Last year, we wrote about how nature and biodiversity were the next frontier of sustainability. This was followed up by our takeaways from COP15, the UN Biodiversity Conference hosted in December 2022 in Montreal, where the world collectively agreed on ambitious goals and targets to stem the growing biodiversity crisis. September 2023 marked another significant milestone in the rise of nature and biodiversity as material sustainability issues for companies across all sectors: the launch of the final Taskforce on Nature-related Financial Disclosures (TNFD) Recommendations.

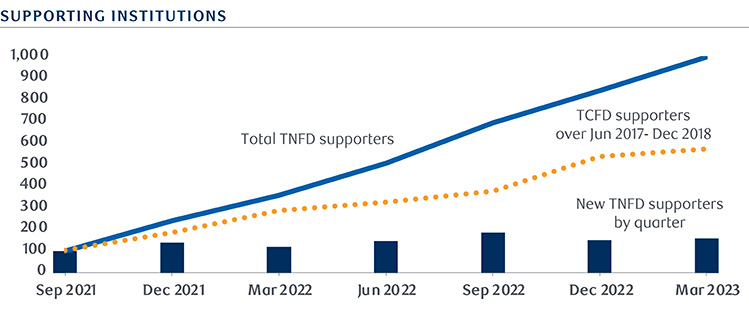

The TNFD Recommendations are a framework to help companies identify, assess, manage and disclose nature and biodiversity related risks and opportunities. These recommendations mirror the work of the Taskforce on Climate-Related Financial Disclosures (TCFD) which published their inaugural recommendations in 2017 and have become the global standard for disclosing on climate risks and opportunities. The culmination of a two-year development process, the TNFD has garnered support from over 1,200 corporations, financial institutions and market service providers. 80% of these supporters have expressed their intent to publish nature-related disclosures by 2026 and 30 initial companies are already piloting the TNFD framework for disclosures releasing next year.

Source: Bloomberg New Energy Finance

This work comes at a crucial time for the world. A recent study shows that human activities, such as over consumption of fresh water and land use change, have pushed the Earth outside of its safe operating space, threatening its ability to continue sustaining human society.1 Furthermore, 69% of global wildlife has been lost since 1970 highlighting the rapid deterioration of our natural world2. As highlighted in the UN's State of Finance for Nature report3, there exists a massive gap of USD $4.1 trillion in financing for nature that must be bridged by 2050 to meet global climate, biodiversity, and land degradation targets. The private sector plays a pivotal role in helping to fill this gap, complementing the public sector's efforts.

