- Nature and biodiversity collectively represent one of the largest economic opportunities, and are increasingly recognized as emerging and material ESG risks.

- Frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) and organizations such as the Science-based Targets Network (SBTN) are driving the growth in interest and consideration of these topics in the private sector.

- Sustainable finance, through products such as green and sustainability loans and bonds, sustainability-linked loans and bonds, impact bonds and carbon credits, will spur greater investments in nature-based climate solutions which will be increasingly critical to meeting global climate goals.

Introduction

While climate change continues to dominate ESG conversations, a second interconnected and equally important issue is starting to get the spotlight. Governments, investors, corporates and other stakeholders are increasingly focused on the growing crisis of nature and biodiversity loss, which could hold even greater risks for the global economy than climate change1 but conversely are also a material component to the solution. With over half of the world’s GDP listed as highly dependent on nature2, it can be difficult to understand why nature-related financial risks have been overlooked for so long. In this edition of Sustainability Matters, we’ll discuss why nature and biodiversity risks and opportunities are poised to become the next frontier of sustainability.

Nature and biodiversity are vast and complex subjects, a likely reason as to why they have struggled to receive attention in the world of ESG. Unlike the simple cause and effect of carbon dioxide and other greenhouse gases to climate change, there is no equivalent metric to measure risks related to nature and biodiversity, and each country, sector and company will have a different set of dependencies and impacts. Despite this, humanity can no longer ignore its interconnectedness with the natural world, and the economy faces a growing need to better understand and prepare for nature-related risks while capitalizing on the emerging opportunities.

The World Economic Forum estimates that by 2030, nature-positive projects and transitions could generate up to US$10.1 trillion in annual business value and create 395 million jobs3. While biodiversity loss is being accelerated by climate change, nature-based climate solutions represent one of the most cost efficient and effective tools we have to combat it. Reforestation, regenerative agriculture, wetland restoration and cultivating mangroves are just some of the powerful climate solutions that governments and the private sector are looking to invest in. Providers of these solutions are also increasingly able to tap into global carbon markets, monetizing their projects by selling the carbon reductions as offsets, further incentivizing investment in restorative projects.

On the risk side, one must look no further than the COVID pandemic. The virus itself originating from nature, demonstrates just how extensive and disruptive the risks can be. Studies show that a further degradation of the natural world will increase the likelihood of future pandemics4.

A more specific example is the impact that declining bee populations are having on certain agricultural sectors, with blueberry growers in Canada being the latest to signal the alarm, projecting reduced yields due to hive shortages5. An estimated $235-577 billion worth of agricultural products are dependent on pollinators6, and their contributions are especially critical during this period of rising food insecurity. These risks are increasingly seen as financially material, with a recent study showing that biodiversity loss could cause enough economic damage by 2030 to severely cut more than half of the world’s sovereign credit ratings7.

A New Support System

To help advance the growing market interest in measuring and managing nature-related risks as well as identifying opportunities, numerous frameworks, intergovernmental groups and industry associations are emerging and rapidly gaining traction. These have the benefit of building off of similar efforts for climate change, helping them bring their guidance and solutions to market quickly.

