Closer to the Brink

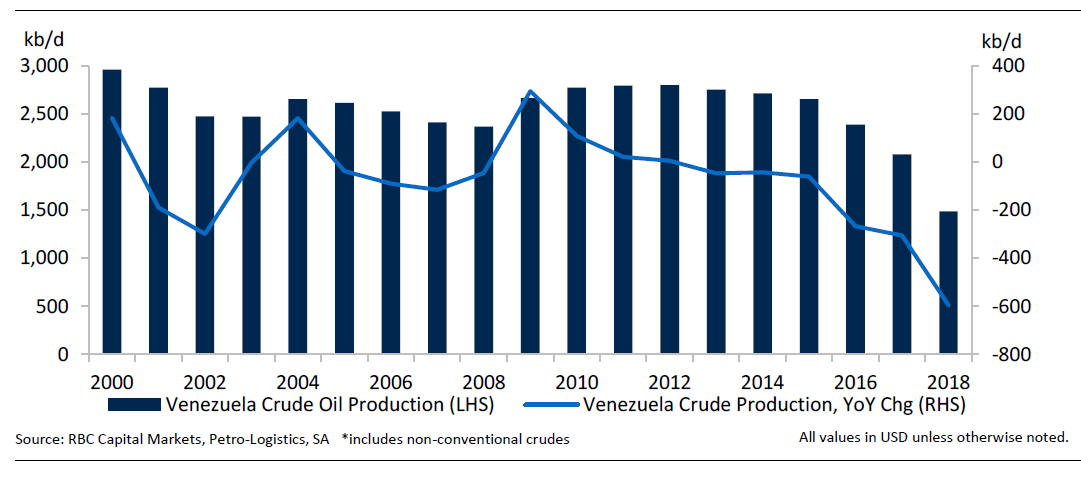

Since the 2014 price collapse, Venezuelan oil production has plunged by over 45% and we believe it could fall by another 300-500 kb/d or more, this year. Since most production is earmarked for export, though the government that derives 90% of its revenue from oil exports, any interruption in sales could trigger a quick test of domestic storage capacity and in turn, lead to an additional decrease in production. Tran believes that an additional issue is quality, since Venezuela’s heavy, sour crudes are becoming increasingly difficult to replace. Potential replacements from Canada are hampered by egress and policy challenges, while sanctions on Iranian oil also mean similar quality barrels are unable to make their way to market.

Venezuelan Crude Oil Production, Annual Average*

Market Share Up For Grabs

Tran thinks the U.S. will be most impacted by a shortfall in Venezuelan barrels, with nearly 40% of current Venezuelan crude exports headed to the U.S. and 25% to China. Further reduction of exports to the U.S. means that the barrels will have to find alternate homes such as Asia, but the region is also the most competitive market globally. Tran adds that while they remain the second largest market for Venezuelan crudes, China has tapered buying from Caracas over the past two years. As for which country will likely increase market share in the U.S. Gulf, Tran expects it will be Mexico and Iraq due to their meaningful customer network in the region and the fact they already compete with Venezuelan heavies at the greatest number of U.S. refineries.