With less than a month before the presidential election, the White House is trying to shape the contours of the impending Israeli strike on Iran, in part to avoid an oil price shock, and leading Democrats to continue to call back to Obama’s “all of the above” energy strategy.

Despite coming into office with a strong climate action agenda, the Biden administration has prioritized keeping the oil market well supplied and retail gasoline prices contained.

To that end, it has avoided imposing sanction policies that would restrict the supply of oil on the market. For example, immediately after the Russian invasion of Ukraine, the White House carved out exemptions for energy transaction in its sweeping sanctions suite, and later crafted price controls to allow Russian barrels to continue to flow to Asia.

At the moment, the White House seems to be scrambling to prevent Israel from attacking Iran’s oil facilities in response to last week’s missile strikes.

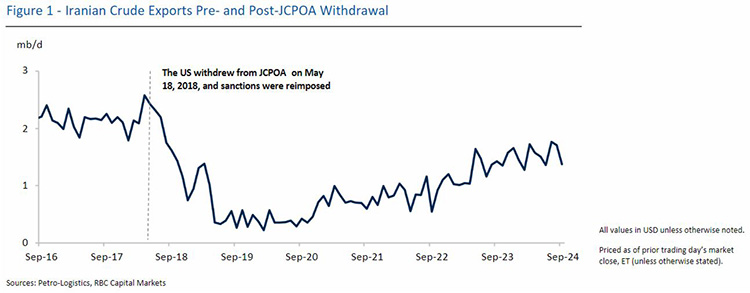

Today, the Office of Foreign Asset Control announced that it was sanctioning a number of shipping companies and trading houses involved in the Iran oil trade, including entities in the UAE, Hong Kong, and China. We see this move as likely designed with an eye to keep Israel from striking Iranian oil facilities, such as the export infrastructure on Kharg Island. However, it is not clear how much today’s action will move the needle. Trump-era maximum pressure policies remain in place, and stricter enforcement of existing secondary sanctions would appear critical for cutting off the Iranian oil cash flow. Oil exports have hovered near six-year highs for much of this year.

Even with the measures announced today, Prime Minister Netanyahu may judge that Washington is not sufficiently serious about restricting Iranian exports at this juncture.

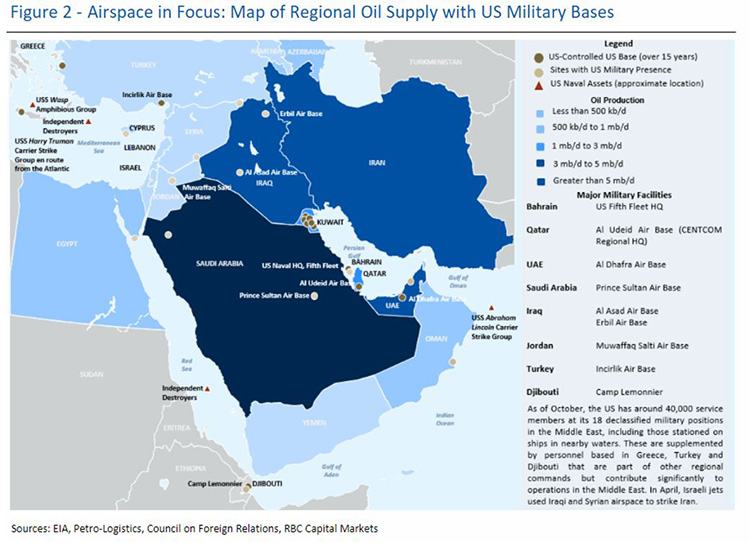

Hence, he may greenlight strikes on the Iranian oil infrastructure to close its ATM for the Axis of Resistance. While Washington was apparently able to influence Israel to opt for a more muted retaliation against Iran in April, its ability to shape the response may be more limited now. Moreover, even if Israel does focus exclusively on military sites, Iran could still respond by going after regional energy infrastructure to internationalize the cost of the war. It has already vowed to punish countries in the region that aid the Israeli response, including by providing overflight rights to Israeli warplanes.

There is an expectation in Washington that Israel will indeed launch a major strike that will cause substantial damage.

While administration officials hope that Iran will opt for a more calibrated counteraction to enable an offramp, the Iranian leadership is not expected to sit on its hands and do nothing. While some officials at UNGA indicated that the newly elected reformist President Pezeshkian was exercising a restraining influence on Supreme Leader Khamenei, the Iranian Revolutionary Guard apparently drove the decision to launch the missile strike and may hold considerable sway in the coming weeks. We also continue to highlight that the US election calendar may also influence Netanyahu’s war calculations, with American support potentially at its peak before the polls close on November 5.

We believe that there is a corner of the market that will hit the sell button on any sign that Israel is taking a pass on hitting Iranian oil facilities, and wind the clock back by several weeks.

We would caution that we may be entering the most dangerous retaliatory spiral of this one-year war, and the risk of a full regional confrontation will remain appreciably high, even if Kharg Island is spared in the next Israeli strike. Moreover, based on our conversations here, Israel apparently has a serious contingency plan on the books to inflict a devastating blow on Iran’s oil industry.

Just as the Biden White House has sought to keep oil on the water, the Harris campaign and prominent Democrats have continued to endorse the Obama era “all of the above” energy strategy.

During yesterday’s RBC Beyond the Ballot/Atlantic Council Front Page event, Senator Mark Warner (D-VA) also emphasized the need to have all forms of energy until renewables can be sufficiently scaled up. He also acknowledged the important role that US natural gas exports played in helping to stave off a serious economic crisis in Europe following the Russian invasion of Ukraine. We continue to hear that the pause is polling badly with certain constituencies in the critical swing state of Pennsylvania. Hence, there seems to be some skepticism amongst energy industry executives about the durability of this pivot past November. That said, we would note officials from the Obama administration are playing a leading role in the campaign and are expected to fill top roles in a potential Harris administration.

Helima Croft authored “Post Card from Washington: Closing Time,” published on October 11, 2024. For more information on the full report, please contact your RBC representative.