In their recent Economic and Financial Market Outlook report, RBC Economics takes a closer look at the significant trends defining 2019, and what the outlook is for the remainder of the year.

6 Main Themes to Watch for the rest of 2019

1. Uncertainty taking a toll on global economy

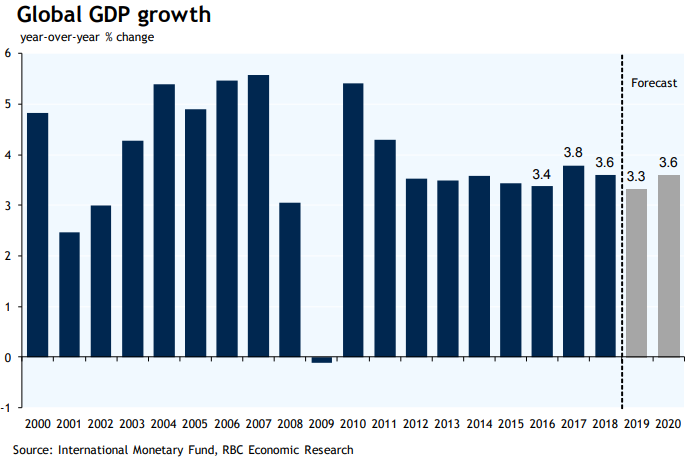

Marked by the 10th anniversary of global economic expansion, 2019 has been a year of slowed global growth as policy uncertainty continues to take its toll on the world’s economy. The prospect of a prolonged US-China trade war, the lack of clarity around Brexit, and political and economic upheaval in countries like Venezuela have combined to generate downside risks to the outlook. Data points to the global economy expanding by 3.3% this year, slower than 2018’s 3.6% pace. Together, these risks have forced central banks to play the long game, keeping interest rates stagnant until they have a better line of sight on how much damage this latest round of tariff turbulence will cause.

2. Eye of the storm

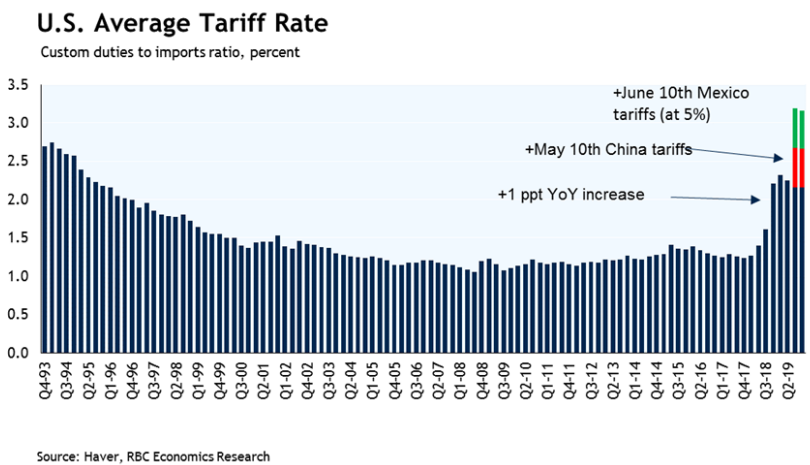

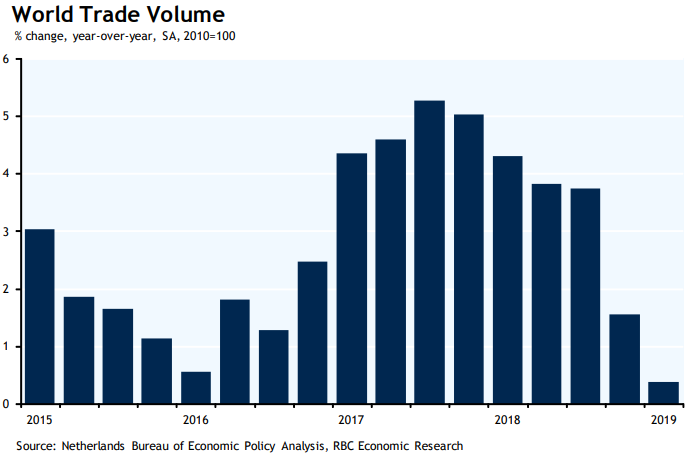

On trade policy, the US is the eye of the storm. The recent removal of tariffs on steel and aluminum imports and the Trump Administration’s desire to ratify the new trade agreement with Canada and Mexico had dampened some of the pressures within North America. Tensions continue to remain heated between US and China after the US increased tariff rates. China has implemented retaliatory measures adding to the uncertainty of the global trade backdrop, with the latest world trade outlook indicator holding at its weakest level since 2010.

