Required Conflicts Disclosures

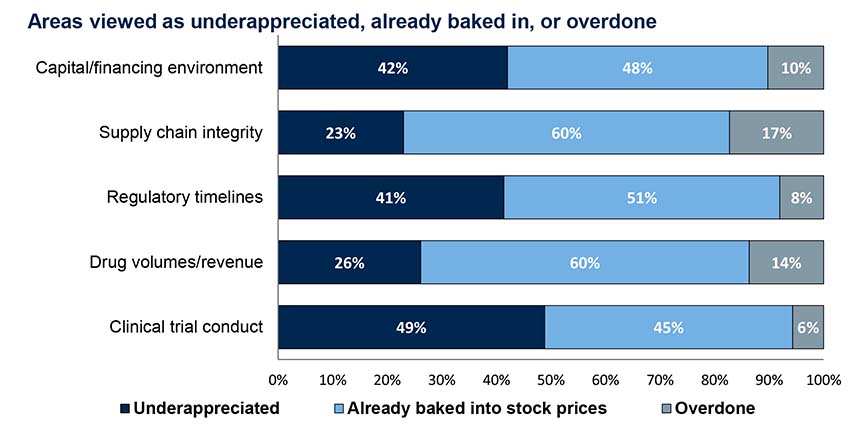

Clinical development: Expect risks from delays and compromised data

Our pulse checks over the past month show that COVID-19 has essentially put the brakes on near-term clinical trials and drug development. Partially-completed trials may not resume for several quarters, while those that require in-person or in-clinic administration will face even longer delays.

Rest assured, clinical trials will slowly resume on a gradual basis. But even if they return full steam later this year, the disruption will impact data integrity. Participant travel limitations, site closures and quarantines will further complicate trials as safety protocols take top priority.

Both, biotech companies and regulators such as the FDA have already reacted to data challenges with statistical tools, protocol flexibility, as well as continued guidance.

Commercialization: Soft or delayed launches and Rx stockpiling

Without the usual sales force engagement with physicians or medical meetings, expect the pandemic to delay or hamper near-term commercial launches. Prescription stockpiling, particularly for certain classes of therapies, will probably keep 1Q20 intact or even high, but may trigger steeper reductions during 2Q/3Q.

But it’s not just volume that will change dramatically. As the outbreak continues to alter the way we live, patients may become wary of clinic visits and prefer easily-shipped oral medicines or may not continue to take their meds at all, even if self-isolation measures are eased somewhat.

Revenue growth: Loss of jobs and benefits drives down revenues

Industry-watchers generally agree that the outbreak is unlikely to affect long-term pharmaceutical sales. But it’s hard to ignore the impact that tremendous job and benefit losses are going to have on this sector.

The longer our communities stay on lockdown, the more we’ll see uninsured or under-insured citizens decrease drug compliance, driving down revenues. Payers who continue to shift the cost-share burden to patients, reducing affordability, may compound these effects.

We can expect a lively return to political/payer dialogue about drug pricing, as insurers will be forced to adjust for an expected $90B in direct coronavirus claims through higher premiums and revitalized drug pricing policy debates.

Cash runway: Most pre-cash flow companies are prepared to weather the storm

Record-setting funding over the past several years has given most pre-cash flow companies a pretty solid cash foundation for the next 18+ months.

The few that are short on cash may depend on value inflections from clinical trial readouts or launches for funding. In either case, we believe they may turn to strategies like opex reductions or partnerships/M&A (especially given strong large biopharma balance sheets) to raise and preserve capital, depending on how the pandemic and financial disruptions play out.

