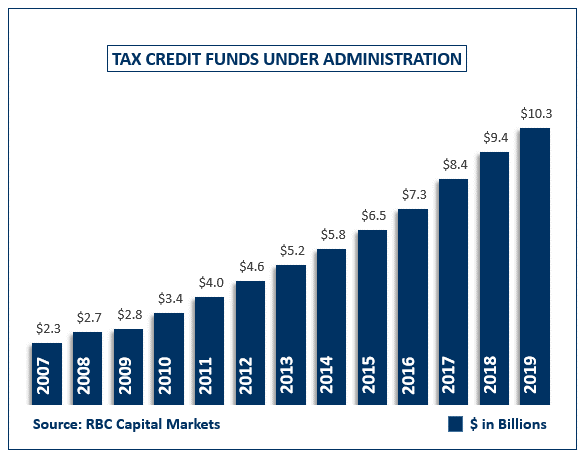

RBC Community Investments provides equity capital by utilizing the Low Income Housing Tax Credit (LIHTC), Historic Tax Credit, New Markets Tax Credit (NMTC), Renewable Energy Tax Credit (RETC), and various State Tax Credit programs. As of December 2019, our team of over 100 professionals has raised over $11.0 billion of equity, including over $1.0 billion in RBC RETC Direct Investments and Syndications, and 998 affordable housing tax credit assets under administration. In addition, RBC Community Investments has closed 21 NMTC developments nationwide. These experienced specialists identify strategic investments and design equity structures that serve the long term interests of all our partners, including investors, developers and public authorities. We provide investors with full asset management and reporting services during the investment life cycle.

Areas of Expertise

- Low Income Housing Tax Credit Equity

- Investor Asset Management Services

- Workforce Housing Investments

- Historic Tax Credit Equity

- New Markets Tax Credit Equity

- Renewable Energy Tax Credits

- State Tax Credit Equity

- Underwriting and Advisory Services

Housing Finance

Our Housing Finance Group is the largest State HFA platform in the country

The syndications group enjoys deep relationships with the industry’s most active developers and investors. We have expertise in fully leveraging the synergies that exist in matching the needs for affordable housing at the local level with the tax credit investment objectives of our investor clients. Our depth of talent in effectively structuring quality tax-advantaged investments, coupled with the strength of RBC in worldwide financial markets, makes us a premier tax credit syndicator.

RBC Community Investments’ team of originators, underwriters and closing specialists works with developers nationwide to provide solid deal execution and follow-up through closing. We deploy substantial resources in all major markets to meet the dynamic development needs of affordable housing sponsors. Our capabilities include the flexibility to close a transaction with RBC funding within a developer’s timeframe.

Our mission is to find quality investment opportunities for our clients and our syndication platform is built on the principle of providing strategic diversification for tax credit investors. We are disciplined in maintaining dual distribution channels – looking to syndicate tax credit investments equally through proprietary funds as well as multi-investor funds. This balance allows us to provide flexible capital to meet the needs of our developer partners and to provide strong investment opportunities to our investor partners. In the last five years, we have worked with 55 different institutional investors and have closed on tax credit investment funds totaling $4.7 billion.

Our Asset and Fund Management teams are structured to effectively monitor our entire portfolio of properties at any stage of the asset lifecycle. Serving to protect yield and asset quality for both investors and developers, we employ a diverse team of strong professionals in the following areas of expertise:

Development Risk Management monitors the development portfolio (through receipt of the Certificate of Occupancy) by performing site inspections, monitoring construction, sources and uses, funding equity contributions through C.O., completing monthly risk assessments for internal reporting and communicating with developers and investors.

Stabilized Asset Management monitors the portfolio beginning at C.O. through disposition by reviewing the lease up process, funding equity contributions, performing annual site inspections, reviewing property financial performance, completing risk rating assessments quarterly for investor reporting, responsible for the disposition process and communicating with developers and investors about property performance.

Asset Risk Management monitors a select group of underperforming properties with watch list criteria and aggressively manage properties off of the watch list or through workout, review risk ratings for the entire portfolio to ensure proper rankings and communicate with developers and investors.

Asset Management Operations monitors the aggregate portfolio from inception to disposition by coordinating property data collection, quality control over the database, evaluating insurance requirements, tenant file reviews, ensuring Qualified Occupancy is achieved, and communicating with developers, property managers and investors.

Fund Management manages investor communications regarding changes and requests to the portfolio, as well as providing investor reporting needs, fund performance analysis, audits and tax returns and communicating portfolio reporting results with investors.

The architects, engineers, asset managers, compliance experts, CPAs and attorneys who lead and work in these areas develop valuable relationships with investor and developer clients. This specialization strategy enhances our ability to deliver best in class service.

Click on a state in the map below to view a sampling of key projects in that state.

Executive Team

Managing Director, Head, Municipal Finance

New York

+1.212.618.5645

bob.spangler@rbccm.com

Managing Director, Head, RBC Community Investments

North Carolina

+1.980.369.6507

craig.wagner@rbccm.com

Functional Heads

Managing Director,

Head, Renewables and Direct Investing

+1.212.301.1555

jonathan.cheng@rbccm.com

Managing Director, Head, Originations and Syndications

Ohio

+1.216.875.6042

Tammy.Thiessen@rbc.com

Managing Director,

Head, Underwriting and Asset Management

North Carolina

+1.980.369.6467

Eric.Moody@rbc.com

Managing Director, Head, Asset Management

North Carolina

+1.980.369.6456

lorraine.coram@rbccm.com

Managing Director, Head, Investment Services

Ohio

+1.216.875.2623

nancy.amstadt.rbccm.com

Managing Director, Head, Operations and Technology

Ohio

+1.216.272.4998

kenneth.lohiser@rbccm.com

Originations and Syndications

Managing Director, Head, Originations and Syndications

+1.216.875.6042

Tammy.Thiessen@rbc.com

Managing Director, Regional Mid-Atlantic

+1.212.618.5619

christopher.tully@rbccm.com

Renewables and Direct Investments

Managing Director,

Head, Renewables and Direct Investing

+1.212.301.1555

jonathan.cheng@rbccm.com

Vice President, Financial Management Lead

+1.212.437.9150

george.giannopoulos@rbccm.com

Underwriting and Asset Management

Managing Director,

Head, Underwriting and Asset Management

+1.980.369.6467

Eric.Moody@rbc.com

Managing Director, Construction Risk Management Lead

+1.954.405.7220

zack.tabak@rbccm.com

Director, Stabilized Asset Management Lead

lauren.dwyer@rbccm.com

Director, Asset Management Operations Lead

+1.216.536.4654

elizabeth.dziak@rbccm.com

Director, Acquisitions Management Lead

+1.980.233.6432

christopher.cummings@rbccm.com

Vice President, Development Equity Management Lead

+1.720.537.9067

nicole.brunswig@rbccm.com

Investment Services

Operations and Technology

Managing Director, Head, Operations and Technology

+1.216.272.4998

kenneth.lohiser@rbccm.com