The new capital of global diplomacy

Riyadh currently finds itself at the center of several diplomatic negotiations that could have major implications for energy markets over the next several months. On Tuesday, it played host to the first major bilateral meetings between the US and Russia and is a key player in the effort to craft an offramp for the Middle East crises, convening leaders from the GCC, Jordan, and Egypt on Friday. The Kingdom has emerged as the interlocutor to many of the competing factions in these global disputes and appears well placed to navigate the politics of a multipolar world. A long-time partner of the US, the Kingdom has seemingly formed new ties with countries that were once adversaries. We see some of the seeds of this internationalist agenda in the 2016 Declaration of Cooperation, which brought Russia into the OPEC fold. The fact that two countries on opposite sides of the Cold War could partner to manage the oil market may have helped facilitate the relationship reset that extends beyond energy.

The need to derisk Vision 2030 and prevent a repeat of the 2019 Abqaiq attacks likely helped drive Riyadh’s decision to normalize relations with Iran in March of 2023. While the two countries could not be described as friends, the détente and functional relationship have helped safeguard Saudi infrastructure from the spate of regional attacks that have occurred since October 7, 2023. Senior officials from the two nations have engaged in multiple rounds of shuttle diplomacy, and it is our understanding that Tehran is especially keen to highlight improved ties with Riyadh for its domestic audience. Hence, it is not surprising that Riyadh could emerge as a major facilitator of a new round of US-Iran talks aimed at crafting a new nuclear accord that would reduce the risk of further military action in the region.

Oil dividends?

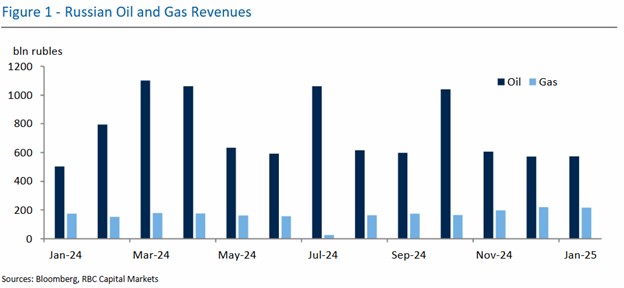

Certainly, a resolution of the Russia-Ukraine war and the Iranian nuclear standoff could result in the lifting of sanctions and more molecules on the market. And yet, potential pitfalls remain on the path to such an energy abundant endgame. As we have pointed out on multiple occasions, President Trump does have the ability to peel back US sanctions that were enacted through executive order, but he cannot force Europe to lift their own measures, especially given the deepening Atlantic diversion in support for Ukraine. It is worth noting that most of the EU sanctions apply to Russian oil, rather than gas, and hence, it will be more of an individual member state decision regarding those molecules. Oil has traditionally been the largest revenue source for Moscow.

Moreover, Trump does not have an entirely free hand with the US sanctions, as a number of punitive measures were imposed or backstopped by Congress. Even removing the eleventh-hour Biden sanctions targeting 180 vessels and dozens of trading houses, as well as the largest insurers involved in the Russian energy trade, would require a congressional review before being lifted due to their imposition through E.O. 13662, which was codified into law under the 2017 Countering America’s Adversaries Through Sanctions Act. Though to date President Trump has not encountered much opposition from congressional Republicans to his flood-the-zone policy blitzkrieg, there remains a pocket of GOP support for Ukraine. Hence, it is not clear that the White House will have an easy time lifting these measures if the terms of the deal are viewed as overly favorable to Moscow.

We will also be closely watching if Ukraine steps up its attacks on Russian energy infrastructure to enhance its negotiating position. Last week saw a key escalation, as drones struck a pumping station of the Caspian Pipeline Consortium (CPC), which is the pipeline route responsible for transporting around 80% of Kazakhstan’s oil production that carries barrels through Russia to the Black Sea. With producers like Exxon and Chevron among the key users of the CPC pipeline, this marks the first Ukrainian infrastructure attack with direct implications for Western oil majors (though CPC officially named terrorists, not Ukraine directly, Ukraine claimed the attack).