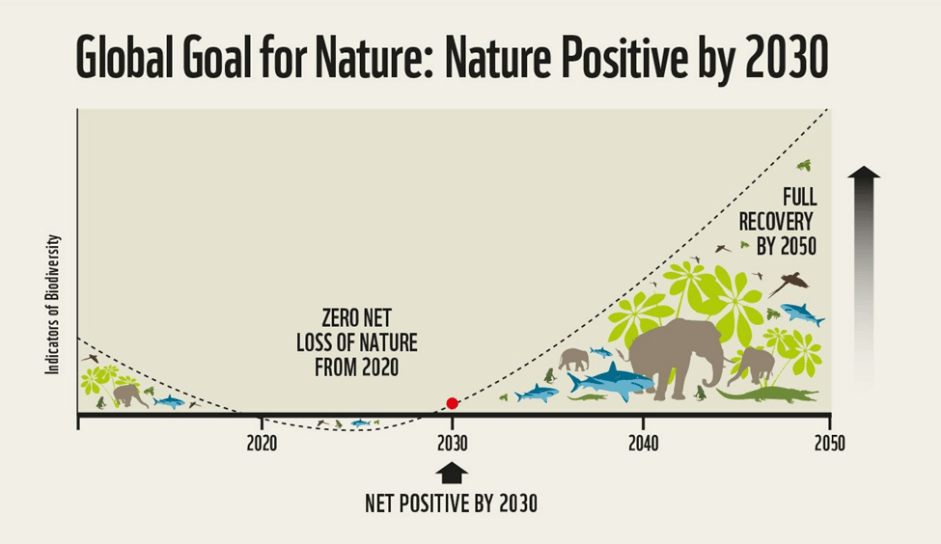

Later this year, part two of the 15th UN Biodiversity Conference of the Parties, COP15, will be held in Montreal. Largely considered as important a meeting for biodiversity as the Paris Agreement was for climate, its primary goal will be to align on a new framework, known as the Post 2020 Global Biodiversity Framework8, and to set an overarching target for biodiversity and nature. While climate action has rallied around a goal of limiting global warming to 1.5 degrees Celsius, the goal of COP15 will be to halt and reverse biodiversity loss by 2030. Another key target is to ensure that at least 30% of global land and sea areas are permanently conserved by the end of the decade. Agreement on these targets will provide a critical guidepost for companies looking to lead and track their progress and commitments.

Source: naturepositive.org

Reaching this ambitious goal will require major efforts from all stakeholder groups. To aid the private sector, the Task-Force on Nature Related Financial Disclosures (TNFD) was formed. Like its sister organization, the Task-Force on Climate Related Financial Disclosures (TCFD), the TNFD provides guidance and an overarching framework to help companies measure and disclose their nature related risks and opportunities. The TNFD aims to publish their guidelines by September 2023 and has released beta frameworks for organizations looking to pilot the methodology9. So far, over 500 companies and institutions have committed to the TNFD and it is already being discussed as a future mandatory disclosure by some governments10.

In addition to the TNFD, financial institutions (FIs) can leverage the Partnership for Biodiversity Accounting Financials (PBAF), modeled after another climate-focused sister organization, the Partnership for Carbon Accounting Financials (PCAF). PBAF provides practical guidance that FIs can use to assess, manage and disclose the impacts and dependencies on biodiversity of loans and investments.

Other notable developments include the launch of the Science Based Targets Network (SBTN), modeled after the highly successful Science-Based Targets Initiative (SBTi) which has become the leading standard for setting credible carbon reduction targets. The SBTN is building sector specific science-based targets for nature, examples of which include achieving zero deforestation in a supply chain from 2020 onwards, reducing water use by 50% by 2030 or avoiding sourcing from fisheries with stocks outside biologically sustainable levels. The SBTN will be further supported by the Nature Action 100, an investor-led collaborative engagement program that will work with companies and policymakers to advance nature-related strategies and is launching later this year. Just as greenhouse gas emissions targets became table stakes for any large company, in a few years we expect nature-related targets to also be the norm.

Investor Perspectives

From an investor point of view, corporate impacts on the environment, either through the use of nonrenewable natural resources or through harmful releases into the environment including air, water and land, can impact a company’s financial and operating performance. For example, unsustainable cultivation or resource extraction practices can have negative environmental externalities, such as deforestation and biodiversity loss, soil degradation, and water pollution. Investors have increasingly been joining multi-stakeholder initiatives to help drive system transformation and sustainable supply chains. Furthermore, to help examine how the impacts of companies contribute to stable and resilient ecosystems, resources like the World Benchmarking Alliance have been created to track corporate performance towards nature-positive externalities by measuring how companies are reducing impact and regenerating ecosystems.

Investors have also been rallying a call to action to recognize the importance of biodiversity and ecosystem services. The Financial Institution Statement ahead of COP1511 provides a recent example of financial institutions working collaboratively to address the systemic consequences for the global economy related to biodiversity loss and the need to capture future opportunities. These factors are contributing to investors accelerating direct investment in natural capital and integrating biodiversity into their investment decision process, while developing methodologies to measure companies’ impact on biodiversity.

