We assign our base case Brent scenario a 60% probability of prices averaging $64/bbl average this year, and a 25% bull case scenario with an average of $70.25/bbl, in the event of further escalation and material outages. Such barrels would have to be off for a meaningful period without being replaced by an increase in OPEC production, a surge in shale output or a policy driven event such as a release from US strategic reserves.

Michael Tran shares his strategic outlook for Energy 2020

Producer Hedging

Prices are in the sweet spot for many North American E&Ps. Many underhedged producers have been waiting or hoping for a chance to lock in Cal’20 WTI pricing at $60/bbl, a level that the 2020 strip hit late last week. Furthermore, while Cal’20 averaged $55-57/bbl last year, WTI only closed above $60/bbl during a mere 15 trading days during the whole of 2019. Hedging activity has picked up over recent weeks and volumes should only increase as the price rally coincides with improving liquidity given that the holiday season is in the rear view mirror. I expect producers may opt to hedge with collars to provide upside runway, but that given the improved pricing environment and the forward-looking risk profile, fixed price swaps probably remain a safe tool to secure pricing and flatten future cash flow volatility. Overall, I think current pricing offers an attractive opportunity given that backwardation will persist for the foreseeable near to medium term due to the risk premium to spot prices, especially if major consuming countries stockpile heavily like they did last spring.

Investor Positioning

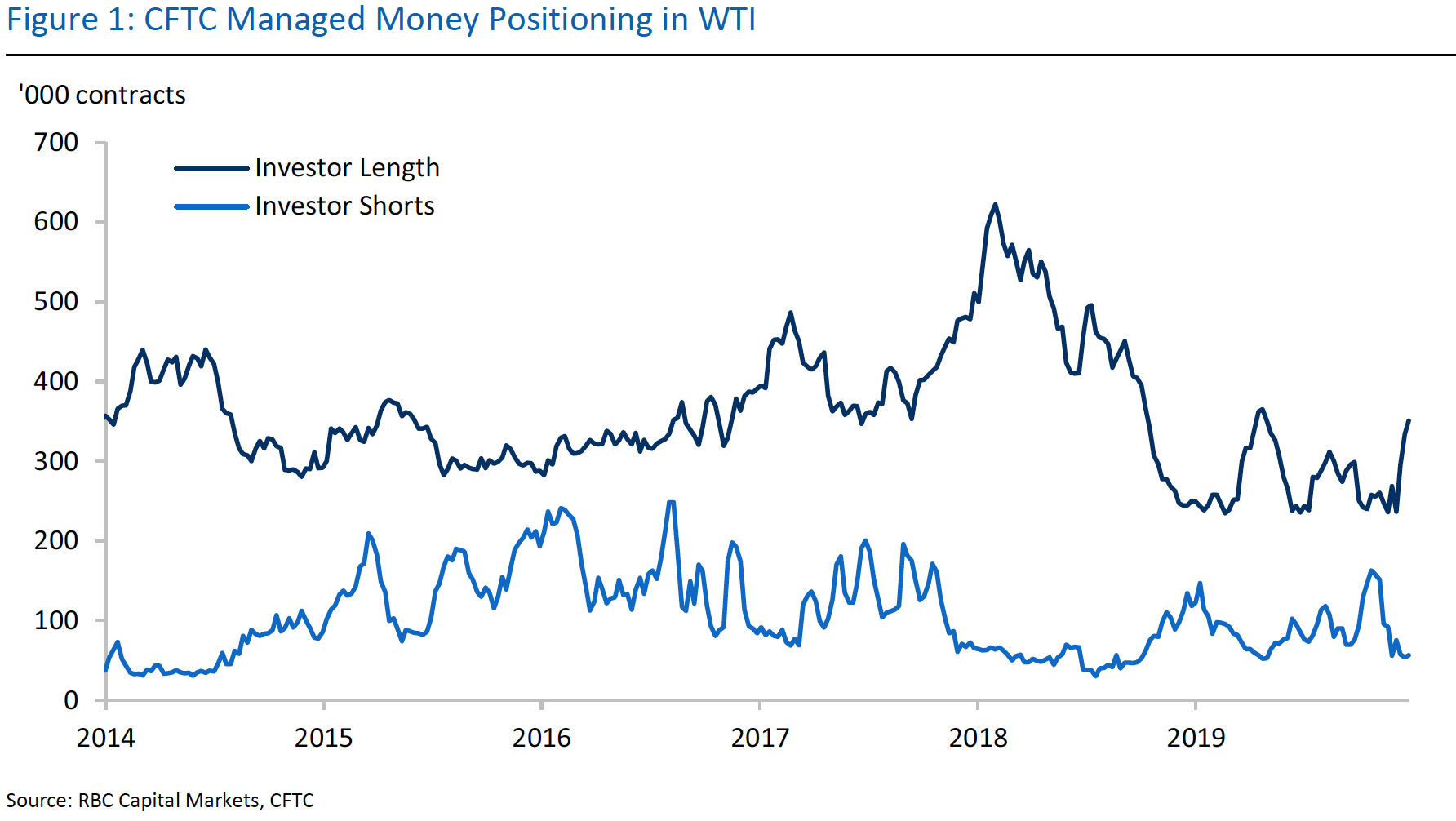

With investor short positioning currently near a 12-month low, this means short covering rallies are likely to provide less upside traction, while for prices to increase significantly from current levels, fresh length must be put to work. The likelihood of such positioning is greater than an increased number of shorts entering the market given the current geopolitical backdrop. However, it’s also worth noting that managed money length is already trending near the highs of the past 12 months.

Trump Policy

Investors remain wary of Trump related oil policy. The potential for a unilateral release from strategic reserves is seemingly correlated with rising oil prices, particularly with the 2020 US election looming. Aside from the preannounced selling of reserves from a policy perspective, there is not a precedent of pre-emptively releasing from strategic reserves in the absence of a major disruption. An impromptu US release from reserves would likely be a unilateral effort unless a major disruption (one that eclipses OPEC spare capacity) ensues. However, all IEA member countries refrained from a knee jerk release last year despite meaningful disruptions to regions like Saudi Arabia, Venezuela and Iran.