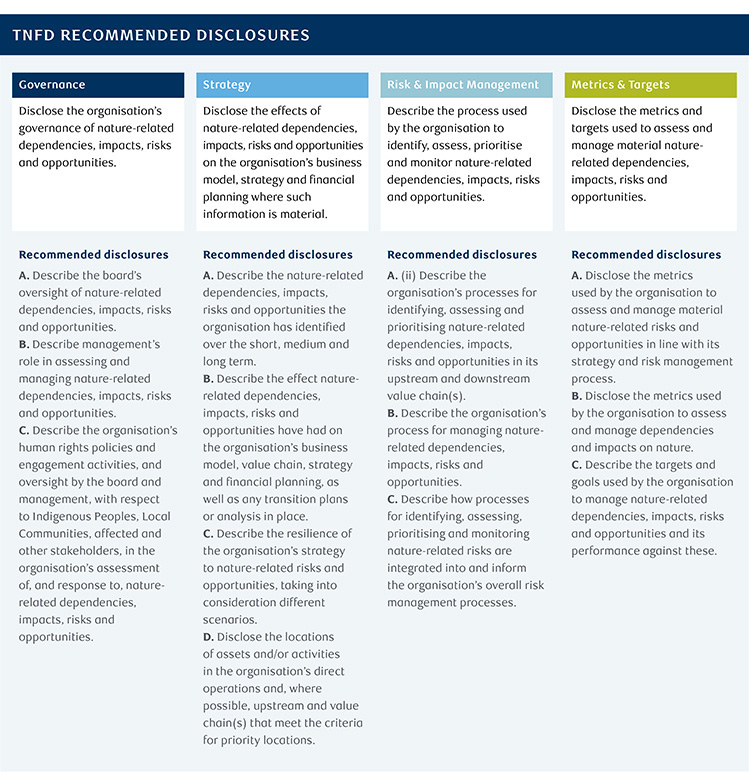

Similar to the TCFD Recommendations, the TNFD Recommendations ask companies to disclose across four main categories: Governance, Strategy, Risk & Impact Management, and Metrics & Targets. These categories comprise 14 specific recommendations, 11 of which are the same as the TCFD in order to align nature-related disclosure recommendations as closely as possible with existing climate-related guidance. By leveraging existing practices as much as possible, the TNFD aims to reduce added workload and provide an easier starting point for the thousands of companies already utilizing the TCFD recommendations.

Source: TNFD

One of the biggest challenges related to nature-related financial disclosures is that nature indicators are local, multi-faceted and unique to each company compared to climate which has a singular indicator, greenhouse gas emissions. To help companies deal with this challenge, the TNFD developed the LEAP (Locate, Evaluate, Assess, Prepare) approach which offers a structured framework that allows companies to scan and triage nature-related issues, even with limited data, knowledge, or expertise. Along with LEAP, the TNFD provides a number of core global metrics to report on, such as waste generation, non-greenhouse gas related pollutants, and annual capital expenditures on nature-positive projects.

A big question facing companies and investors is how soon regulators will require nature-related disclosures from companies. The EU and the UK are expected to lead on this front. In the UK, the Financial Conduct Authority (FCA) has indicated in consultations on sustainability-related governance that it supports the ISSB’s inclusion of nature-related disclosures4. More details on timeline are expected in late 2023. In France, Article 29 of the recent Energy and Climate law outlines expected biodiversity disclosures such as the alignment of strategies towards the international biodiversity goals established through COP15’s Global Biodiversity Framework. Furthermore, financial institutions are required to disclose the portion of assets complying with the EU Taxonomy’s environmental criteria. In the EU more broadly, regulation on deforestation-free products entered into force in summer 2023. These rules require organizations to prove that commodity products do not originate from recently deforested land or have contributed to forest degradation. The direction of travel is clear – existing and future regulation is going to require companies to disclose more in terms of nature-related risks.

Investors are watching these developments closely. The feedback process on the TNFD has sparked greater interest in nature-related risks and opportunities for investors, and the issue is rising up the list of priority engagement areas. Recent RBC Capital Markets research highlights this trend, with Palm Oil and Pesticides among the fastest growing sectors facing exclusionary investment policies5. Collaborative engagement in this area is also growing. For example, Nature Action 100 launched in September, with 190 investors joining to engage with 100 companies in key sectors that are deemed to be systemically important in reversing nature and biodiversity loss. Data providers are launching new products and nature-related metrics for companies to provide investors with more insight. Interest is growing in a small group of global companies who are also working with the Science Based Targets Network (SBTN) to set science-based targets for nature later this year.

Going forward, the TNFD’s immediate focus is to broaden adoption and support companies that are looking to publish inaugural nature-related disclosures. The TNFD is also working to provide specific sectoral guidance, such as for financial institutions, the first of which is anticipated to launch during COP 28, the upcoming UN Climate Change Conference, later this year.

The launch of the final TNFD recommendations is a seminal moment, filling a key gap to supporting a sustainable future and emphasizing the importance of the private sector in assessing and managing nature-related risks, opportunities, impacts, and dependencies. As the famous adage goes, what gets measured gets managed, and the TNFD will enable the increasingly important role that corporations and financial institutions play in supporting climate action while protecting our planet's biodiversity and natural resources. RBC Capital Markets provides support to clients that are looking to better navigate the evolving sustainability disclosure landscape and harness nature-related opportunities through bespoke advice and innovative sustainable finance and carbon markets solutions.

1. https://www.science.org/doi/10.1126/sciadv.adh2458

2. https://wwf.ca/wp-content/uploads/2022/10/lpr_2022_full_report_en.pdf

3. https://www.unep.org/resources/report/state-finance-nature

4. https://www.fca.org.uk/publication/discussion/dp23-1_updated.pdf

5. RBC ESG Strategy, Morningstar, as of 6/30/2023