The transportation industry hasn’t traditionally been recognized for its sustainability efforts. In fact, it ranks as among the worst offenders of U.S. greenhouse gas (GHG) emissions—accounting for nearly a third of total U.S. GHG emissions.

But as the industry announces future mandates to electrify vehicles and decarbonize fleets, it appears to be improving its “E” scores and showing some promise in its “S” and “G” rankings as well. Our report explores the industry’s progress and how it may impact global ESG.

Here are the main takeaways from our report:

EVs accelerate the auto industry’s path toward sustainability

Judging by its swift advancement toward electrification, the pace of change on sustainability within the auto industry may among the fastest in the market. For example, our RBC EV forecast to 2050 shows that although BEV vehicles were <3% of total 2020 new vehicle sales, they could represent 26% of total sales by 2030 (29% 10-year 2020-2030 CAGR), and 83% of total sales by 2050 – which could amount to 13% 30-year (2020-2050) CAGR.

Auto companies’ ESG credentials show improvement

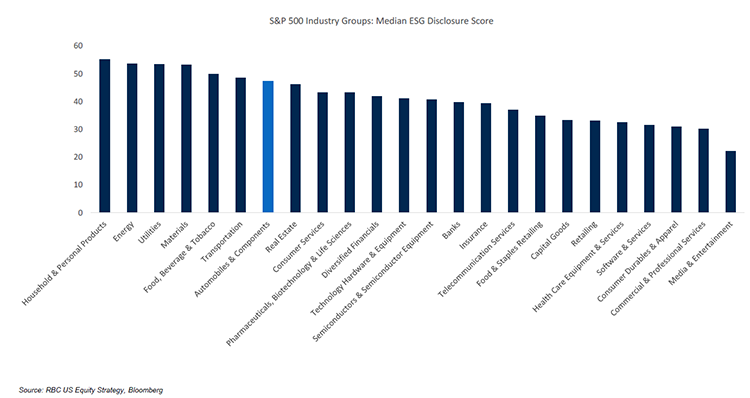

Investors typically evaluate a company’s ESG performance and strategy across 3 main pillars: current operations, ESG controversies, and future positive impact. Given autos’ contribution to GHG emissions, many will not screen well on current “E” operations, which may lead to more controversies.

But amid these bumps in the road, we see signs of progress. Although ESG metrics and factors disclosure was inconsistent (an issue that we believe is common in ESG), many companies in our coverage have embraced ESG by issuing sustainability reports. Moreover, three of these companies have committed to the Science Based Target Initiative (SBTi), while several others have set targets.

Higher confidence may lead to greater ownership

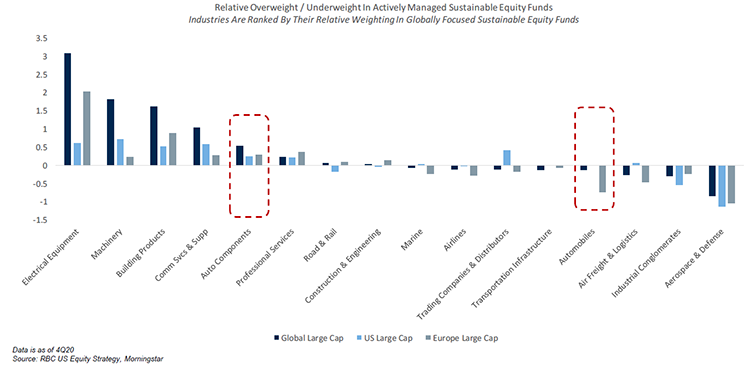

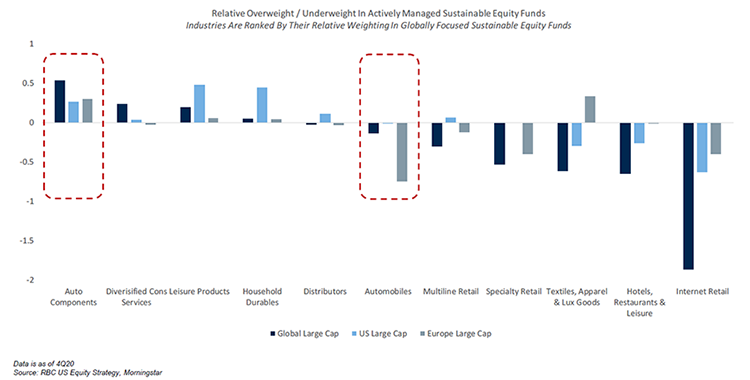

As investors gain more confidence in auto companies’ sustainability efforts, we believe it raises the potential for greater ownership. Currently, global & U.S. focused sustainable investors are neutral Autos within the GICS Consumer Discretionary sector. European funds are underweight, while global, U.S., and European sustainable funds tend to be slightly overweight the Auto Components (parts) industry.

Although Autos and Auto Components technically reside under GICS Consumer Discretionary, we believe the industries are often covered by Industrial analysts on the buyside. Dedicated actively-managed sustainable equities tend to be relatively overweight Industrials, driven by overweights to the Electrical Equipment, Building Products, Machinery, and Commercial Services & Supplies industries. The overweights we see for these industries are generally more meaningful than those we see for the Auto Components industry.

Auto industry disruption may present new opportunities for investors

The auto industry may not be the first choice for many ESG-friendly investors. But as it undergoes a massive effort to electrify vehicles and decarbonize fleets, we believe it has significant potential to impact global ESG, particularly the “E.” Consequently, we see greater opportunities for ownership as investors gain more confidence in companies’ future plans.

Joseph Spak and Sara Mahaffy authored “ESG Stratify: U.S. Autos, Connectors, Powersports: Looking Through an ESG Lens” published on March 18, 2021. For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.