Global Financial Institutions Conference 2021

March 9-10

2021 heralds a uniquely tough operating environment for Financial Services. With interest margins near multi-decade lows, leadership must contend with the political agenda of a new administration, respond to ESG imperatives and anticipate the withdrawal of fiscal stimulus packages that have shielded many from loan losses. As investors, leaders and deal makers survey the post-pandemic landscape, we ask; who will emerge as winners and where will consolidation fall?

Please contact your RBC Institutional Salesperson to attend this year’s premier event for financial institutions, investors and thought leaders.

There are a number of uncertainties as 2021 begins. While vaccines are being distributed, they are not occurring at the hoped-for rate and troubling new mutations of the virus suggest that we are not out of the woods yet. The full economic fallout of the COVID-19 crisis over this and last year are yet to be made apparent. And there’s a new administration in the White House, to add to potential macro pressures. But markets finished the year well and there are key themes and key sectors that should continue to improve as the year goes on.

Improved margins and M&A in asset management

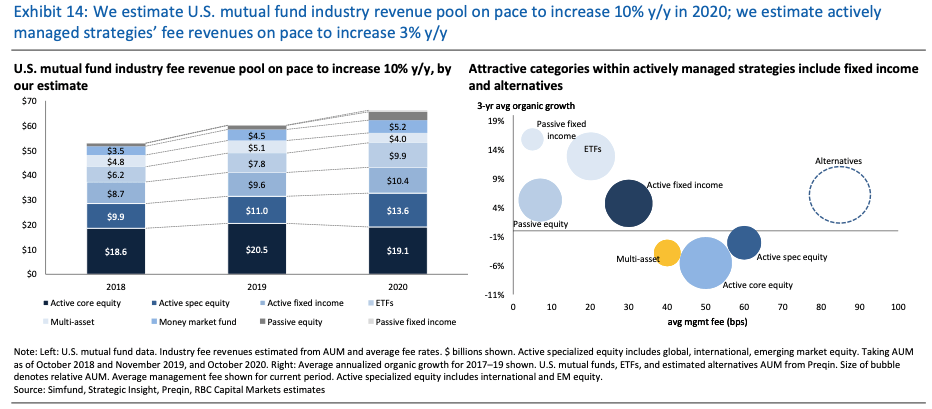

The US asset management sector will enjoy a number of tailwinds going into 2021. Stock valuations remain depressed and there is a strong likelihood that expenses will stay controlled in light of COVID-19, while market returns pick up, providing the economic recovery continues. Pandemic-related travel restrictions are reducing SG&A expenses, and although the effect is probably temporary, that will help operating margins. Particularly as management fee revenues are likely to grow at a modest pace in 2021, despite ongoing fund fee pressure.

There’s also potential for an accelerated pace of industry consolidation through M&A, and not just smaller acquisitions in specialized investment firms. The move from Nelson Peltz’s Trian Fund Management to take an equity stake in Invesco in October 2020 showed the increased probability of larger scale transactions to achieve economies of scale, even if the execution risks remain significant for larger deals.

Small and large asset managers need to broaden their asset mix for favorable asset categories such as specialized equity and fixed income. Smaller firms will also see deals with larger managers as a way to boost their distribution relationships. And for any firms, scale efficiencies can help to offset potential fund fee pressures, spread the cost of technology investments or offset declines in AUM.

BDCs powered by PE dry powder and strong liquidity

The full effects of the pandemic and its restrictions on the economy are still not being felt, but so far, credit losses have been much lower than seen during the 2008 financial crisis. With robust recovery of origination volumes and an active M&A environment, together with favorable regulatory changes such as the potential revision to the SEC’s acquitted fund fees and expenses (AFFE) rule, business development companies (BDCs) have a strong outlook.

The dust has by no means settled on defaults due to the COVID-19 crisis, but given the improving macro outlook and market backdrop, it appears that liquidity risk is receding. BDCs are not dependent on short-term financing and the covenants for revolving credit facilities would require very extreme market conditions before they get breached.

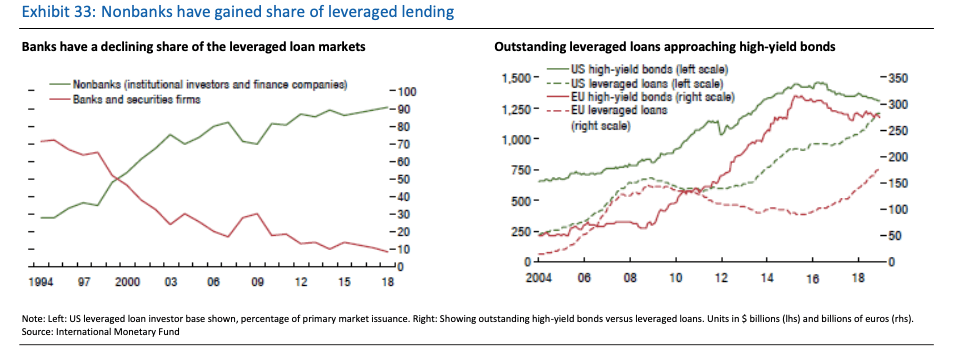

The direct lending offered by BDCs continues to fill a niche in financing US middle-market companies that are less well-served by banks or the capital markets, which are not likely to fill that gap in the near future. Banks have been pulling back from lending to middle-market companies due to regulatory changes and obtaining finance through public markets is often not a realistic option for these firms. Consequently, direct lending has been growing meaningfully over the last few years, with outstanding US direct loans estimated to be close to $1 trillion in 2018, according to Ares Capital Corporation, a meaningful increase from the roughly $750 million in 2012.

