Already pretty clean, but the pie is getting bigger.

The Canadian electricity grid is relatively clean with over 80% of electricity generation from non-carbon emitting sources (58% hydro, 13% nuclear, 8% wind, and 2% solar). However, renewable development opportunities are quickly emerging from electricity demand growth driven by a combination of electrification of industries (e.g., mining and transportation), decarbonization initiatives, and population growth. With respect to the two largest Canadian markets, Quebec is looking to double electricity output by 2050, while Ontario forecasts electricity demand growth of 59% by 2050. We note that datacenter demand may drive incremental growth if provinces cater to the sector (Alberta's Premier Danielle Smith has shown an interest in attracting datacenters, and the respective investment and high-tech jobs).

Alberta's pace of renewables development may slow while other provinces accelerate.

Over the past ten years through 2023, wind and solar capacity increased an average of ~1.3 GW/year. Wind and solar capacity additions were initially driven by Ontario and Quebec but slowed even as renewable energy costs declined (pace of capacity additions driven by RFPs). In contrast, the pace of deployment ramped up in Alberta, which is a deregulated market. In the 2020-23 period, Alberta accounted for ~87% of utility scale wind and solar deployment in Canada, making Alberta the largest market for utility scale wind and solar despite being a much smaller power market than Quebec and Ontario. The pace of development in Alberta may slow due to uncertainties regarding a potential change in the power market structure, while other provinces are actively procuring renewable energy. In Canada (excluding Alberta), most of the renewable deployment is provincially driven, but Federal policies and subsidies (e.g., Investment Tax Credit, and Carbon Tax) could impact the all-in cost and economics for end customers.

Renewables still out of favor despite easing inflation and interest rates.

We expect lower inflation and interest rates to eventually be tailwinds for the sector because renewable valuations should be sensitive to interest rate movements. We believe the ideal situation for the renewables sector with respect to sentiment and valuation includes i) a Liberal or NDP government in Canada, which doesn't seem likely based on current polls, ii) a Democratic government in the upcoming U.S. elections, iii) moderate recession that leads to better labor availability, lower inflation, and a change in investor sector allocations, and iv) more interest rate cuts.

Canada is an attractive destination for renewable investment.

The electricity grids of the United States and Canada differ significantly in terms of generation mix and their environmental impact. Canada's power grid is notably cleaner, with over 80% of its electricity coming from carbon-free sources, primarily due to its abundant hydroelectric resources. In contrast, the U.S. grid is about 40% clean (renewables and nuclear), relying more heavily on fossil fuels such as natural gas and coal.

While Canada's power grid is relatively clean, there are many opportunities for renewable energy development. Canada's supportive renewables policies provide an attractive landscape for renewable energy developers. Federal and provincial governments have committed to ambitious climate targets, such as achieving net-zero emissions by 2050 and requiring all electricity generation to be net-zero by 2035. These commitments are backed by strong policies and incentives, including the carbon pricing, clean fuel standards, and substantial investments in renewable energy infrastructure.

Several provinces are actively pursuing large- scale renewable energy procurements (RFPs) offering 20-30 year contracts, creating a favorable market for developers. This clarity and commitment to renewable energy makes Canada an attractive destination for investment, especially in times of near-term policy uncertainty surrounding the U.S. elections, which could impact renewable investments south of the border. Former President Donald Trump recently pledged to rescind any unspent funds under the Inflation Reduction Act should he be elected in November, and he would also terminate the Green New Deal.