3. US economy not seeing ill-effects of trade turmoil yet

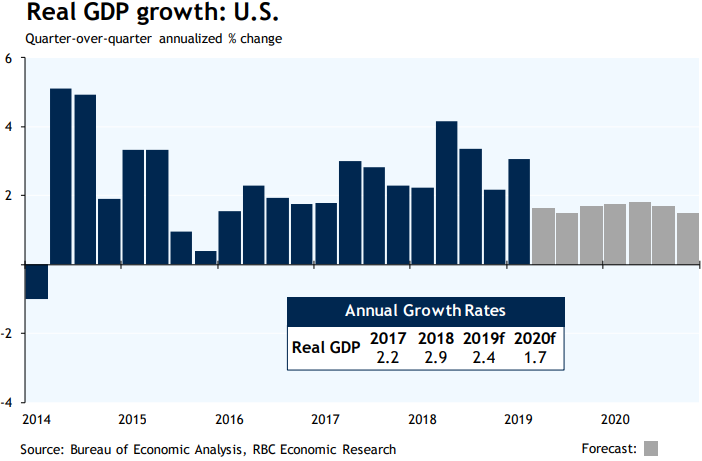

The US economy continued to grow at a solid clip in the first quarter of 2019 on the back of net exports and inventory building. The key driver of the US economy remains the consumer, with strong demand for labour pushing the unemployment rate to a 50-year low. Business investment is also forecast to contribute to the economy as companies take advantage of corporate tax cuts. With more people working and wages rising faster than inflation, we expect consumer spending to increase 2.3% this year, slightly slower than the previous two years.

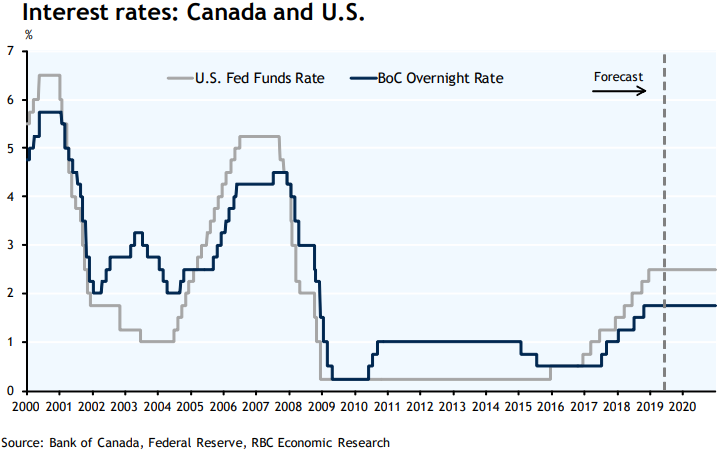

4. Federal reserve taking a risk management tact to monetary policy

The US Federal Reserve accomplished its mission, getting the economy to full employment with most inflation measures at or slightly below the 2% target. Fragile financial market sentiment, growing concerns about the US-China trade tensions and global policy uncertainty raise the potential for more aggressive slowing ahead, making maintaining these conditions even more challenging. The prospect that these uncertain conditions will persist limits how much US Treasury bond yields can be expected to rise in the near term. Due to uncertain conditions, the 10-year rate is projected to hold below 3%.

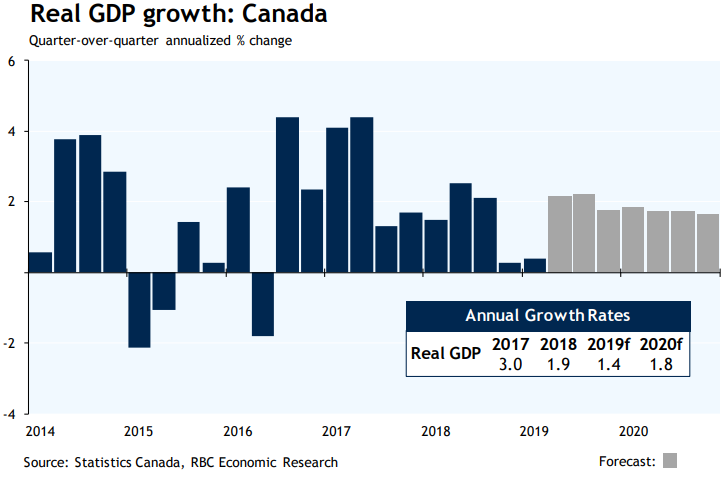

5. Canada’s economy hit turbulence in late 2018; tailwinds could return

Falling oil prices and a deepening in the housing-market correction saw Canada’s economy grow at just a 0.3% annualized rate in the last quarter of 2018 and contributed to the economy growing at a similar pace in the first quarter of 2019. A recovery in oil production, easing of pressure in the housing market and the end to long cold winter saw the economy grow in March, paving the way for stronger gains ahead. After growing close to 1 1/2% in 2019, the economy is expected to accelerate modestly in 2020 to 1.8%.

6. US tariffs creating risks for Canada and the Global economy

The growing list of US tariffs is starting to show itself globally. The potential for the US to implement more tariffs on China and the possibility of retaliatory measures to follow, is keeping the risk of an even greater slowing in global growth in the months to come. The $200 billion worth of imports from China hit with a higher tariff rate as of May has bumped up the average U.S. tariff rate by more than a percentage point. While the impact of these tariff wars doesn’t currently look very large for Canada, the risk remains that they will pack a bigger punch over the quarters ahead. While the impact of these tariff wars doesn’t currently look very large for Canada, the risk remains that they will pack a bigger punch over the quarters ahead.