First generation biofuels such as ethanol and vegetable oils which are blended into regular hydrocarbon fuels are in widespread use across North America, Europe and Brazil. Incentivized through tax breaks or mandated by fuel standards, first generation biofuels do however have technical “blendwall” limitations in gasoline or diesel / jet which are close to being reached in many developed markets.

Second generation or “advanced” biofuels are produced by oleochemically processing waste agricultural or biomass feedstocks such as tallow from slaughterhouses, non-food grade vegetable oils and used cooking oil. The hydrogenated vegetable oil fuels produced are chemically identical to their traditional counterparts such as jet fuel and diesel. Advanced biofuels such as Renewable Diesel or Sustainable Aviation Fuel (“SAF”) can therefore be used as so-called “drop-in” fuels for existing internal combustion or jet engines to replace the crude oil refined product alternatives, hence removing any blendwall limitation. Moreover, their much reduced carbon intensity, reduces the Scope 2 emissions for airlines and trucking companies, bolstering their social license to operate and helping to meet overall corporate and national Net Zero goals.

Technology

The technology for manufacturing advanced biofuels is proven and widely operating today in plants owned amongst others by Eni, Neste, Valero and World Energy. The process, is only a moderate variant of traditional hydrotreating using added hydrogen to refine waste fats into Hydrotreated Vegetable Oil (“HVO”) from which extremely high performance, particulate free, clean burning renewable fuel can be marketed through existing distribution networks.

Scientific and pre-commercial development on third generation biofuels is ongoing aimed at addressing consumer and NGO concerns arising from some current feedstocks, as well as the forecast supply shortage of current feedstocks as biorefining scales up from today’s niche operation to become widespread. The focus of research and development is also on improving the full cycle carbon intensity in particular from indirect land use change (“ILUC”) impacts. The most high profile examples of this are the deforestation impact of the palm oil industry in parts of South East Asia and the rainforest destruction in Brazil resulting from industrial sugar cane grown for ethanol.

Example next generation technologies include algal biomass, genetically modified to enhance lipid production as a fast growing alternative biomass without competing with land use for food production. Other novel technologies include the waste to jet fuel plans being developed by Velocys, British Airways and Shell at their Immingham site, or the Fulcrum Bioenergy and BP projects, both of which utilize Fischer-Tropsch syngas to liquids technology to produce synthetic jet fuel.

Since we are still very much in the early innings for the commercialization of biofuels, as compared to over 100 years of crude oil refining, we can expect many new feedstock pathways and upgrade technologies to be explored and tested, very likely with different solutions applicable in different markets based on the prevailing landmass and agricultural base, as well as local regulations and incentives.

Regulation

As with all components of the energy transition ecosystem, decarbonization policies have become a major force in driving renewable fuels projects. As national and corporate net zero obligations expand, so have policy commitments on both sides of the Atlantic. Legislation such as RED II in Europe and its cousin across the pond, the Low Carbon Fuel Standard (“LCFS”) are designed to incentivize the shift in the fuel mix by supporting margins for producers of higher cost, lower-carbon intensity fuels.

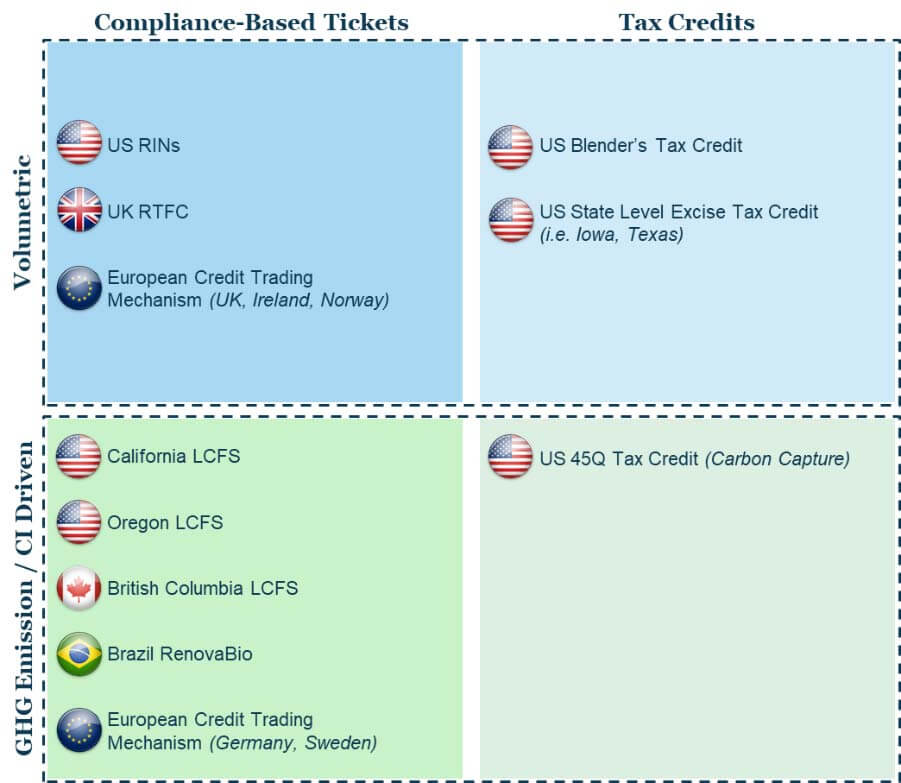

Green credits fall into two buckets with either compliance based “credits” (monetized at a market price) or tax credits. The credits can be generated either based on volume of fuels meeting a given standard or on a basis graduated with regard to the GHG emission reductions of the particular fuel. In the United States, biorefiners are able to stack credits at the State and federal level, making California’s LCFS tickets which were recently capped at $200/tonne the most attractive market. Producers of renewable fuels sold in California are able to benefit from the federal Blenders Tax Credit (“BTC”), the Renewable Fuels Standard (“RINs”) and the state LCFS credits. Examining the economics of key Renewable Diesel producers highlights the financial attractiveness of these incentives (at the expense of traditional fuel producers) with typical EBITDA margins of >$2/gal or $80/bbl supported very largely by green credits.

Key to the implementation of the LCFS scheme is a considerably more nuanced alignment of specific fuel life-cycle carbon intensity than the European RED II system. The California Air Resources Board certifies specific feedstock type, source and process technologies with an applicable CI score, with the lowest CI scores generating the most LCFS credits. So effective is this market incentive that the lowest CI score feedstocks both nationally and internationally will flow to the Californian market. Once the fast food restaurants have been scoured for all the Used Cooking Oil of New York, Chicago and Detroit, sources of organic fats globally will be drawn in. With the incentives offered in California you could monetize yak fat from Mongolia today.

Example Global Green Credit Schemes

Conclusion

The interplay of emerging technologies, consumer sentiment, local politics of land use and regulatory dynamics, make for an evolving, varied and complex market picture. But what does appear clear, is that advanced biofuels will remain an important part of the global picture of the Energy Transition for decades to come, especially for transport segments in which only liquid fuels will be viable in the foreseeable future.