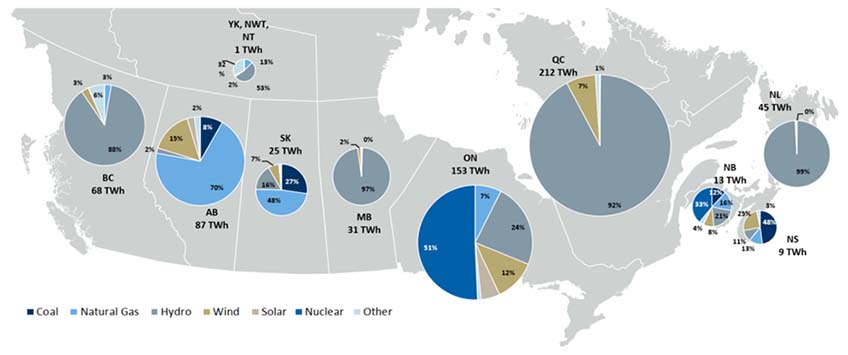

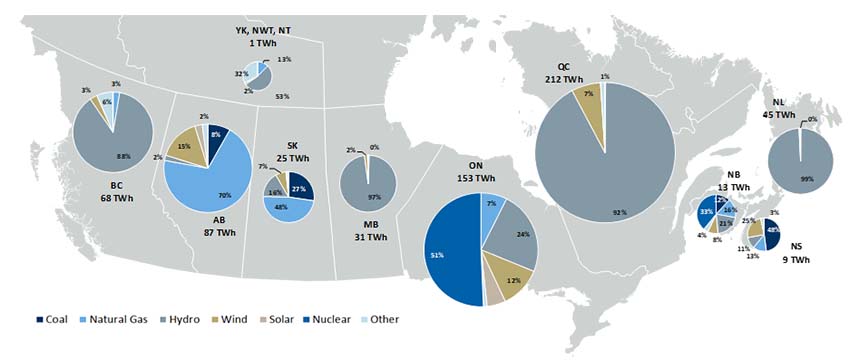

The graph in Exhibit 1 highlights the generation volume and mix in Canada. On an aggregate basis in Canada, 2023 generation from hydro, natural gas and uranium were 58%, 14%, and 13%, respectively. Quebec, B.C., Newfoundland and Labrador, and Manitoba generate most of their power from hydro resources, while Alberta and Saskatchewan have significant gas-fired generation, and Ontario has a large fleet of nuclear generation facilities. From a production perspective, Quebec produces by far the most electricity, followed by Ontario, and at a distant third is Alberta.

Exhibit 1 - Canada's grid is already pretty green (generation mix 2023)

If you need Exhibit title and sources, please refer to the original report.

Better labels in these ones. Pick one…

Renewable electricity demand set to ramp up

We estimate that Canadian electricity generation was essentially flat for the past decade and grew by ~0.3% in the past 15 years. However, demand for electricity is set to grow over the next 25 years, and some key factors contributing to this demand growth include:

- Increasing energy demand: The demand for electricity in Canada is growing, driven by factors such as population growth, and economic development.

- Datacenter demand: Datacenters are very energy intensive and require significant power for both computing and cooling. Natural Resources Canada estimated in 2022 that datacenters consume 1% of all electricity used in Canada and continues to grow. We note that Alberta's Premier Danielle Smith has shown an interest in attracting datacenters to the province.

- Industries transitioning to renewable energy: Canada is committed to reducing greenhouse gas emissions and transitioning to renewable energy sources. The electrification of various sectors has started, including transportation with the rise of EVs. Another example is the use of an electric arc furnace to produce steel rather than a blast furnace (coke/coal energy source).

- Decarbonization initiatives: Canada has a federal target of having a net zero electricity grid by 2035, and a net zero economy by 2050. Various provinces also have their own decarbonization targets, and their commitments are reflected in the renewable RFPs currently taking place. We expect that some renewable energy procurement will be replacing existing generation rather than servicing load growth.

Impact from a potential Federal Conservative government in Canada?

Except for Alberta, renewable energy is generally procured at the provincial level. We acknowledge that if a Federal Conservative government comes into power in the next election, it could negatively impact the renewable energy sentiment in Canada as it is generally viewed that a Conservative government is more supportive of fossil fuels.

The Conservatives have made it clear that they want to remove the consumer carbon tax ("axe the tax"). While it is less clear how the Conservatives will approach the industrial carbon tax, they believe provinces and territories should be free to develop their own climate change policies, without federal interference, penalties, or incentives. The most direct federal support for renewables is the recently established Investment Tax Credit (ITC), which provides a 30% subsidy on eligible project costs.

The Conservative party has not made any direct statements about ITC, but we expect the market to have concerns regarding the potential reduction or elimination of the ITC until there is more clarity in the Conservative's platform. Some points to consider:

- Renewables procurement is driven provincially. We expect renewables will continue to be procured in Canada regardless of whether the ITC exists or not. However, if the ITC is reduced or eliminated, it could slow the pace of renewable deployment in Alberta due to its current market-driven structure.

- Benefits of ITCs generally pass through to end customers. Although there is generally a transition period from when the ITC is introduced (uncertainty on terms, conditions, and eligibility) to when there is clarity on the ITC, the benefits generally flow through to customers (i.e., developers factor the ITC into project costs and bid lower power prices). Reducing or eliminating the ITC would result in higher power prices in provincial procurements.

- Growth in demand for power needs to be met. Various provinces are forecasting growth in power demand and procuring more generation capacity regardless of whether federal subsidies are available.

- ITC puts Canada closer to a level playing field with the U.S. Investment Tax Credits (ITCs) and Production Tax Credits (PTCs) have been in place in the U.S. for a number of years, which we estimate subsidizes 30-40% of project costs. Introducing the ITC in Canada (subsidizes 30% of eligible costs) provides some support for the renewables sector, which is still short of what is available in the U.S., but it puts Canada closer to a level playing field and helps attract capital investment into Canada.