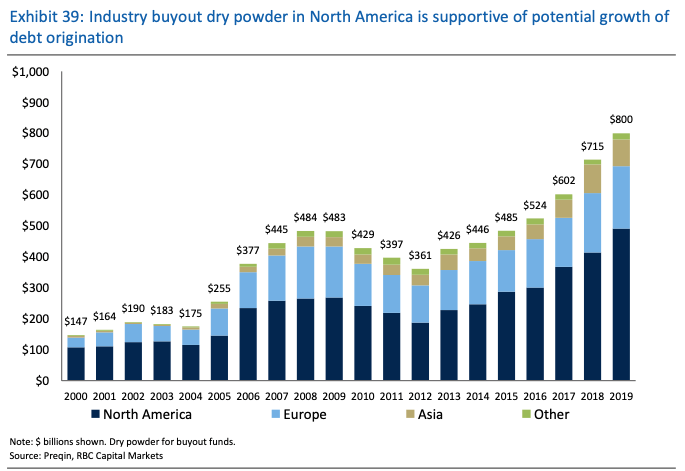

In the long term, the level of private equity dry powder in the US, specifically buyout fund dry powder, could support potentially substantial debt origination volume growth. This, in turn, could benefit direct lending. Data provider Preqin pegs North America dry powder for buyout funds to be in the $400–500bn range, which suggests ample opportunities for direct lending capital deployment, especially because buyout funds would typically contribute 30–40% in equity for a transaction, with the rest being made up of debt.

Mortgage REITs see challenge and opportunity in interest rates

The upturn in the macro outlook is also helping real estate investment trusts (mortgage REITs), which are seeing risks receding within mortgage credit. The interest rate environment continues to be very favorable, with the yield curve steepening and there are attractive investment opportunities for mortgage REITs to re-deploy capital.

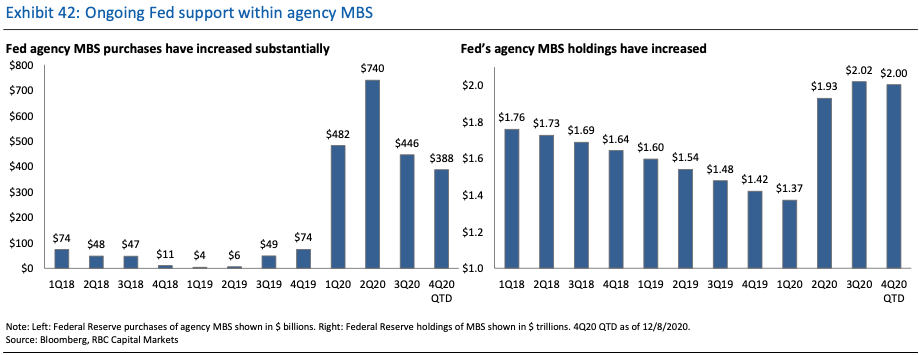

At the same time, this market is still seeing the same favorable backdrop for agency mortgage-backed securities (MBS), as Fed purchases support agency valuations. On the funding cost side for agencies, repo rates have remained at very low levels, and Fed provision of substantial liquidity within the repo markets should keep repo rates very low over the near-term, which should help investment spreads.

There are concerns around prepayments, which have elevated in an environment of low interest rates and very active mortgage re-financings. These are a risk to mortgage REIT earnings, as they drive the accelerated amortization of mortgage bond premiums and reinvestment risks. But mortgage REITs can lessen their exposure by shifting toward lower-coupon MBS, more seasoned loans, specified pools of loans and prepayment protection. In addition, mortgage REITs are prepared for this risk and tend to hedge against interest rates, so the current environment could end up being positive for new money investments for skilled mortgage REITs.

There are, of course, potential challenges ahead for asset managers, BDCs and mortgage REITs, not least of which is the uncertainty around the outcomes for the pandemic. However, each of these sectors have strong tailwinds behind them that gives them a favorable outlook for the year ahead.

Kenneth Lee, Vice President, Equity Research, U.S. at RBC Capital Markets, authored the research report “2021 Outlook: US Asset Managers, BDCs, Mortgage REITs” published on January 6, 2021. For more information, please contact your RBC sales representative.