With the recent uptick in volatility, the Market Wide Circuit Breakers (MWCB’s) have come to the forefront. Prior to last month, the trading halts -- aimed at minimizing significant intraday market declines by pausing trading across equities and equity-linked options and futures -- had not been triggered since FINRA and the U.S. equity exchanges adopted the current rules in 2012.

With recent COVID-19-related volatility, we now have experiences to gauge how the current MWCB protocols worked. While the markets overall performed exceptionally well under stress in March 2020, the Level 1 MWCB was triggered on multiple days in the minutes immediately following the 9:30 a.m. start of the regular equity trading session. In each of these 3 instances -- March 9, 12 and 16 -- trading was halted for 15 minutes as a result. We believe there is room for improvement and have outlined at the end of this article several suggestions that we believe could help optimize the process.

The sharp price decline in the major indices, including the S&P 500®, (on which the MWCB’s are based) was well known pre-open on these days. The S&P 500® index futures were trading limit down (-5%) and the widely-tracked S&P 500® ETF (SPY) was trading down even more. This is important because a key rationale for the MWCB halt is to allow time for market participants to digest news and to “let cooler heads prevail” in an effort to help draw buyers into the market to reduce the severity of the selling pressure.

We believe that when it is clear from pre-open trading levels of the SPY that a Level 1 halt would likely be triggered shortly after 9:30 a.m., the Level 1 threshold should not be in effect. This would allow trading to continue uninterrupted, unless the S&P 500® were to decline to the Level 2 threshold (-13%). It is important to note that a MWCB halt can only be triggered once per dayiii, so eliminating the Level 1 halt in these circumstances merely expedites this level being removed, albeit forgoing the associated 15 minute trading pause.

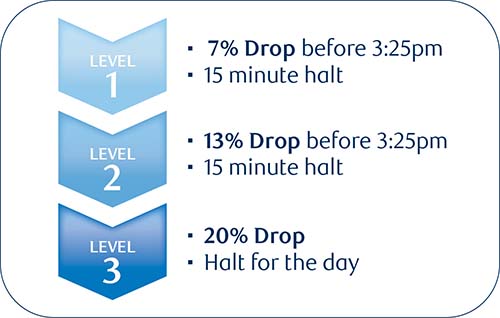

As it stands now, the MWCB’s have 3 levels for declinesiv:

A market decline which results in a Level 1 or Level 2 halt after 9:30 a.m. and before 3:25 p.m. would halt market-wide trading for 15 minutes, whereas a similar market decline at or after 3:25 p.m. would not halt market-wide tradingv.

A market decline which leads to a Level 3 halt, at any time during the trading day, would halt market-wide trading until the listing market opens the next trading dayvi.

RBC's Suggestions:

If SPY is trading down 7% or more at 9:15 a.m., eliminate the Level 1 threshold for the trading day

In this instance, the first MWCB Level would be Level 2, down 13%.

Increase the Level 2 halt time to 30 minutes, rather than the current time of 15 minutes

This would provide institutional investors more time to discuss what orders to put in place and at what price levels to participate at with their portfolio managers when markets are down significantly. This could be particularly helpful in an environment such as the current one, where employees are physically separated and communication is more cumbersome and time consuming.

Policy Matters - our regular series of briefings from Rich Steiner – interprets today’s emerging political and market trends to positively influence policy decisions on equity markets. This is the second installment in the Policy Matters program, click here to learn more about our suggestions on upgrading the Securities Information Processors (SIPs).

For future insights on the Market Wide Circuit Breakers and more from our Policy Matters program, subscribe below.

Comment Letter - CTA/UTP Conflicts of Interest Policy

Comment Letter - Rescinding the Effective-Upon-Filing Procedure for NMS Plan Fee Amendments

Comment Letter - Market Data and Market Access

v https://www.sec.gov/oiea/investor-alerts-bulletins/investor-alerts-circuitbreakersbulletinhtm.html