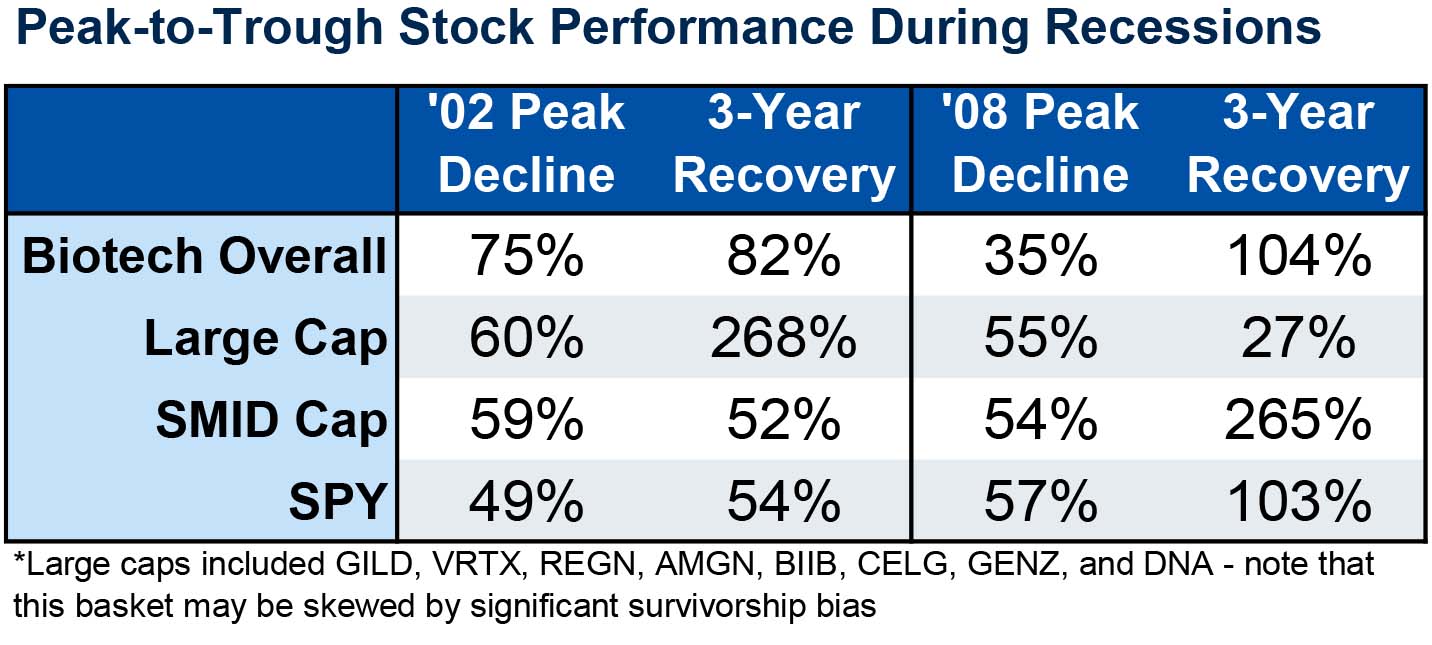

Relative performance: Biotech shows its muster during market downturns

Although the markets have snapped back a bit from the initial slump, it’s becoming likely that the lingering toll of the coronavirus will push us into a global recession. Slowed launches, long-term drug pricing shifts, and changing consumer behavior all present headwinds for biotech.

The good news is this sector was the “comeback kid” following both the ‘02 and ’08 recessions; in fact, in 2008, biotech experienced substantially less decline than the broader market. During those time periods, investors that hung in and focused on high-quality names were rewarded during the market decline.

Closing thoughts

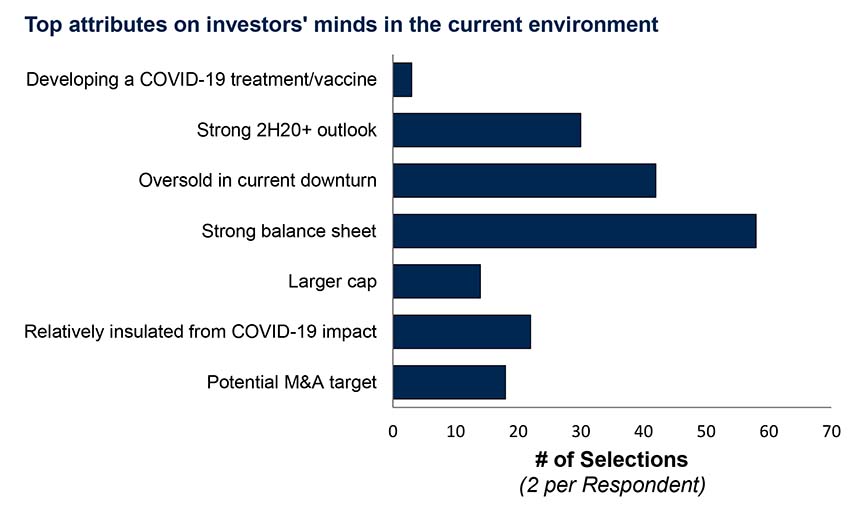

When we tapped into investors’ minds about how COVID-19 may impact their view of biotech in March, we were fairly optimistic about the prospects. But as the world adjusts to “a new normal,” we now believe that drug pricing, volumes, and slowed launches present emerging and continued risks to this sector.

Historically, biotech has proven to be quite defensive in a recession. What’s more, funding continues to pour into this sector, with 1Q20 setting a fresh record for venture capital. Lastly, we believe the race for COVID-19 treatments and vaccines can play well into biopharma’s long-term image, broadening its scope of investors and record of innovation.

For more of our unique perspectives on the forces shaping tomorrow’s world today, read our Imagine 2025 research.

Brian Abrahams authored “Putting It All Together: Assessing COVID-19 Impact on the Biotech Sector as the World Adjusts to a New Normal.” For more information about the full report, please contact your RBC sales representative.

For Required Conflicts Disclosures, click here. These disclosures are also available by sending a written request to RBC Capital Markets Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7 or sending an email to rbcinsight@rbccm.com.