It follows on the heels of a flurry of recent Ukrainian drone attacks, which have significantly increased in tempo since the start of the year. These latest strikes have also increasingly targeted sites oriented towards servicing the fuel needs of Russia’s military (both oil refineries and fuel depots alike), with many being repeat, and seemingly high value, targets that Ukraine has previously attacked. Some of these latest attacks include those on the Ilsky and Saratov refineries, both of which transpired less than a week before the CPC strike. President Biden’s team had reportedly made it clear that continued US support would be conditioned on Kyiv allowing the transit of Russian commodities through the Black Sea corridor but with such support now in serious peril, Ukraine may judge that it has little to lose by more aggressively seeking to target such strategic resources.

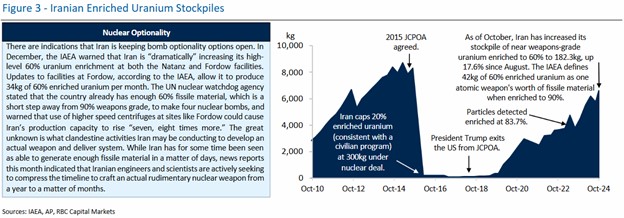

As the United States was the principal driver of maximum pressure policies on Iran since its exit from JCPOA in 2018, unilateral US action may be more impactful for markets. Iranian export volumes have fluctuated significantly depending on the degree of US sanctions enforcement. Trump administration officials have pledged a rigorous effort to drive large volumes of Iranian oil off the market, and today announced fresh sanctions on 13 vessels and 22 individuals. However, this time around the intended goal appears to be a new deal as opposed to a new government. There are indications that President Pezeshkian would favor a new accord from the US that would exchange nuclear concessions for economic relief. We envision that he will push the Supreme Leader to try to reach a deal with the US to secure sanctions relief and avert complete economic collapse. On the other hand, hardliner factions in the Revolutionary Guard may press for a rapid sprint to nuclear weapons capabilities to achieve the ultimate deterrence following the collapse of its key proxies in Lebanon and Syria. We have also been told that elements in the Revolutionary Guard are seeking to have someone from their ranks, rather than a cleric, succeed the aging Supreme Leader.

The other huge wildcard is Israel, as there are increasing reports that Prime Minister Netanyahu is seriously contemplating a military strike on the Iranian nuclear facilities. Even though Iran’s Axis of Resistance proxy network has been dealt a serious blow, we think it is unwise to entirely write off Iran’s disruptive capabilities in a retaliatory spiral. Even more than Russia, Iran could emerge as the source of the biggest geopolitical price delta, depending on if the country strikes a deal, obtains a bomb, or is bombed.

A case for keeping the OPEC powder dry

We think there is a strong case for OPEC+ to delay the phase-in of the voluntary barrels until the second half of the year, given the uncertainty surrounding the outcome of Russia and Iran sanctions, as well as the impact of new US tariff measures. While President Trump keeps publicly pushing for lower oil prices, such an ask seems at odds with his call for a ramp-up in US output as well for up to a trillion dollars in new US investment from key OPEC players. Neither the US nor OPEC producers seem to have any desire to publicly push back against the White House ask, but we suspect that both will be engaging in a behind-the-scenes effort to lower the temperature on the oil price issue. In addition to their own domestic spending priorities, OPEC’s Gulf Cooperation Council (GCC) contingent could soon be called on to make considerable outlays to craft a sustainable post-conflict Gaza solution. A significantly lower price point would make it challenging for them to achieve both domestic investment and Middle East stabilization goals. Moreover, if the OPEC producers buckled under White House pressure to rapidly sunset their voluntary cuts, we think there would once again be a flurry of “Houston, we have a problem” calls by shale executives to Washington.

Helima Croft authored “All roads lead to Riyadh,” published on February 24, 2025. For more information on the full report, please contact your RBC representative.