The White House is fanning out its senior diplomats across the Middle East in a last-ditch effort to limit the scope of the impending Iran/Hezbollah military action to less than or equal to what occurred in April.

In that case, Iranian officials telegraphed the Israel strikes in advance to US regional allies, which in turn gave the US time to assemble a multinational air defense coalition. Despite over 300 rockets being fired, there was minimal damage, and the Israeli counterstrike was also designed to avert a wider regional conflict.

There is still a prevailing view in Washington that Iran does not want a regional war, preferring a grey-zone, proxy conflict.

The new Iranian president also continues to signal a desire to revive the JCPOA nuclear talks in order to secure sanction relief from the West; a full- blown conflict, in turn, would undermine that key economic goal. In addition, the ongoing Gaza ceasefire talks may have delayed the military response to the Israeli strikes in Lebanon and Tehran, as Iranian officials have signaled that the scope of their retaliation could be impacted by the scope of those negotiations.

Nonetheless, the White House containment effort may prove more challenging than in April. With a broader Gaza deal still proving elusive, the prospect of delaying a military response beyond this week seems precarious.

Moreover, the White House now has to contend with a coordinated Hezbollah/IRGC strike and hardliners in both groups may be pushing for a more material response than what transpired in April, such as a direct strike on military and intelligence facilities in places like Tel Aviv and Haifa.

Calibrating a shock-and-awe military response that falls short of a regional war could be a tough needle to thread for Hezbollah and IRGC strategists.

Israeli Prime Minister Netanyahu has already vowed a ferocious response to any strike that results in casualties or significant structural damage. Certainly, there are officials in Israel pushing for a military operation to move Hezbollah off the border and help enable the return of 60,000 internally displaced Israelis to the north of the country. It was our understanding that the preferred plan of action was to rest troops after the Gaza operation wound down before redeploying them to the northern border. However, depending on what the anticipated Iran/Hezbollah action looks like, these plans could be accelerated.

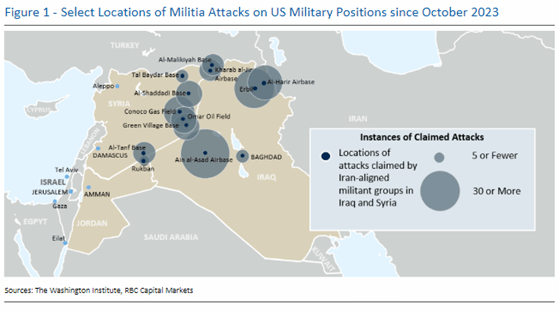

Another risk to the US containment strategy is the participation of other Axis of Resistance armed actors in Iraq, Syria and Yemen who could target not only Israeli assets, but US personnel in the region.

As we have indicated on multiple occasions, the redlines of the various players in this conflict may prove imperceptible, heightening the chances of an unintended escalation through miscalculation. We continue to see the main pathway to oil disruption running through direct Iranian involvement in the war. Israel could target Iranian oil facilities if a wider war does come to pass. At the same time, Iran could take a page from the 2019 playbook and once again target regional energy infrastructure to internationalize the cost of the conflict.

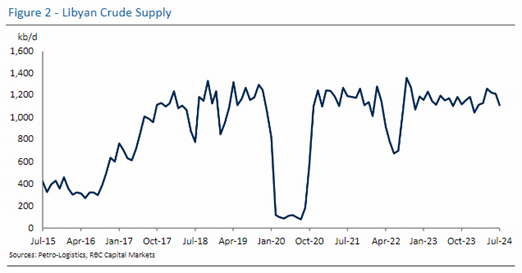

While Libya is not nearly as high on the priority list, Washington is still keeping an eye on the deteriorating security situation in the country.

In recent days, the UN, US, UK, France, and Algeria have all expressed concerns about General Khalifa Haftar’s troop deployment to the southwest of the country, fearing it could trigger another round of fighting with Tripoli-backed forces. Haftar maintains that the mobilization is necessary to deal with extremist groups and smuggling operations. However, other well-placed observers insist that the eastern militia leader is seeking to expand his Libyan National Army’s control over strategic assets close to the borders of Tunisia and Algeria, such as Ghadames airport.

Haftar has held Libyan oil production hostage on prior occasions to push his political, economic, and territorial claims, and there are indications that supplies could be imperiled once again.

The 270 kb/d Sharara Field, Libya’s largest, was completely shut down on Monday following gradual cuts the week before. The outage was initially attributed to a revival of the Fezzan communal protests. On closer inspection, Spain’s decision to issue an arrest warrant for Haftar’s son on weapons smuggling charges may have been a catalyst for the recent production problems, according to press reports. It goes without saying that any further breakdown in Libya would be exceedingly difficult for the White House to manage as it tries to contain the latest Israel/Hezbollah/Iran fire.

Helima Croft authored “Middle East Update: Last-Ditch Diplomacy,” published on August 13, 2024. For more information on the full report, please contact your RBC representative.