- With a long-term investment horizon, focus on active ownership, and ability to bring about meaningful change within portfolio companies, private capital is well-suited to ESG integration and is fundamental to advancing progress on environmental and social issues

- Limited Partners (LPs) are embedding ESG considerations throughout the investment decision-making process and are increasingly looking to General Partners (GPs) for more transparency on ESG-related disclosures; the ESG ecosystem is evolving accordingly to provide the supporting data, structures, advice, and deal flow required

- RBC Capital Markets provides sophisticated sustainable finance solutions for financial sponsor clients across the entire lifecycle of their funds, from fundraising and capital call facilities to the M&A acquisition process and through to exit, delivering a broad range of capabilities in a seamless, integrated manner across our global platform

ESG Integration in Private Capital

ESG integration, defined as the systematic incorporation of environmental, social, and governance considerations alongside traditional financial analysis in investment decision-making, is widely recognized by corporates and investors alike as both a driver of value creation and a tool for risk mitigation. Private capital, which encompasses both private equity and credit investments, is especially well-suited to ESG integration due to its long-term investment horizon and focus on active ownership, which enables firms to meaningfully influence the strategy and operations of portfolio companies. Adding an ESG and impact lens can also serve to bring new ideas to the forefront and identify emerging investment opportunities, and many LPs and GPs have developed policies to formalize the ways in which ESG considerations are incorporated into their investment processes. In an effort to quantify ESG integration and use the data to drive returns, a number of firms have developed proprietary impact measurement frameworks. In 2021, over half of total private equity fundraising flowed to GPs with formal ESG policies, the highest percentage on record.1

Impact investing is emerging as an important growth opportunity, with a recent marked increase in thematic funds focused on healthcare, education, financial inclusion, and climate. Governance improvements have long been a key driver of returns in this market, and looking ahead, we see significant opportunity for private capital to drive positive environmental and social outcomes. This edition of Sustainability Matters explores ESG integration in private capital from a variety of perspectives, including the ways in which LPs are incorporating ESG factors in investment decision-making, how GPs are embedding sustainability considerations in active ownership strategies and establishing dedicated impact funds, and how firms are utilizing sustainability-linked financing to tie their cost of capital to sustainability performance improvements at the portfolio company level.

Growing Investor Focus on ESG Considerations in Investment Decision-Making

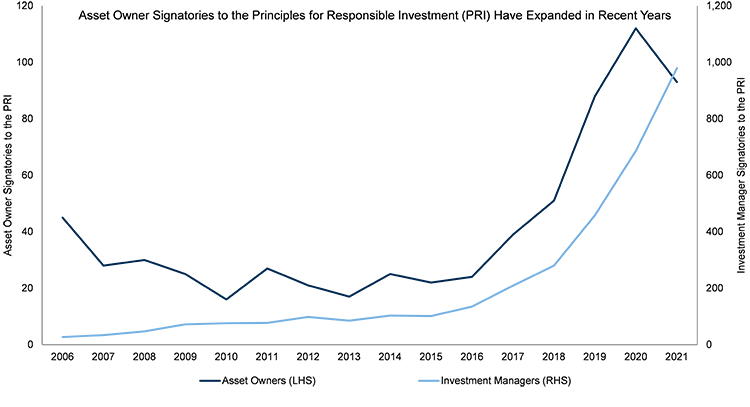

LPs are increasingly integrating ESG considerations into their investment decision-making processes, driven by evolving stakeholder expectations, regulatory developments, and recognition that ESG factors provide an important lens for both value creation and risk mitigation. The number of asset owner signatories to the UN Principles for Responsible Investment (PRI), which are a set of principles reflecting investor commitment to incorporate ESG issues into investment practices, has expanded meaningfully over the past three years. As of May 2022, nearly 700 asset owners globally have signed on to the PRI, and within that group, almost half have joined since 2019.2

Source: UN Principles for Responsible Investment (UN PRI), 2022

A recent study conducted by the Institutional Limited Partners Association (ILPA) and Bain indicated that nearly 70% of LPs surveyed have investment policies that include an ESG approach, with one of the primary motivations being the belief that ESG factors are additive to performance. Overall, half of all LPs said that ESG is additive to investment performance, but regional differences persist. While 70% of European LPs indicated that they believed strong ESG performance increased valuation premiums, only 38% of North American LPs said the same. A significant majority (93%) of LPs reported that they were prepared to walk away from an investment based on ESG performance, with LPs in North America more concerned about the risk of negative headlines (72%) and European LPs more concerned about a lack of desire to improve poor ESG performance (78%).

