Visit fees drive future revenue stream

Telehealth has reached its tipping point.

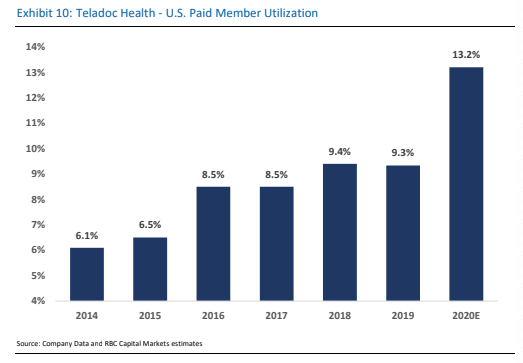

With help from both the pandemic and its engagement policies, Teladoc Health, Inc. (TDOC) drove utilization of its telemedicine services to nearly 18% in 1Q20, up from just 4.7% in 2015.

But some of its longtime clients are now at 80-100% levels, and across its own employee base of ~4,300 total covered individuals, utilization is running at 307%. While we expect subscription access fees from new clients to fuel short-term revenues, we believe visit fees from higher utilization will drive revenues over the long term.

Post COVID, there’s plenty of room to grow

During the COVID-19 outbreak, many patients have used virtual rather than in-person visits. But even without lockdowns, growing numbers will likely use virtual visits for a wide range of ailments.

Here’s why: CDC data indicates that the average person visits a physician office, hospital, or urgent care center 4x per year; Adding in behavioral visits, it becomes 4.6x per year.

When we overlaid why these individuals seek care and what conditions can be replaced with virtual visits, our findings revealed that 35-40% (40-45% including behavioral health) of general medical and specialist visits could be conducted remotely, equating to 150-200% annual utilization, respectively. More specifically, we think long term utilization rates may reach 150%+.

What would a 1% uptick in utilization mean for Teladoc?

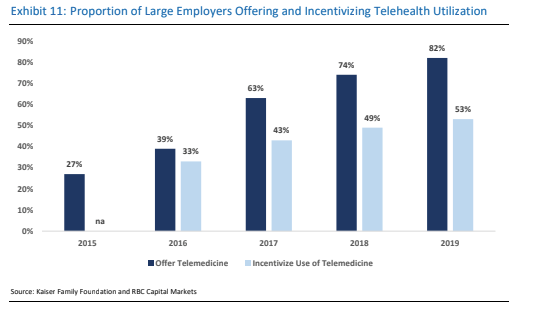

TDOC has increased adoption among its biggest clients to 80-100% utilization. This is key to its value proposition—payers only save money if their members use the service.

We believe the rise of Virtual-First Plan Designs adds even more momentum to its outlook. The Virtual-First contracts will likely continue to be its common revenue model, with the initial upside coming from higher visit revenue.

Assuming an average $25 of the visit fee is paid to the doctor and another $5 covers the call center, malpractice insurance, and other overhead, a 1% increase in utilization may contribute an incremental $9-10M.

With help from both the pandemic and its engagement policies, Teladoc Health, Inc. drove utilization of its telemedicine services to nearly 18% in 1Q20, up from just 4.7% in 2015.

Closing thoughts

Virtual health has gone mainstream, and the range of potential use cases has grown rapidly. We’ve seen growing evidence that the Virtual First Plan Design is starting to take hold, which only adds even more momentum to its outlook.

With its superior customer engagement platform, breadth of capabilities, and global reach, we believe Teladoc is best positioned to capture this momentum. Its ability to draw new members, cross sell offerings, and ramp up utilization should continue to drive substantial growth.

Sean Dodge authored “Teladoc Health, Inc, COVID-19 Has Pushed Telehealth to its Tipping Point…How High Can Utilization Go?” on May 27, 2020. For more information about the full report, please contact your RBC sales representative.