Congress and on the campaign trail, Republicans have been calling for a repeal of the IRA and the billions in clean energy funding within the legislation. The IRA is protected from being repealed solely through executive order, as it was passed through Congress, yet the President still has authority to contour the framework of the law through executive agencies (Treasury, DOE, EPA) to make tax credits more difficult to access, freeze any unallocated money, or revise unfinalized rules.

From our conversations around the G7 Ministerial Meeting in April, stymying wind development in particular could be high up on the Trump agenda, possibly stalled through inaction on the 45Y/48E Clean Energy Investment Tax Credit (ITC)/Production Tax Credit (PTC) set to come into effect January 2025. Of the $145 billion in direct agency spending provided in the IRA, only 41% has been awarded.

Any unallocated funds may be paused indefinitely under a Trump administration, even those that have been announced. The Biden administration is rushing to finalize rules for outstanding tax credits and disperse billions in grants and loans by the end of June to protect it from the Congressional Review Act (CRA).

If Republicans take control of the White House and both chambers of Congress, they could use the CRA to quickly void rules promulgated by federal agencies or repeal aspects of the IRA through a simple majority. A divided Congress would make a partial or full repeal difficult, providing a safeguard to Biden's keystone climate legislation.

Helima Croft authored “Beyond the Ballot: Overtaken by Events Energy Issues and People to Watch Ahead of the 2024 Election,” published on May 15, 2024. For more information on the full report, please contact your RBC representative.