One of the most common ways in which LPs currently incorporate ESG considerations in investment decision-making is through a pre-investment due diligence questionnaire. By asking GPs to share their approaches to ESG integration, a growing number of LPs are signaling the importance of sustainable investing to their organizations and selecting fund managers that align with their sustainability commitments. There are a variety of resources available to support LPs as they engage with and evaluate GPs’ ESG integration efforts. The ILPA ESG Assessment Framework, which provides a detailed rubric for LPs to evaluate and benchmark GPs, helps to facilitate and inform goal-setting conversations and measure the progress of ESG integration over time.3 The UN PRI’s LP Private Equity Responsible Investment Due Diligence Questionnaire (DDQ), which forms part of the ILPA’s broader Due Diligence Questionnaire, is organized into seven sections to help investors understand a GP’s approach to incorporating material ESG risks and opportunities into the investment process.4

Overview of the UN PRI LP Private Equity Responsible Investment Due Diligence Questionnaire

| Section | Purpose | Illustrative DDQ Question | |

|---|---|---|---|

| 1 | Policy | Understand GP’s ESG-related policies, governance structure, and oversight. | Do you have a responsible investment policy? |

| 2 | Fundraising | Understand GP’s formal ESG commitments within fund documentation. | What formal ESG commitments have you made or do you plan to make in the Limited Partnership Agreement? |

| 3 | Pre-investment | Understand how GP identifies material ESG risks and opportunities in investment selection. | How do ESG risks and opportunities affect the selection of your investments? |

| 4 | Post-investment | Understand how GP contributes to portfolio companies’ ESG risk mitigation and value creation efforts. | Do you monitor and track ESG key performance indicators (KPIs) for your investments? |

| 5 | Reporting & Disclosure | Understand how LP can monitor GP’s performance and ensure that the fund is operating within agreed-upon parameters. | How do you report and evidence progress on ESG performance, including data and targets, to LPs? |

| 6 | Climate Change | Understand how GP measures and reports GHG emissions associated with investments, as well as firm-level climate targets. | How do you measure and report the greenhouse gas (GHG) emissions associated with your investments? |

| 7 | Additional Information | Understand how GP’s approach addresses any other specific ESG topics or practices not otherwise covered. | How do you manage firm-level internal ESG risks and opportunities? |

Source: UN Principles for Responsible Investment (UN PRI), 2021

Impact Investing Is Emerging as an Important Area of Growth for Private Capital

GPs increasingly view ESG integration as an important driver of long-term value creation and are incorporating ESG considerations throughout the deal sourcing, due diligence, active ownership, and exit phases of the investment lifecycle. The active ownership phase presents GPs with an especially valuable opportunity to effect meaningful positive change at the portfolio company level. A number of firms, including Carlyle and KKR, have set and achieved board-level diverse representation targets and developed bespoke training to strengthen diversity, equity, and inclusion (DEI) initiatives across portfolio companies. Research on ESG implications for investment exits is emerging: Carlyle notes that the firm has increasingly observed valuation premiums for business models that reflect ESG best practices.5 Carlyle cites research showing that increasing an oil and gas company’s share of total revenue from renewable energy from zero to 40% could lead to a doubling of the typical energy company’s trailing EBITDA valuation multiple.6

Firms are identifying innovative ways to quantify and highlight the positive financial impact of ESG integration across their portfolios. In 2019, TPG, which has built one of the largest private equity impact investing platforms globally, launched Y Analytics, a public benefit corporation dedicated to helping capital allocators better understand, value, and manage social and environmental impact.7 Recognizing the challenges of measuring the anticipated social and environmental impact of potential investments, TPG and Y Analytics developed a new metric called the Impact Multiple of Money (IMM), a forward-looking methodology to estimate the financial value of the social and environmental good that is likely to result from each dollar invested.8 In 2018, the Global Impact Investing Network (GIIN) published the first comprehensive analysis of the financial performance of private debt impact investment funds, which showed that private debt funds seeking positive impact can offer stable returns across various private debt risk-return strategies, sectors, impact themes, and geographies.9

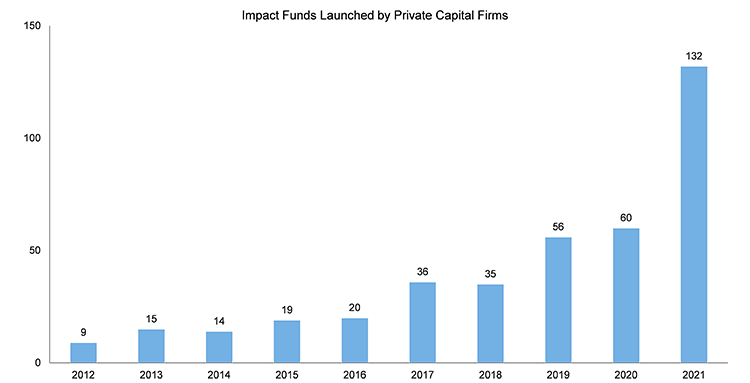

The number of impact funds launched by private capital firms has soared in recent years, with a record 132 funds launched in the first ten months of 2021.10 Impact funds are often structure-agnostic and combine private equity, private credit, infrastructure, and private real estate. In addition to environmental opportunities, key thematic areas of focus from a social perspective include affordable housing, financial inclusion, and access to education, healthcare, and communications. Funds focused on diversity, equity, and inclusion are also gaining traction: in 2021, BlackRock launched the BlackRock Impact Opportunities Fund, a multi-alternatives strategy geared toward investing in businesses and projects owned, led by, or serving people of color in the United States. In May 2022, BlackRock announced that it had secured more than US$800 million in initial commitments towards its US$1 billion target, underscoring broad-based institutional demand for a differentiated investment opportunity.11

Source: Preqin, Based on date of first investment, 2021 as of October 28.