Looking Ahead

We expect capital markets and sustainable finance to play an important role in accelerating capital flows towards nature-based climate solutions and biodiversity protection. In June 2022, the International Capital Markets Association (ICMA) published a new registry with nearly 300 example key performance indicators for sustainability-linked bonds. Of these, over 40 were related to nature and biodiversity, highlighting the materiality of these topics across industries. Project categories related to nature and biodiversity are also increasingly common inclusions in green bonds, even for companies not usually associated with conservation such as Walmart12. Nature and biodiversity protection has also been an area of innovation for capital markets products. An example of this is the World Bank’s “Rhino Bond” which is a first-of-its-kind, outcome-based, financial instrument that channels investments to achieve conservation outcomes, measured in this case by an increase in black rhino populations13. Lastly, there has been massive growth in the demand for credible and impactful nature-based carbon offsets. In July 2022, Indigo Ag, a US-based Ag-Tech company, announced the first sale of soil carbon credits generated from its carbon farming program. Buyers included JPMorgan Chase, Barclays and The North Face who paid US$40 per credit, up US$20 per credit when they were initially marketed just two years ago14.

Case Study: Ontario Power Generation (OPG) Sustainability-Linked Loan

OPG is one of the largest, most diverse clean power producers in North America. Biodiversity and wildlife habitats are one of OPG’s priority sustainability topics and they are investing in biodiversity by retaining, restoring and enhancing natural habitats at their sites and in communities where biodiversity is under threat. In support of this goal, OPG has aligned their financing with their commitment to protect biodiversity through annual tree and shrub planting by linking the interest rate on their credit facilities to the number of trees and shrubs planted each year, highlighting the ability of sustainable finance to accelerate investment in nature.

Closing Thoughts

Companies and investors that recognize and address their nature-related risks have an immense opportunity to lead the next wave of ESG and corporate sustainability. While it took climate change decades to become the mainstream issue it is today, by building on existing climate frameworks we expect nature and biodiversity to become high priority ESG topics within the next few years. RBC Capital Markets supports its clients looking to better integrate, understand and invest in nature-based climate solutions through innovative sustainable finance and carbon markets solutions.

1 https://www.economist.com/technology-quarterly/2021/06/15/loss-of-biodiversity-poses-as-great-a-risk-to-humanity-as-climate-change

2 https://www.weforum.org/press/2020/01/half-of-world-s-gdp-moderately-or-highly-dependent-on-nature-says-new-report/

3 https://www.weforum.org/reports/new-nature-economy-report-ii-the-future-of-nature-and-business

4 https://www.nature.com/articles/d41586-020-02341-1

5 https://www.bloomberg.com/news/articles/2022-06-27/bee-hive-wipeout-is-crimping-harvests-as-crisis-enters-new-stage?sref=IzT270oE

6 Assessment Report on Pollinators, Pollination and Food Production, IPBES, 2016

7 https://www.reuters.com/business/sustainable-business/mass-biodiversity-loss-would-slash-global-credit-ratings-report-warns-2022-06-22/

8 https://www.cbd.int/article/draft-1-global-biodiversity-framework#:~:text=The%20post%2D2020%20global%20biodiversity%20framework%20builds%20on%20the%20Strategic,in%20harmony%20with%20nature'%20is

9 https://framework.tnfd.global/executive-summary/v02-beta-release/

10 https://www.responsible-investor.com/uk-government-pushing-gfanz-members-on-nature-says-lord-goldsmith/

11 COP15-Financial-Institution-Statement.pdf (financeforbiodiversity.org)

12 https://s2.q4cdn.com/056532643/files/ESG%20Investors/2021/09/WMT-Green-Financing-Framework-FINAL.pdf

13 https://www.worldbank.org/en/news/press-release/2022/03/23/wildlife-conservation-bond-boosts-south-africa-s-efforts-to-protect-black-rhinos-and-support-local-communities#:~:text=Also%20known%20as%20the%20%E2%80%9CRhino,the%20Addo%20Elephant%20National%20Park

14 https://www.reuters.com/business/sustainable-business/indigo-ag-roll-out-first-tranche-farm-soil-carbon-credits-2022-06-29/