Dedicated pools of capital focused on the energy transition are also emerging. Last year, Brookfield Asset Management announced an initial US$7 billion closing for the Brookfield Global Transition Fund (BGTF), the largest fund globally focused on the transition to a net-zero economy. The BGTF targets investment opportunities relating to reducing greenhouse gas emissions and energy consumption, as well as increasing low-carbon energy capacity and supporting sustainable solutions. Due to overwhelming interest from institutional investors, Brookfield now expects to have its final closing at US$15 billion.12 Asset owners are also allocating dedicated capital to the energy transition: in September 2021, the Caisse de dépôt et placement du Québec (CDPQ) announced the establishment of a C$10bn transition envelope to support the decarbonization of high-emitting sectors, including raw materials production, transportation, and agriculture.13

Private equity firms are beginning to tap into sustainability-linked finance, aligning their cost of capital to the achievement of predetermined sustainability performance targets at both the firm and portfolio company level. Earlier this year, RBC Capital Markets acted as sustainability structuring agent for a mid-market private equity firm based in the UK. In March 2022, the firm announced the closing of their newest buyout fund. As part of the private equity firm’s commitment to ESG, the fund entered into a capital call facility which included a pricing mechanism linked to ESG metrics. The interest rate margin on the capital call facility will ratchet up or down depending on performance against three annual targets aligned to key ESG pillars, including climate change, diversity and governance policies. As part of its role, RBC partnered with the firm to select the ESG key performance indicators, calibrate the sustainability performance targets, and socialize the structure with other lenders.

The Evolution of the ESG Ecosystem: Data Challenges and Opportunities

Robust, accurate data on environmental, social, and governance indicators is fundamental to ESG integration. The availability and quality of ESG data in private markets has historically presented a challenge, but industry partnerships and offerings from ESG data providers are emerging. In September 2021, Carlyle and CalPERS launched the ESG Data Convergence Project in an effort to standardize the industry’s approach to ESG data collection and reporting. Disclosure standards will cover six areas – greenhouse gas emissions, renewable energy, board diversity, work-related injuries, net new hires, and employee engagement – and will be anonymized and aggregated into a benchmark for all participants.14

ESG data providers including MSCI and Sustainalytics have also made significant strides in advancing the quality and availability of ESG data in private markets. Both providers now offer third parties, including banks, the opportunity to acquire provisional ESG ratings on behalf of private clients to support corporate activities such as IPOs.15 Apex Group, a financial services provider, offers an ESG ratings and advisory service focused specifically on private markets.16 As ESG data availability and quality continues to improve, we anticipate that LPs and GPs will become increasingly sophisticated in their respective approaches to ESG integration in the years ahead.

Closing Thoughts

Private capital is well-suited to ESG integration due to its long-term investment horizon, focus on active ownership, and ability to effect meaningful strategic and operational change within portfolio companies. A growing number of LPs are embedding ESG considerations throughout the investment decision-making process and encouraging GPs to enhance ESG-related policies, data, and disclosure practices. Looking ahead, we see significant opportunity for private capital to play an integral role in driving positive environmental and social outcomes, enabling the transition to a low-carbon economy and contributing to a more equitable and inclusive society. RBC Capital Markets provides sophisticated sustainable finance solutions for financial sponsor clients throughout the entire lifecycle of their funds, from fundraising and capital call facilities to the M&A acquisition process and through to exit, delivering a broad range of capabilities in a seamless, integrated manner across our global platform.

Featured Transactions

1 PE Wire - Private markets bounced back from pandemic-driven turbulence to reach new heights in 2021

2 https://www.unpri.org/signatories/signatory-resources/signatory-directory

3 ILPA-ESG-Assessment-Framework.pdf

4 Responsible investment DDQ for PE limited partners | DDQ | PRI (unpri.org)

5 https://www.carlyle.com/sites/default/files/2021-02/2020_Carlyle_ESG-Policy.pdf

6 https://www.carlyle.com/sites/default/files/2021-02/2020_Carlyle_ESG-Policy.pdf

7 https://therisefund.com/

8 https://hbr.org/2019/01/calculating-the-value-of-impact-investing

9 https://thegiin.org/research/publication/private-debt

10 Private Equity Funds Embrace ESG for Good, While Seeking Profits - Bloomberg

11 https://www.blackrock.com/us/individual/investment-ideas/alternative-investments/blackrock-impact-opportunities-fund

12 https://bam.brookfield.com/sites/brookfield-ir/files/2022-02/q4_2021_ltr_to_shareholders.pdf

13 https://www.cdpq.com/sites/default/files/medias/pdf/en/climate_strategy.pdf

14 https://www.ft.com/content/c326c6aa-2d97-4f2d-9822-b21067266770

15 https://www.msci.com/our-clients/corporates/advisors/esg-rating-private-company-assessment

16 https://ww2.apexfunds.co.uk/apex-esg-ratings/esg-brochure-download